Top story

Group organic revenues rose 4.2% in the third quarter at payments specialist PayPoint (PAY) despite a 4.5% reduction in volumes.

Organic net sales rose from £27.3m to £28.4m despite transactions volumes slipping to 150.3m in the three months to 30 June.

Volumes were down as a result of an “expected decline” in its prepay energy volume, but this was partially offset by higher revenue per transaction due to a shift to smaller but higher yielding clients. Additionally is saw strong growth through its ‘multipay’ platform, where transactions doubled to 3.3m.

On a reported basis including the results of PayByPhone, which was sold on 23 December 2016, net revenue reduced 4% from £29.6m to £28.4m.

UK and Ireland retail services net revenue was up 10.5% driven by PayPoint One service fees, card payment transactions which grew by 8.3% to 24.1m and ATM transactions which increased 5% to 10.2 million.

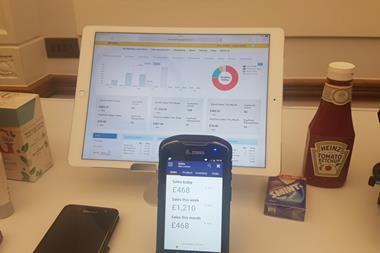

Its PayPoint One terminal, which launched in September 2016, is now in operation in 5,000 sites, an increase of 1,296 since the beginning of this financial year. The group said it remains on target to reach 8,000 sites by 31 March 2018.

It said that due to the strong take up of PayPoint One by our retailers, it has introduced and standardised the service fees for legacy terminals across 14,000 sites, which “caused a small amount of retailer churn” meaning its network reduced by 449 during the first quarter to 28,727 outlets.

Its parcel service increased volume by 16.6% to 6.1 million. The Collect+ network expanded to 6,521 sites up by 354 since the beginning of the financial year.

PayPoint’s business in Romania continued to grow, net revenue reported in constant currency increased by 16.1% and in GBP increased by 25.3%.

Dominic Taylor, PayPoint’s CEO, commented: “We have continued our repositioning of the business in the new financial year, as we have driven profitable growth in UK retail services, increased parcel volumes and delivered another strong performance in Romania.

“The successful roll out of our innovative new PayPoint One terminal in the UK continues, following its launch last September. We are on target to achieve 8,000 installations by the end of this financial year, with 5,000 terminals already in service. This good progress underpins the Board’s confidence in our strategy and our full year outlook remains in line with previous guidance.”

PayPoint shares are up 2.4% to 880.3p in early trading.

Morning update

Brewer and pubco Marston’s (MARS) has released a trading update for the 42 weeks to 22 July, showing like-for-like growth across its portfolio.

In destination and premium like-for-like sales for the 42 week period were 1.3% ahead of last year. In the most recent 12 weeks of the period, like-for-like sales were up 0.6%, which continues to be ahead of the market it claimed.

In Brewing, own-brewed beer volumes were up around 4% compared to last year reflecting the continued good performance of our underlying business and the benefits of the acquisition of Charles Wells Brewing and Beer Business.

Operating margins are slightly below last year in line with expectations.

In Taverns, like-for-like sales for the 42 week period were 1.9% ahead of last year, with growth of 2.4% in the last 12 weeks of the period, principally reflecting the benefits of the warm weather in June. In Leased, profits for the 42 week period are estimated to be 2% ahead of last year.

CEO Ralph Findlay said: “We remain encouraged by our continued market outperformance and focused on delivering sustainable growth and maximising return on capital in an evolving market place.

“Our transformed pub estate continues to deliver positive like for like growth across all three divisions. We benefit from an operating structure which spans food-led destination and wet-let community pubs, accommodation and brewing, maintaining a good balance within our brand portfolio and broad consumer appeal.

“The Charles Wells brewing and beer business is bedding in well, further underpinning our leadership in the UK ale market. We are on track to complete our new-build and lodge expansion plans. We remain confident of delivering further profitable progress for the full financial year.”

