The ambition to create the next big dairy-free alternative has carried many brands into the vegan chiller category.

But startups and big brands alike have found it difficult to compete with established specialists like Alpro, forcing some to exit the space.

Others never made it to market in the first place. Take sausage-maker Heck, which promised a line of milk alternatives was in development back in 2019.

Add to that issues with supplies of grains and cereals used to make such milk and the fight is just not worth it for some.

These nine products exemplify that struggle

Benecol Oat

Benecol’s oat-based range barely made it a year before all its listings had evaporated and it was removed from the brand’s SKU count on its website.

Having first launched in March 2022, the vegan range comprised alternatives to yoghurts and oat shots, all containing plant stanols that lived up to the Benecol brand promise to lower cholesterol.

Holy Moly Nutshakes

These Strawberry Almond, Chocolate Almond and Banana Almond nutshakes by Holy Moly were made with raw, unpasteurised almonds and fresh fruit.

They were among a glut of dairy alternative NPD launched in 2020, securing listings at Sainsbury’s in the ready to drink chillers.

However, they are no longer available to buy in the mults and have disappeared from the brand’s website.

Innocent

NUTTERLY DISAPPOINTING NEWS

— innocent drinks (@innocent) March 21, 2023

We're sad to say that our dairy free range will be leaving shelves in the next few weeks.

We know some of you really love our coconut, hazelnut and almond drinks, so we wanted to say a big thanks for buying them. We really appreciate all five of you. pic.twitter.com/MGE3Vz2JrR

Innocent’s trio of nut-based milk alternatives lasted five years, but couldn’t compete with a swathe of new launches.

A spokesperson for the brand said the alt milks hadn’t been as successful as hoped, leading the brand to axe them in March 2023.

Sales of the hazelnut, almond and coconut-based drinks plummeted by 42% to £3.4m in the 52 weeks to 10 September 2022 [NIQ].

Read more:

-

The death of vegan brands and the unlikely saviour of plant-based diets

-

Meatless Farm set for rescue by vegan pioneer

-

Seven veggie products that prove plant-based can’t guarantee sales

-

What the failure of Garden Gourmet says about the changing vegan market

Lilk

Lilk came to market in 2021, launched by siblings on a mission to break down shopper barriers to entering the dairy alternatives market. Its blended flavours won awards for closely matching dairy.

However, it bit the dust in January, blaming supply shortages making the product less viable. While it’s still available, apparently it will not be for much longer.

The statement on Lilk’s Instagram read: “Today we are sharing some sad news: Lilk will be closing shop. We’ve been so grateful for the support, love, and kindness we’ve received from all our fans and shoppers.

“The response has been amazing and it would have been great to continue this adventure with you all. Sadly, we’ve fallen victim to the supply chain crisis that is gripping the industry and has worsened with the war.

“So once again, thank you all so much for the love and loyalty you showed our bottles – this really meant the world to all of us – and we hope you all continue fighting for a better, tastier and fairer food system!”

M+lk Plus

Brought to life by The Apprentice finalist Camilla Ainsworth, M+lk Plus, or Mylk Plus, aimed to bring some fun to the dairy-free drinks category. Its flavours included Chocolate Orange Oat, Salted Honeycomb Hazelnut and Strawberry Cheesecake Cashew.

It was pitched as a grab-and-go competitor to the likes of Frijj and secured listings with Holland & Barrett and on Amazon, but never really took off in mainstream supermakets.

M+lk Plus was adding new flavours until 2020, and continued social media activity into 2021. However, the company had taken its mylks off shelves for some time before it was officially dissolved on 2 May 2023, according to Companies House.

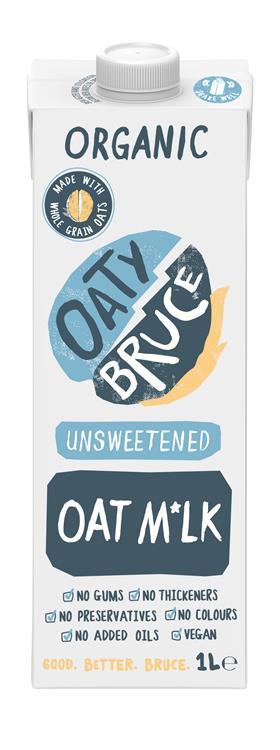

Oaty Bruce

Oaty Bruce, the cereal-based sister to Nutty Bruce, launched in 2020, but has since disappeared from shelves in the UK.

The Australian brand had hoped to challenge Oatly, though faced competition from the likes of Glebe Farm, Mighty, Plenish and Minor Figures, all of whom had the same idea.

With its oat-based line pulled it seems that the brand is sticking to what it knows, at least for now.

However, Bruce’s Activated Almond M*lk and Almond & Coconut M*lk SKUs remain to sell another day.

Shaken Other

Shaken Udder’s dairy-free alternative, Shaken Other, debuted in summer 2020. The brand’s plant-based SKUs have been off shelves for the past couple of months, but not for much longer, according to the brand.

It says it’s it is in the process of changing suppliers, and the drinks are on track to be reintroduced.

Sharpham Park

Sharpham Park’s spelt-based milk alternatives were unveiled in March 2022.

Just over a year later and the Organic Naked Oats & Spelt and Spelt Barista drinks are unavailable while the brand says the packaging is undergoing a redesign. Sharpham Park plans to relaunch the duo in autumn 2023.

Wunda

Food giant Nestlé is not having much luck in the British vegan space. Pea protein-based Wunda first went on sale in the UK in June 2021 and was pitched as a more environmentally friendly alternative to rivals made from ingredients such as soya, almond and oat.

Nestlé relaunched the brand last October with a new pack design playing up its key ingredient. By March, it had decided it wasn’t viable and decided to pull the plug. Little wonder, as Wunda registered sales of just under £1m last year, according to data for The Grocer’s Top Products report [NIQ 52 w/e 10 September 2022], while market leaders Alpro and Oatly registered a combined £166m.

So, are people not drinking alt milk any more?

Dairy-free remains a sizeable category, worth more than £800m, up more than £50m on last year. But fewer dairy alternatives are being bought.

Assosia data shows that while shoppers spent more on dairy alternatives in 2023 than 2022, that’s a result of inflation as volumes have fallen.

Values are growing for both branded and own-label dairy altermatives, though own label added £40m to its value; that’s more than double the value added to branded (£18m).

But branded sold 32 million fewer litres over the same period. Own label picked up some 18 million litres of those volume sales, but the rest have dissipated, leaving the category’s volumes down overall.

No comments yet