Low farmgate beef prices continued to make waves in the UK this week but at a global level the situation could soon change, as beef prices are expected to pick up again later this year.

A new report from Rabobank suggests beef prices will rise significantly in the third quarter of 2014, thanks to growing demand for imports and rising prices for other proteins, especially pork. Unusually strong supply had driven down prices for the moment, but “the global beef market will regain its momentum in Q3 once the current, temporarily higher supply has worked through the system,” the bank said in its latest Beef Quarterly.

The outbreak of PEDv - an aggressive pig diarrhoea virus - in the US was expected to cut supply and cause pork prices to rise towards the end of the year, with beef set to benefit. At the same time, Chinese demand for beef remained high, with imports up 34.2% between January and April this year.

In the EU specifically, beef prices were expected to stabilise around current levels towards the end of the summer “with some potential upside later in the year,” Rabobank predicted.

Higher prices would allow producers to rebuild margins, it added, but warned “longer term, the likely lower availability of feeder cattle and high production costs might limit the possible upside.” For beef processors “the current stabilisation gives them room to regain margins, but prospects are less positive due to the approaching tight supply in most production regions,” it warned.

UK beef farmers have grown increasingly concerned about falling beef prices in recent weeks, prompting Defra to hold a crisis summit with retailers, processors and farming organisations this week. Prices have fallen because of increased cattle numbers in the UK and Ireland, falling exports and reduced consumer demand.

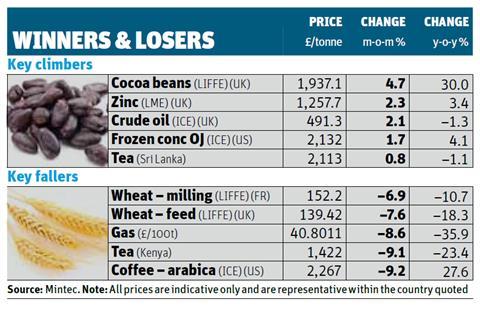

Commodity prices: demand forces continued rise of cocoa bean prices

Demand from emerging markets is putting pressure on cocoa bean supplies, causing prices to rise. They are now up 30% on this time last year, and up by 4.7% month on month.

Strong levels of demand coupled with tight supplies are keeping zinc prices hot, up 2.3% over the past month. And unrest in Iraq continues to take its toll on crude, with prices up 2.1% over the past month.

Meanwhile, orange juice prices are up in response to an expected fall in US production because of crop disease.

Wheat prices are falling sharply, with both feed and milling grades down. Feed wheat in particular has been hit by the current competitive price of maize, while favourable weather in the US and the EU has boosted supply.

No comments yet