Catering giant Compass Group (CPG) has updated the market on trading since 31 March, stating it “continues to have a good year” with organic revenue growth in the third quarter up 3.9% and up 5% excluding the impact of Easter.

Growth accelerated in the quarter with strong net new business in North America, good progress in Europe, and a “challenging, but improving” environment in Rest of World. For the nine months to 30 June 2017 organic revenue growth was 3.7%.

It added that it continues to use efficiencies via its management and performance (MAP) programme to invest in “exciting growth opportunities around the group”. In addition, the end of the restructuring programme its our Offshore & Remote business also contributed to an improvement in the operating margin in the quarter. Overall, the operating margin for the nine months to 30 June 2017 increased by 20 basis points.

North America saw organic revenue growth of 7.1% (up 7.8% excluding Easter) in the third quarter and 7.1% in the nine months to 30 June 2017.

In Europe organic revenue declined by 0.3% (up 2.2% excluding Easter) in the third quarter, and grew by 1.0% in the nine month period to 30 June 2017. Rest of World saw organic revenue decline by 1.3% (down 1.1% excluding Easter) in the third quarter, and declined by 3.8% in the nine month period to 30 June 2017.

Compass Group added: “Looking to the longer term, we continue to be excited about the significant structural market opportunity globally and the potential for further revenue growth, margin improvement and continued returns to shareholders.”

On the markets this morning, the FTSE 100 is up another 0.5% so far to 7,473.8pts.

Compass Group is up 1.7% to 1,626.9p, but Marston’s has dropped 13.7% back to 116.9p despite is sales uplift.

Fever-Tree (FEVR) is up another 1.9% to 2,097p, TATE & Lyle has risen 1.8% to 673p, British American Tobacco (BATS) has bounced back 1.8% to 5,376p, while ahead of their respective trading updates tomorrow Associated British Foods (ABF) is up 1.3% to 2,959p and Diageo (DGE) is up 1.1% to 232.4p.

Yesterday in the City

FeverTree smashed through the 2,000p barrier for the first time yesterday, jumping 17.9% to 2,058p after announcing sales growth of 77% in the first half on the back of “exceptional” growth in the UK. The premium mixer brand, which only floated in 2014, is now worth close to £2.4bn and has a larger market cap than companies such as WH Smith, Ocado, Britvic and Greencore.

The wider FTSE 100 bounced back from the UK and US IMF growth downgrades earlier this week to end the day back up 0.8% at 7,434.8pts.

Some of the key grocery movers included Associated British Foods (ABF) ahead of its trading update tomorrow, rising 1.4% to 2921p, and SSP Group (SSPG), which rose 0.9% to 494p.

Other climbers included McColl’s (MCLS), up 2.1% to 214.5p, Science in Sport (SIS), up 2.7% to 94p and Just Eat (JE), up 1.5% to 713p.

Major fallers during the day were led by British American Tobacco (BATS), which confirmed its $49.4bn deal for Reynolds America, but fell 2.4% to 5,283p. Other fallers included Hotel Chocolat (HOTC), down 2.8% to 308.8p, PayPoint (PAY), down 1.7% to 860p ahead of this morning’s announcement and Hilton Food Group (HFG), down 1.6% to 690.5p.

Morrisons was the major loser from the Kantar and Nielsen market share figures to come out yesterday, dropping 2.2% to 241.2p, while Marks & Spencer (MKS) fell back 1.5% to 321.1p. Sainsbury’s (SBRY) and Tesco (TSCO) both rose 0.7% to 245.1p and 174p respectively.

PZ Cussons (PZC) edged down 0.1% to 361.6p after its sales fell 1.5% in the year to 31 May amid currency devaluation in its key market of Nigeria.

Internationally Refresco (RFRG) slid 4.7% to €16.38 after announcing the $1.3bn (£1bn) acquisition of the bottling operations of Canadian drinks manufacturer Cott.

No comments yet