The UK is a nation of pet lovers, but the cost of living crisis is putting that love to the test. Pet welfare organisations such as Cats Protection have recorded soaring numbers of animals being put up for adoption, as a growing number of Brits find they can’t afford to care for their four-legged friends.

Such a gloomy prospect has yet to trouble the major petfood suppliers, though. “Petcare is one of the last categories in which shoppers say they will look to save money,” says Zoe Taphouse, category & market activation director at Mars Petcare.

Such confidence seems justified given market value has risen more than £220m in the past year, and four of the top five brands are up around £20m each.

While much of that value growth has been driven by suppliers passing on cost increases, consumers have nevertheless favoured brands over cheaper own label lines. Branded volumes are up 2.2% as private label has fallen 6.9% – the latter driving the 0.5% dip in unit sales overall.

Among the leading brands, however, the picture is mixed. Four of the top 10 are in volume decline, including Pedigree and Sheba. Being pulled temporarily by Tesco in a summer pricing dispute with owner Mars likely played a part.

NielsenIQ senior insights analyst Francesca Wright says this was symptomatic of pressures in the category. “As petcare brands are faced with internal pressures of trying to tackle the effects of Brexit and the increase in raw ingredients, oil and fuel, this has affected the distribution of some as discussions with retailers over price continue,” she explains.

It’s played out well for Nestlé Purina, though, whose brands are largely on the up. Gourmet, for example, is up £22m, having benefited from the launch of Nature’s Creations and Revelations ranges in recent years, and this year’s relaunch of Mon Petit mini pouches.

Bakers, which was in decline a year ago, has recorded double-digit value and volume gains after a repositioning. And Lily’s Kitchen, acquired by Nestlé Purina in 2020, is powering up the ranking with an £11.2m gain.

Felix, however, has been less successful. Volumes fell 4.4% as it struggled with the impact of inflation – something Nestlé Purina is looking to address.

“Felix needs to meet shopper needs by looking appealing at different price points and offering affordable luxuries, both of which will be areas of focus in the upcoming year,” says Purina market development organisation director Ben Duncan.

Given catfood rival Whiskas is piling on the pressure, overtaking Mars stablemate Pedigree to bag the second spot in the ranking, that’s a wise plan.

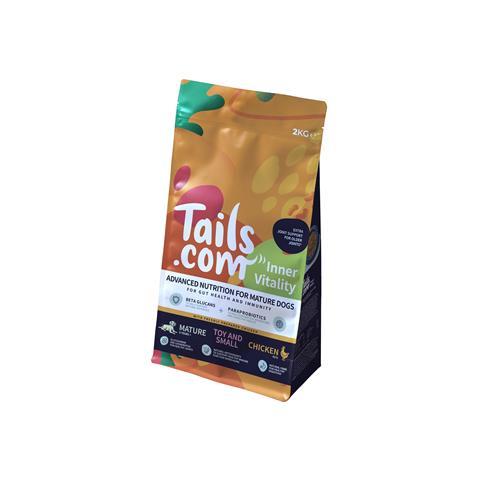

Top Launch 2022

Inner Vitality | Tails.com

DTC brand Tails.com made its retail debut in February with Nourish & Protect dogfood, listed in Sainsbury’s as part of its Future Brands programme. The range of 22 wet and dry products, since renamed Inner Vitality, is tailored by age, breed size and health need – such as weight, gut health and immunity. Plus, consumers can answer online questions to bag a free scoop that feeds their pet the ideal portion. Having initially rolled out to 108 stores, distribution was expanded to 400 in the summer.

Topics

The Grocer Top Products Survey 2022: How can brands stay in focus?

Commodity price hikes, the war in Ukraine and inflation have changed the way Brits shop in the past year, while also piling pressure on suppliers and retailers. Which brands and categories have negotiated the system shock best?

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

Currently

reading

Currently

reading

Petcare 2022: Premium pet products still lead the pack

- 40

- 41

- 42

- 43

- 44

- 45

- 46

![Cheese ]GettyImages-664658023](https://www.thegrocer.co.uk/Pictures/80x50/1/8/6/282186_cheesegettyimages664658023_540979.jpg)

![Cheese ]GettyImages-664658023](https://dmrqkbkq8el9i.cloudfront.net/Pictures/80x50/1/8/6/282186_cheesegettyimages664658023_540979.jpg)

No comments yet