January means watching the waistline. But it also means watching the pennies. And that counts as much for small independent retailers as it does their customers. So how can symbol members reduce their operating costs - and counter the threat of the discounters by saving their customers money, too?

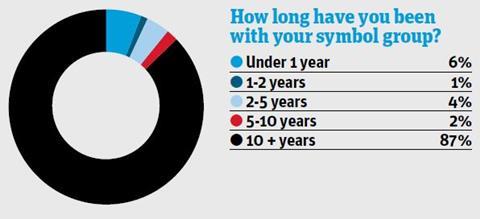

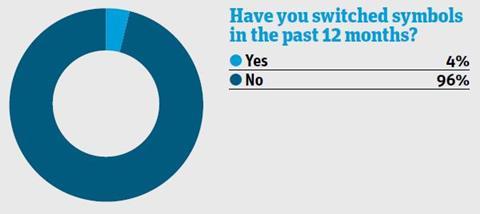

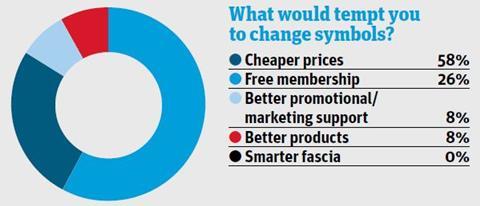

As the barometer shows, the vast majority of stores are happy with their symbol group but money is an issue. Of those asked, 87% said they had been with their symbol group for over a decade.

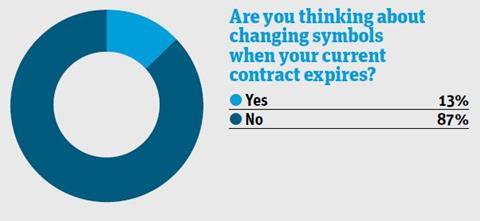

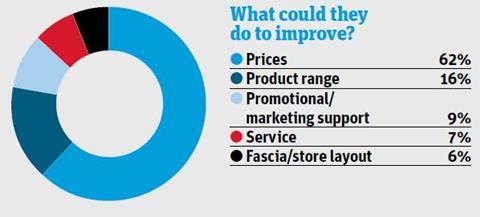

The same number had no intention of switching symbols when their contract comes to an end. Yet if there was one thing their symbol group could do to convince them to switch, it would be saving them money, with 84% saying free membership or cheaper prices could tempt them away, as 62% believe the most important improvement they could make is on price.

Price crash

With customers feeling the pinch, symbols have unveiled a raft of new initiatives to fight the discounters - and the increasing array of grocery on offer in the pound shops - on price. Last week, Londis cut prices on hundreds of products as it launched a ‘Price Crash’ campaign, including 50p deals on essentials from 5 January to 8 February.

“Our insight team means we are able to see where opportunities lie and what the customer is looking for”

Bestway kicked off the new year with a Family Fortune promotion on more than 300 lines from its Best-in own-label range, delivering up to 80% profit on return for retailers during January.

“The £1 price point has been a big issue, particularly as the discounters have brought products into the £1 range that weren’t there before, which puts pressure on suppliers and independent retailers to respond,” says Today’s Group retail director John Kinney. “Many suppliers have responded well with £1 pack formats but the challenge is to retain a sustainable margin.”

Kinney says Today’s has responded to the challenge by offering “highly competitive price points on our own-label products, including £1 price points on key lines with attractive margins for retailer and wholesaler.”

He highlights Today’s Select chocolate, which offers a “highly competitive 35% profit on return for our retailers at a very competitive 59p for the consumer.”

At One Stop, franchise director Andrew King says customers are “increasingly expecting KVIs to be keenly priced,” so One Stop has identified what it believes are the c-store’s biggest - including bread, milk and eggs - and reduced the prices.

Booker-owned Premier is using a combination of keen promotions and above-the-line advertising to lure customers away from Aldi and Lidl. Director Martin Swadling says it has introduced “four Mega Deals,” which are supported by year-round advertising on national TV. “These four deals deliver over £3m on average for Premier retailers each month,” he claims.

Get baking

Yet it’s not just ramping up the promotions on the shelf that can be used to tackle the discount threat. Selection is also important. As a “credible threat” to the convenience sector, says Daniel Quest, retail director for Costcutter, “the discounters are expanding their fresh and in-store bakery ranges and the c-stores must recognise this as a growth area and provide it for their customers.”

Nisa goes further. It’s created a new insights team to analyse market and customer insight intelligence to help understand both to a far greater degree and help it drive sales.

Business unit director Nigel Gray says it is “starting to drive and influence all our activity. The market place is extremely competitive, with discounters continuing to reposition the value proposition. With the creation of our insight team we are able to see where the opportunities across the marketplace lie and what the customer is looking for.”

Upselling

Nisa has also launched an eye-catching new upselling unit specifically designed for £1 deals, new products or seasonal lines with margins of at least 20%.

It’s also made an upselling coaching video available to its members so they can train staff on how to upsell and have till point conversations with customers. And early indications suggests it’s worth a watch; Nisa claims sales uplifts on promoted products have risen more than 500%.

However, ultimately the biggest weapon the discounters are carrying into the convenience war is price - or more importantly, value.

“With figures this high, even a small reduction in energy use can offer significant cost savings - as high as 70%”

“Value is key,” says Gray. “We have tackled the competition through KVI lines, weekly WOW deals, 5.5 million leaflets delivered to homes and a three-weekly promotional programme, which runs over 400 eye-catching offers.”

Put together and it’s a lot of activity from all the symbols aimed at saving everyone money in January.

But it’s not just prices, of course. There’s also costs. And there are a few avenues open to small independent retailers to pare these down. And if the question of wages and opening hours is a trade-off that’s down to every store owner to decide, we urge you to consider your energy costs.

Even if plummeting oil prices result in lower heating and lighting bills in the short term, there’s no point throwing money down the drain. As The Grocer’s Switch the Lights campaign has shown in great detail, there are myriad opportunities open to independent stores to cut down (by up to 70%) on their lighting bills through switching to LED lighting. And refrigeration is another big utility bill that can be slashed through upgrading to the latest technology.

Energy guzzlers

“LED lighting is a great commercial and environmental move for the industry,” says Tony Wright, divisional director at Ebm-papst, which supplies high efficiency fan and motor products used in refrigeration by most of the UK’s leading supermarkets.

“However, we believe this move towards energy efficiency in the sector could go even further. And the biggest energy user in their stores is refrigeration.”

The Carbon Trust says for smaller shops, more than 70% of total energy used goes towards powering energy-guzzling chillers.

“There are changes to refrigeration that don’t require costly actions, with the Carbon Trust stating that up to 20% energy savings can be made through actions that require little or no investment,” says Wright. “And upgrading them can provide bigger savings overall.”

So make the call. What harm can it do?

Top tips

- Slash operating costs: by investigating LED lighting or more efficient refrigeration to save up to 70% a year on utility bills

- Attack the discounters: by investing in KVIs like bread, milk and eggs and shout about it via promotional material or TV ads

- Round pricing: hit round price points of 50p or £1, but ensure you can retain a sustainable margin at the same time

- Get smart: use market analysis and customer insight to identify what customers are looking for

Business Barometer

No comments yet