As meat alternatives battle shopper misgivings around taste and processing levels, plant-based milks and yoghurts are continuing to gain ground

The UK is facing a “great vegan slump”. So proclaimed the Daily Mail in December, as it warned of the dual pressures of the cost of living crisis and a saturated market. Brands were struggling to find any growth, it reported, leaving their future in the balance.

There was one crucial caveat, though: the Mail’s article focused solely on the alt-meat market. In the case of alt-dairy, the picture is far rosier.

Take-home value sales of dairy-free milks have risen 3.2% to £430.6m in the past year, while volumes have edged up 0.4% [Worldpanel by Numerator 52 w/e 15 June 2025]. Less established corners of the market are boasting higher growth. plant-based yoghurts are up 12.3% in value to £113.2m, driven by an 8.8% volume boost.

“The UK’s plant-based dairy sector has rapidly evolved from niche to mainstream, with plant-based milks, yoghurts and cheeses now embraced by a broad spectrum of consumers,” says Philip Rayner, co-founder & MD of Glebe Farm Foods, which makes a range of oat-based products. “Once seen as an alternative for vegans, these products have found traction among flexitarians.”

So, why are alt-dairy products faring so much better than their meat-mimicking counterparts? Where are the bright spots of activity? And how much headroom is there for further growth?

- Plant-based dairy is holding its own in tough conditions. The value of its retail market has risen 2.2% to £812.3m in the past year. To put that into context, that’s roughly a fifth of the size of the dairy milk category, which is worth more than £4bn.

- Volumes are up 0.4%, which may not seem like much to write home about. But that has been in the face of “challenging market conditions around pricing and evolving consumer expectations”, points out Philip Rayner, co-founder & MD of Glebe Farm Foods.

- Milk alternatives are the largest segment of the market, accounting for 53% of its total value. Oat makes up half of those milk alternative sales, worth £235.1m in the year to 10 August 2025.

- Milk alternatives have performed slightly above the total market in the past year, up 3.2% in value and 0.4% in volume. But the real growth has come from smaller categories.

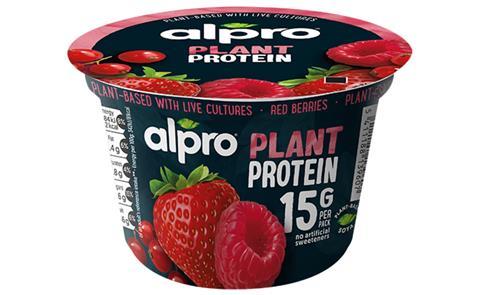

- Plant-based yoghurts are the standout performer, up 12.3% in value. Danone reports that level of growth in its Alpro yoghurts, while its high-protein yoghurt alternatives are growing at an even faster rate of 17%.

- The drinks category – which comprises plant-based beverages other than pure milks – is also showing promising growth. It’s up 6.6% in value and 5.8% in volume.

- Only spreads and cheeses are in volume decline, of 10.2% and 1.6% respectively. Bel UK says cheese continues to suffer from concerns over taste, which it is working to address with lines such as Boursin Plant-Based.

The total plant-based dairy market – which spans drinks, cheese, cream and spreads – has grown 2.2% in value to £812.3m. Volumes have crept up 0.4%. That may not seem overly impressive compared to the state of play a few years ago, when dairy-free lines were regularly posting double-digit gains. Rayner admits there has been something of a “slowdown” amid challenging market conditions.

However, Bryan Carroll, UK GM at Oatly, believes it is primarily a sign of a maturing market. Worldpanel figures put household penetration at 35% in July, he points out. “Now more than ever, plant-based products are seen as a credible, mainstream lifestyle option.”

Even in this mature market, brands are still reporting spots of double-digit growth. “Plant-based alternatives to yoghurts, barista-style plant-based drinks and no-sugar variants are areas that continue to drive momentum in the sector,” says Tom Kerr, Danone’s head of category management & commercial planning for plant-based. For example, he reports 12% growth in Alpro’s yoghurt alternative range over the past 12 months.

Meanwhile, Rude Health says its organic Coconut Drink has grown value 15.3% year on year to become its top-performing SKU. The brand attributes that growth to its pairing with matcha, which hit nationwide coffee chains this summer.

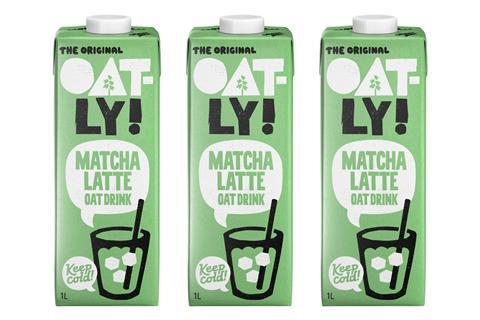

The matcha opportunity has similarly been spotted by Oatly, which launched its own Matcha Latte Oat Drink into retail in July.

For Rude Health CEO Tim Smith, it’s a sign of how out-of-home trends are fuelling adoption of alt-milks – which account for half of the plant-based dairy market by value. “Consumers actually are consuming plant-based without necessarily even knowing it – with matcha products, with their iced coffee, or even with their lattes,” he says. “It just goes to show how you can really elevate the experience of the consumer through the use of dairy alternatives.”

That mainstream appeal is one reason why brands believe plant-based dairy is fundamentally different from plant-based meat alternatives, which fell 7.1% in value and 8.7% in volume last year [NIQ 52 w/e 7 September 2024].

