Shoppers are opting to buy organic despite steep price hikes in many product categories.

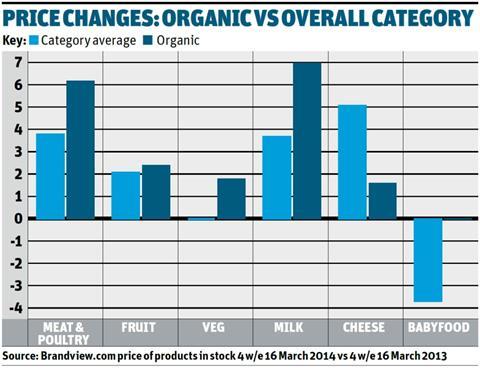

The Soil Association last week revealed total value sales of organic products returned to growth in 2013, rising 2.8% year on year. But this week, research by The Grocer reveals organic prices are, in many cases, rising faster than the category average (see table).

The supermarket price war means shoppers are currently paying less for the most popular milk format - the four-pinter - but the average price of a litre of milk rose 3.7% year-on-year to 84p in the big five mults over the four weeks ending 16 March. Shoppers buying organic, however, are currently paying 96p - 7% more than in 2013.

Organic butter and spreads have also risen faster than the category average - up 6.7% to £6.80 a kilo versus the typical increase of 4.2% to £4.99.

While the retail price of organic milk has risen, the price of organic yoghurt has dropped 4.4% in a category where average prices have remained static.

Meat prices have risen sharply, meanwhile, but this hasn’t deterred shoppers, with the Soil Association reporting a 2.2% growth in sales driven partly by the knock-on effect of the horsemeat scandal. Shoppers who go organic are currently paying an average of £20.73 a kilo for meat or poultry - up 6.2% year on year - while prices in the overall meat category are up 3.8% to £11.89.

Consumers who opt for organic sausages are also paying considerably more than the category average (at £11.75 a kilo versus £6.75) but are forking out just 1.3% more than a year ago, compared with the typical 2.9% hike across the market.

And the price of organic bacon is virtually twice that of the category average, at £19.91, but has fallen 2% while average market prices remain static.

Average prices also remained static across the fruit and veg market, at £3.73 a kilo. The price of organic fruit and veg has risen 2.4%, but is lower than the category average at £3.69 - a reflection of the more basic product selection in organic veg. Breaking the organic category down further, the average price hike of veg has been 1.8%, while fruit has risen 2.4%.

The average price of organic babyfood, one of the five largest organic categories, has remained static, but the typical price across the entire babyfood market has fallen year on year.

The Soil Association this week said the retail price of organic and non-organic food would fluctuate during any 12-month period, due to seasonality and availability.

A spokesman added that in many categories organic was outperforming the market and that the association “was confident there had been real growth in volume in the organic market outside the supermarket sector,” particularly through box delivery schemes and independent retailers.

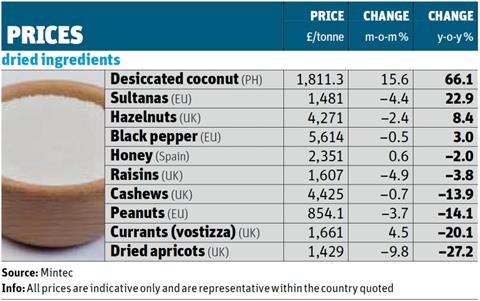

Wholesale prices: Typhoon Haiyan continues to push up coconut prices

The coconut market continues to feel the impact of Typhoon Haiyan. Coconut growers in the Philippines lost 33 million coconut trees, and prices have soared year on year. However, price are now also facing pressure month on month amid concerns production output could suffer as a result of increased pest infestation. As a result, desiccated coconut prices have risen 15.6% since last month to £1,811.3/tonne.

Elsewhere in the dried ingredients category, weather concerns in turkey are continuing to have an impact. Hazelnuts are up nearly 10% year on year - although prices have started to ease on a month-on-month basis - while sultana prices are up by 22.9% year on year because of high demand from the EU and reduced Turkish production.

By contrast, dried apricot prices are falling, as increased supply from the US and exports from new producers boost supply to the UK, pushing prices down.

No comments yet