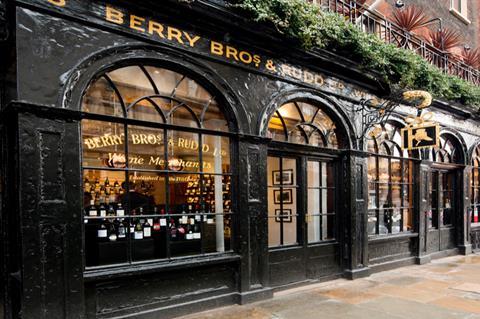

Upmarket wine merchant Berry Bros & Rudd saw sales surge to their highest point since 2010 last year, latest financials reveal.

Turnover at the London-based retailer grew 17.4% to £219m (excluding adjustments for en primeur) for the year ending 31 March 2019, documents filed with Companies House this week show.

Operating profits, meanwhile, grew 4.9% to £1.6m. Pre-tax profits were down 98.4% compared to the prior year, when they surged thanks to the sales of exceptional items such as The Glenrothes, which was bought by Edrington, and Anchor Brewing, which Berry Bros was a major shareholder in and was sold to Japanese beer giant Sapporo.

The business’ performance “has been achieved within the context of a challenging economic and political environment, and a competitive market”, said company secretary Janet Impey.

“Our focus through the year has been on redefining our core operation and re-centring our attention on the customer – be that private customer, investor or trade.”

Furthermore, she added: “We have used this year to begin to actively improve our working capital cycle, particularly in light of an uncertain Brexit.”

It comes after a slew of recent personnel changes at Berry Bros & Rudd. Its CFO Chris Robinson, former group finance and planning director for Tesco, stepped down in August, and was succeeded by former head of financial planning Emily Rae, who took up the new role of finance director.

January 2019 saw the departure of its CEO Dan Jago, who was succeeded by Berry Bros & Rudd’s executive chairman Lizzy Rudd at the helm of the business after spearheading a three-year turnaround project.

No comments yet