Although there have since been signs of recovery, the number of meat-free companies hitting the wall prompted questions over the viability of the entire plant-based category.

That’s a false logic, says plant-based dairy brand Califia Farms. “While plant-based meat has faced headwinds, alt-dairy has remained resilient because it’s solving a different set of consumer needs,” says Damien Threadgold, Califia UK/EU general manager. “For many shoppers, plant-based milk isn’t a direct replacement for dairy milk, it’s a choice driven by taste, lifestyle and versatility as much as dietary preference.”

Where are the opportunities to recruit consumers to plant-based drinks?

In August, Finnish alt-dairy company Oddlygood Group conducted research to uncover growth opportunities for plant-based dairy.

In the face of slowing category sales, the Rude Health owner looked at three distinct groups for potential recruitment: low users, lapsed users and non-users.

Lapsed users came out as a key group for recruitment. More than half (53%) were open to trying plant-based drinks again, and 62% still felt positive towards the category.

The lapsed user group was predominantly young: 49% are under 35 years old. More than half (58%) felt confident in understanding the health benefits of plant-based drinks.

Unsurprisingly, low and lapsed users were much more likely to have positive associations with plant-based milks than non-users. However, the majority of non-users were apathetic rather than negative.

“By tackling barriers in different ways across consumer groups – from flavour cues for non-users to quality reassurance for lapsed users – the plant-based category can move beyond early adopters and capture a much broader audience,” Oddlygood said.

Challenging areas

Still, it’s not all rosy. Plant-based dairy does face some of the same challenges as alt-meat – the first being health perceptions. As the UPF narrative gathers pace, plant-based dairy products have, to some extent, been tarred with the same brush as meat alternatives. That’s despite brands like Glebe and Rude Health making a selling point of their clean ingredient lists.

“Plant-based milks have faced their share of challenges in recent years, with misinformation, particularly surrounding nutrition, topping that list,” says Oatly’s Carroll. “Negative perceptions from uncredible sources make it increasingly difficult for consumers to know what to trust – especially among younger, health-conscious consumers who closely follow wellness content on social media.”

Glebe believes consumers are beginning to see a greater nuance on the UPF front, at least. “There’s a growing sense that dairy alternatives are less processed compared to some alt-meat products, which often rely on long ingredient lists and additives to replicate meat flavour and texture,” argues Rayner.

But plant-based milks were dealt another blow in July, when the government released new advice on their consumption. It concluded no almond, oat or soya drink available in the UK was nutritionally equivalent to cows milk, prompting headlines warning children under five could be “at risk” from consuming only plant-based milk.

Glebe admits the “ability to compete with real dairy on nutritional value” has been a particular hurdle. “Therefore, nutritional fortification has become a critical differentiator,” says Rayner. Glebe PureOaty Creamy Enriched Oat Drink, for instance, makes a selling point of containing calcium, vitamin B12 and other nutrients typically found in cows milk.

Danone takes a slightly different tack. Rather than making comparisons with cows milk, it calls for a change in attitude towards plant-based products. “When it comes to plant-based alternatives, there is a tendency to think about what is ‘missing’,” says Kerr.

“This is an unhelpful approach, and we should instead emphasise the additional nutritional benefits these products can bring to shoppers’ diets, like vitamins, minerals, proteins and fibre, to address potential misconceptions.”

Another challenging area for plant-based dairy is the conversation around sustainability.

Plant-based products have generally been perceived positively on this front, especially when compared with the carbon and methane emissions of the dairy and meat industries. Yet some critics have called out arable farms for their own environmental impact. Almond milk, for example, has been lambasted for its use of water and impact on bee populations.

In the face of that scrutiny, Rayner says it is more important than ever for plant-based brands to be fully transparent about their sustainability credentials.

“Unfortunately, greenwashing is widespread in our sector, with vague claims and questionable carbon accounting now all too common.” For its own part, Glebe grows some oats on its farm in Cambridgeshire and sources others within a 70-mile radius.

Optimism for the future

The main selling point for all food and drink, of course, is taste. For Rayner, that’s a crucial reason why plant-based dairy stands to outperform meat alternatives. “It fits easily into people’s routines, unlike many alt-meat products, which are still working to win over consumers on taste and texture.”

So, when it comes to headroom for growth, plant-based dairy brands are unequivocally optimistic. Rude Health points to research undertaken by parent group Oddlygood, which found a sizeable opportunity to increase frequency of purchase and penetration.

“I think there is potential for huge growth in the future, particularly as we know a lot of consumers that have fallen out of the category are very open to coming back,” says Rude Health’s Smith. He also sees an opportunity “to convert a whole load of consumers” who have never bought plant-based milks, using out of home as a starting point.

“If you look at the number of coffees or drinks made with plant-based dairy in our café, over time that’s increasing, and I think we’ll see that flow through into the major retailers as well,” he forecasts.

Innovation is a further opportunity to recruit. Rayner says brands are innovating “to keep ahead of trends and appeal to more mainstream customers”.

In the case of Glebe, it brought out a PureOaty Tea-rrific line in September 2024 to complement tea. At Califia, a focus on flavour innovation has fuelled the upcoming launch of a Peppermint Mocha Almond Latte in November.

The potential for growth is perhaps best summed up by Danone’s Kerr, who points to the wider trends at play. “Younger generations are already growing up more aware of the benefits of plant-based alternatives to dairy – for dietary reasons, and simply to explore flexitarian diets,” he points out.

So much for that “vegan slump”.

No comments yet