Britain has gone on a health kick since Covid, helping to drive sales of vitamins, minerals and supplements (VMS). We’ve quizzed 1,000 VMS shoppers to get to the heart of their health concerns and reasons for buying. So, what’s making VMS shoppers tick in 2023?

This research was commissioned by The Grocer and carried out by Lumina Intelligence independently from Centrum.

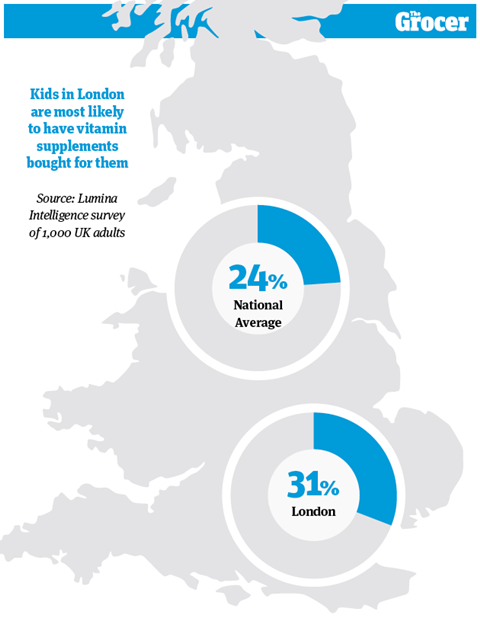

1. Kids in London are most likely to have vitamin supplements bought for them

Kids supplements are in line for a shot in the arm.

“The kids VMS segment is a major growth area for the category. While the segment is worth £60.6m [NIQ 52 w/e 17 June 2023], only 24% of respondents from our survey buy into the category for their children currently, so there’s clearly headroom for growth,” says Centrum brand owner Haleon’s marketing director Monica Michalopoulou.

Just how much headroom depends on location, of course. As we’ve seen, 31% of VMS shoppers living in London buy them for their kids – the highest proportion in the UK – while the lowest proportion is in Northern Ireland, where just 13% of shoppers do so.

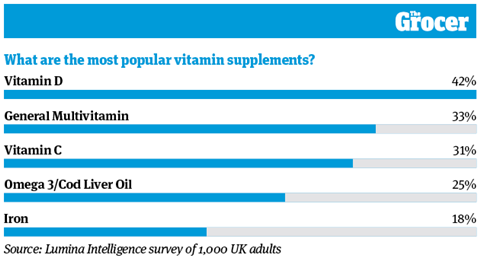

2. Vitamin D is the most popular supplement

When it comes to the market in general, one supplement is a clear winner in terms of popularity: vitamin D. It was bought by 42% of the shoppers we polled. The next most popular are general multivitamins (33%), vitamin C (31%) and Omega 3 (25%).

As we explore in this week’s report on healthcare and supplements, multivitamin sales are in decline as shoppers opt for VMS tailored for specific health needs and life stages. Our survey reveals 11% of shoppers buy probiotics and 15% buy age or gender-specific multivitamins. Does this mean there’s further headroom for growth in these categories?

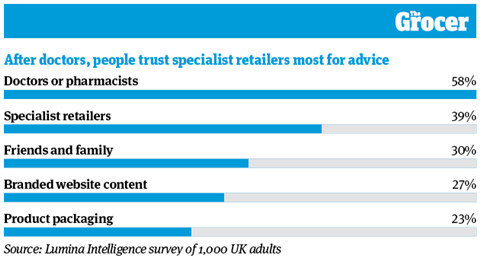

3. After doctors, people trust specialist retailers most for advice

It will probably come as no surprise that doctors and pharmacists are most trusted for advice and guidance on VMS. Fifty eight per cent of the people we polled told us they trust healthcare professionals as a source of information.

Specialist retailers are the next most trusted source – 39% of shoppers say they would turn to them for guidance. This suggests retailers can help drive growth in VMS with shelf-edge information and ensuring staff are able to give shoppers advice.

Given the booming market for VMS on social media platforms such as TikTok, what might raise eyebrows is how few trust online influencers as a source of information. Just 7% say they do.

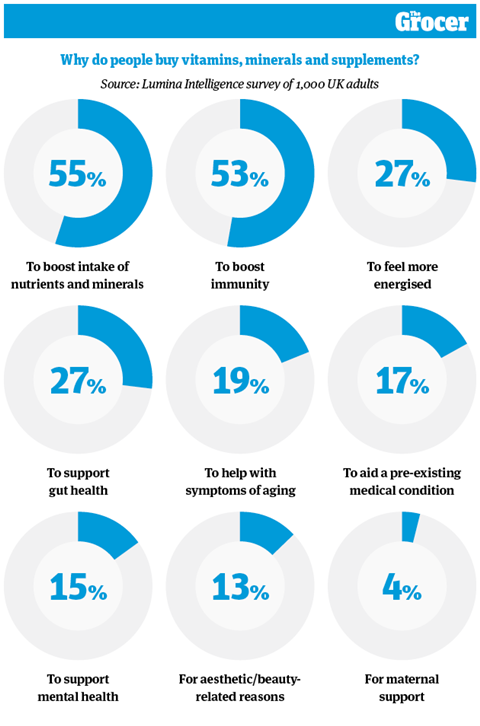

4. Over half of consumers are looking for immune support

Fifty five per cent of shoppers buy VMS to supplement the nutrients they get from their diet, according to our research. Almost as many (53%) do so to boost their immune system – a consideration that’s become more important since Covid, says Michalopoulou.

“The pandemic has had an obvious knock-on effect on how we view our wellbeing with consumers tending towards a more proactive approach to their health,” she says. “After a particularly strong cold and flu season last year, we’re seeing increased attention being placed on supporting our immunity.”

