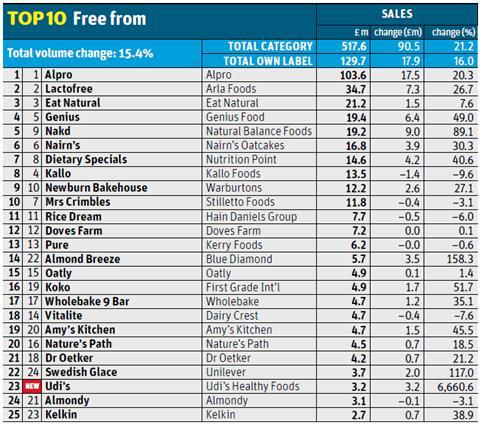

Free from has come of age, blasting through the £500m barrier for the first time, in 2014, with value sales up 21.2% on volumes up 15.4%.

The growth is worth a staggering £90.5m to retailers. And free-from success stories abound. For example, Alpro is now the third biggest brand in milk (see p109), despite its dairy-free status. Sales of wholefood snack brand Nakd have surged 89.1% after it won a place at 10,000 Tesco checkouts earlier this year. And following the success of mainstream players such as Warburtons, Heinz (in 2013) and now Cereal Partners (in August) have joined the free-from party.

Of course, that free-from brands are managing to appeal to mainstream shoppers, and not just those with allergies, is key. A recent YouGov poll found that 55% of free-from food shoppers have no food allergies or intolerances. But so is the fact retailers are giving free-from brands greater prominence at prime spots in store, says Vicky Upton, marketing controller at Alpro UK.

“As plant-based consumption increases, with one in five households now consuming, retailers have realised the benefit of working with us to display our products in off-shelf opportunities,” says Upton. “By creating strong promotions in key locations, we have continued to increase visibility in store. And this increased visibility and availability have been a key factor in another year of double-digit growth for Alpro.”

An increasingly wide array of products are under the free-from umbrella. Alpro’s range now includes unsweetened almond milk (its best-selling line), soya milk and yoghurt and coconut, hazelnut and rice milk, among others. The company also says pot desserts will be a major focus in coming years.

Rival Lactofree has similar designs. In the past year, brand owner Arla has taken the brand into semi-skimmed milk, Cheddar and yoghurt. “Our multipack yoghurts are in 23% value growth while our mature Cheddar has gone from a value of nothing to £1m within a year, which is superb NPD for us,” says Harriet O’Regan, Arla Group brand manager. She adds that marketing will be a key focus in the coming year. “Gluten-free has had the benefit of celebrity endorsements and that’s something we would aspire to.”

NPD in other dairy categories will continue in 2015, adds O’Regan, as will expansion into new retail channels. “We want to offer a total diet solution, not just milk,” she says. “We’re looking at working with foodservice chains such as Pizza Express and Pret, which are great for brand awareness.”

Getting into foodservice at the start of 2014 has driven rocketing growth of Newburn Bakehouse’s gluten-free seeded wrap, produced by Warburtons. The brand has since signed deals with Starbucks and Pret and rival Genius began supplying bread for sandwiches in Tesco in April. In the supermarkets, Newburn is having similar success: value is up 27.1% on volumes up 24%. “We were the first to market with a gluten-free wrap,” says Newburn’s free-from director Chris Hook. “We’re also seeing good growth in bakery alternatives such as sandwich thins.”

It was arguably Genius that really kick-started the free-from revolution and it’s had another great year, with sales rocketing 49% on volumes up 43.9%. The biggest contributor in 2014 has been its pains au chocolat and croissants, which launched in Tesco in 2012, says commercial director Dave Shaw: “They’re now distributed across all the retailers and are our biggest single area of growth.”

But recent innovation has seen Genius extend its reach far further. “Choice is the major factor behind our growth, and innovation has had a stunning effect, with 15% of the category value coming from NPD,” says Shaw. Among the 15 new products launched this year are cupcakes, pastry and pies.

Retailers are also contributing here: M&S has focused on gluten-free pastry. Executive director of food Steve Rowe claims: “The crumb in our gluten-free quiches is now so good we’ve converted all our crumb-based ranges to gluten free.”

While free from has been helped by gluten-dodging celebrities, including Victoria Beckham and Miley Cyrus, who extol the virtues of a free-from lifestyle, other brands are benefitting from more practical considerations. Nakd, for example, has the ongoing removal of confectionery from retailers’ checkouts - a trend that gathered pace earlier this year when Tesco banished so-called ‘guilt lanes’ from its stores - to thank for much of its impressive growth of late.

“Around six months ago there was a lot of bad press around sugar, which opened doors for brands like us,” says Steve Mellor, trade marketing manager at Natural Balance Foods, which owns Nakd. “We were able to move on to till points and secure additional space on ends for promotions. Retailers are realising it’s an important category for them.”

With new listings have come greater use of promotions to drive impulse purchase (when Nakd entered Tesco it was at an introductory price point of 50p/bar; down from 75p), which has led to a 5.9% fall in average price for the brand. However, Mellor is confident that shoppers are continuing to buy the products once promotions such as this have ended, because of the more general shift away from processed foods in grocery.

“Shelf space has trebled in the last two years. Retailers are extending space and consistently communicating”

“We’ve seen a lot of switching from heavily processed bars as people become disillusioned with ingredients such as sugar,” he says. “We’ve done a lot of research and as consumers understand more about what’s going into their body, it’s translating into sales. Our penetration is now around the 52% mark and that is driven heavily by what we call the ‘healthy lifestyler’.”

This growth in penetration is being driven by extra shelf space for free-from players. “It’s trebled over the last two years,” says Shaw at Genius. “The category is growing so fast it has rapidly moved up the retailers’ agenda so they’re expanding space and consistently communicating.”

Improved communication now extends beyond increased point of sale and directional signs. After trialling 340 new foods in 80 stores in its free-from food fair this summer, Tesco is rolling out its first branded free-from bays this autumn. “The Achilles heel of free-from food is its availability,” says Newburn’s Hook. “It’s about getting product on shelf and customers being able to see it. Tesco has been at the forefront of improving availability.”

There remains one possible hurdle to overcome, however. Shoppers are demanding less processed foods, says Natural Balance’s Mellor, and are deterred by long ingredients lists. “Examining what you’re eating will continue to grow and span all categories,” says Mellor. “It will become the new norm.”

While Mellor says the maximum number of ingredients in a Nakd bar is five, some gluten-free breads have dozens. “We’re all aspiring to shorter ingredients lists,” says Hook. “But you need several components to replace the functionality of gluten.”

Top launch: No G by Riverside Bakery

Making a gluten-free pastry that tastes good and doesn’t crack is the Holy Grail of free-from food manufacturing.

That’s why Riverside Bakery spent over a year and £250,000 developing what it claims is the UK’s first range of gluten-free pastry products.

The range scooped the Great New Idea Award at this year’s Food & Drink Expo in April and was launched into Whole Foods Market in the same month. In September, No G pastries arrived on the shelves of 150 Sainsbury’s.

No comments yet