Supermarket milk wars are back with a bang. Some might argue they never went away, with Asda, Aldi, Lidl and Iceland plugging away at the same £1 price point for four pints, while Tesco, Sainsbury’s and the rest temporarily reversed their aggressive positions to meet profit and sales targets at the business end of their financial calendars.

“Milk is not an incremental category. Fruit & veg is, and let’s hope the majority of Tesco’s price investment is focused on the latter”

Adam Leyland, Editor

But with Tesco re-entering the fray this week, the stakes are automatically raised. It’s not just the volumes Tesco sells - around one billion litres or 1.76 billion pints according to our sources. It’s the domino effect. Sainsbury’s, Morrisons, Waitrose, Ocado are happy to let Asda fly solo amongst the major multiples. But Tesco’s milk price cuts from Monday have now been matched by Sainsbury’s and Waitrose (the latter for myWaitrose cardholders only), while The Co-op slashed the price of one and two pints, and Nisa announced a new 2 for £2 deal to help its retailers keep up. And today, Morrisons has weighed in with its own price drop - to 84p a pint.

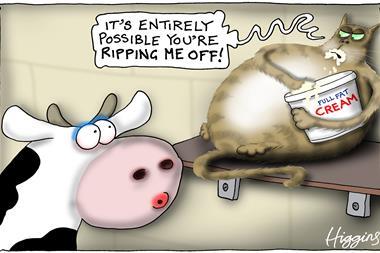

All insist they are the ones making the investment in price cuts. But cynicism among farmers about such reassurances is hardly surprising given the numbers we are talking about.

In a thought-provoking online-only analysis piece, our back-of-an-envelope calculations estimate Tesco will lose at least £100m in sales if its promise that milk is “down and staying down” is applied across this new financial year. And most experts agree it is unlikely to be offset by any incremental increase in volumes - at least in the dairy category.

The same cannot be said for the fresh produce category. Announcing its £200m price investment, Tesco acknowledged last week that its pricing on fruit and veg needed to be “sharper”. And it’s clear from the declines in both fruit and veg sales that we report in this week’s issue in 2013, that “blunt” pricing played a significant part. Some experts suggest shoppers are wasting less by buying little and often.

But while the discrepancy between the volume declines and the heady value sales increases is to some extent linked to raw material price increases, the truth is: tlhe likes of Tesco have been promoting less.

I’ve even heard some UK fresh produce farmers are reducing the amount of land they commit to fruit and veg. Which is sort of depressing. And one reason why - unlike dairy farmers - this is one group that won’t be too worried by Tesco’s £200m price pledge.

No comments yet