“As we approach the cooler months when cold and flu viruses are more present, we’re predicting that immunity-supporting SKUs will come to the fore,” adds Michalopoulou.

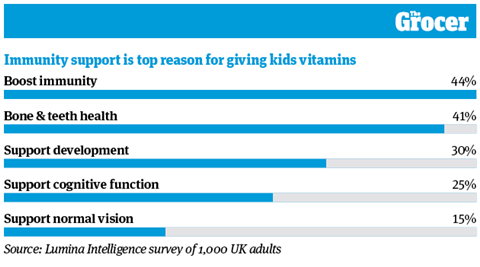

5. And immunity is the top reason for giving kids vitamins

Immunity support is also a priority for shoppers who buy VMS for their kids. In fact, it’s the number one reason for doing so. “Forty four per cent of shoppers who buy supplements for their children do so to boost their immunity,” says Michalopoulou.

As such, Centrum has launched two Multigummies for Everyday Health and two vitamins that target certain areas: Immunity and Bones & Teeth. This is “in line with parents’ preferences for their children aged four-plus”, says Michalopoulou.

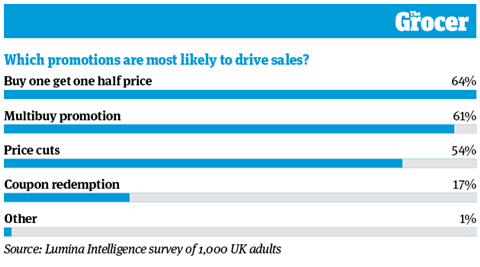

6. Bogof deals incentivise purchases

Times are hard for many people, so it’s crucial for retailers and their suppliers to offer products at the right price. When it comes to promotions, our research suggests buy-one-get-one-half-price and other multibuy deals are likely to drive the most sales, with 64% and 61% of the vote respectively.

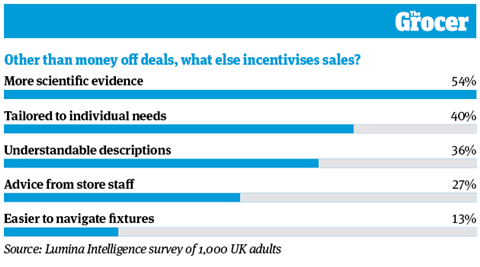

7. Shoppers want more scientific advice

It’s not just money off that will drive sales. Fifty four per cent of our survey said that greater scientific evidence of certain VMS would persuade them to make a purchase, suggesting some shoppers are sceptical about the claims some products carry.

More products tailored to specific needs such as health conditions or life stage (40%), easier to understand descriptions (36%), more advice from staff (27%) and easier to navigate fixtures (13%) would also incentivise sales, our survey found.

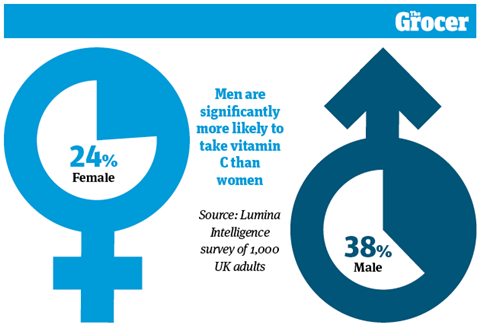

8. Men are significantly more likely to take vitamin C than women

There are also significant differences between men and women when it comes to VMS shopping habits. Thirty eight per cent of the male shoppers we polled buy vitamin C supplements, while just 24% of the women do.

Men are also significantly more likely to have become more concerned about the amount of exercise they do (see chart 10) in the past year. Four in men say this has become a more pressing concern, versus 27% of women.

Women, meanwhile, are more likely to be concerned about ageing. Sixteen per cent of female VMS shoppers say they are more concerned about combating the ageing process than they were a year ago. Ten per cent of male shoppers say they are.

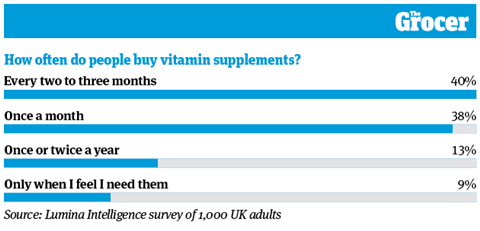

9. VMS is a low purchase frequency category

VMS is a low purchase frequency category. Four in ten shoppers (40%) stock up once every two or three months, and a similar number (38%) purchases every month. Significantly, 9% of shoppers only buy VMS when they feel they could do with a boost, suggesting brands and retailers could do more to convince this group to become habitual buyers.

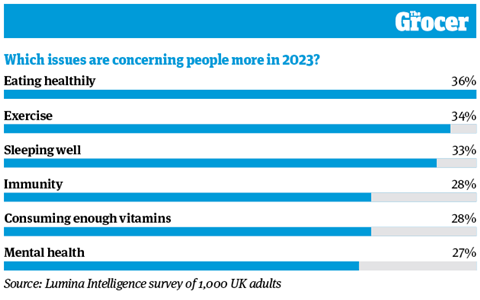

10. Healthy eating is becoming more of a concern

We’ve also had a look at which health concerns are becoming more important to VMS shoppers. Healthy eating considerations have become more important for most people (36%), followed by exercise (34%) and sleeping well (33%).

Then comes boosting the immune system. “Twenty eight per cent of shoppers stated that immunity has become more important to them in the past year, and the results also show a greater consideration of immunity-supporting supplements across adults and kids VMS,” says Michalopoulou.

Time to stock up, then!

No comments yet