Suppliers are counting their costs as coronavirus, recession and Brexit are offset against one another

Download: The OC&C Top 150 Supplier Index 2020

The food and drink industry’s 2020 was meant to be defined by Brexit. Then along came a global pandemic. Suddenly the focus shifted to keeping shelves stocked.

The industry rose to the task, enhanced its reputation and in many cases grew sales substantially. But it’s certainly not been plain sailing. And looking ahead, the picture only gets murkier.

With a huge recession, more lockdowns and restrictions, and the upheaval of potential Brexit tariffs and disruption to the supply of goods, the uncertainty plaguing the industry has multiplied.

So how will the UK’s top suppliers be affected?

Food and drink producers were already under pressure before the pandemic hit. The 2020 OC&C Top 150 shows momentum across leading UK suppliers had slowed markedly in 2019.

Aggregate revenue growth across the country’s largest food and drink suppliers fell back to 1.9%, from 4.3% in 2018 and well below the long-term average of 4.9%. Except for the zero growth of 2015 and 2016, that’s the weakest overall growth figure for 20 years.

However, the industry was probably in better shape than the headline figures suggest. Growth relative to inflation improved, as consumer price inflation weakened to 0.9%. That means the industry’s 1.9% growth outperformed the wider inflation rate to a greater extent than the 0.7 percentage point differential in 2018.

Importantly, margins also remained stable. Aggregate 2019 profit margins ticked back up to 6.1% from 6% in 2018 and remained well above the depressed rates of the five years following the last recession.

“Overall economic conditions last year weren’t spectacular,” says OC&C UK managing partner Will Hayllar. “But the relative economic stability and benign commodity prices have meant businesses have been able to make progress to drive growth and profitability.”

As such, these conditions represent a period of calm for suppliers, in between pressure from the rise of the discounters and the UK’s exit from the EU. That calm has, of course, been dismantled with the coronavirus and resulting changes to consumer behaviour.

The UK-wide lockdown in spring immediately shifted spend into grocery retail, which experienced unprecedented demand – up as much as 18.9% in June and still up almost 10% year on year [Kantar].

Sales of the listed food players demonstrate the effect of this huge transference of spend. First-half revenues in those who primarily supply supermarkets have grown. Tesco meat supplier Hilton Food Group is up 39%, pork supplier Cranswick is up 21% and Premier Foods is up 15%. Meanwhile, those with out-of-home exposure have seen a sharp fall, with Vimto producer Nichols down 17% and Fever-Tree falling 11%.

That has created expensive challenges on both sides. Those supplying the supermarkets have had to rapidly scale up production, focusing on core product lines as retailers cut SKUs. At the same time, they have incurred significant extra costs related to social distancing, staff absences and PPE.

On the flip side, those supplying out-of-home sectors were forced to scale back production destined for food to go and prioritise at-home consumption.

Suntory Beverage & Food has seen both sides of the coin. Its offer was “no longer a match for consumer needs” in the wake of the virus, says GB & Ireland COO Carol Robert. “We had to quickly pivot, producing larger packs and bigger bottles. That required a speed to market we had never achieved in the past.”

“If a supplier is heavily exposed to central London or travel retail, they will be less positive than those focused on more suburban areas”

Those new patterns look likely to continue for the foreseeable. Despite the easing of the lockdown over summer OC&C found 59% of foodservice and accommodation businesses were still underperforming. As further restrictions come in, that figure is likely to rise.

Plus, Global Workplace Analytics estimates 25%-30% of the workforce will still be working from home on multiple days a week by the end of 2021. “This is the new normal,” says Suntory’s Robert. “This shift to at-home consumption is here to stay.”

That could present more problems for some than others. “If a supplier is heavily exposed to central London or travel retail, they will be less positive than those focused on more suburban areas,” points out Hayllar.

Still, no one can afford to stand still. Jefferies consumer goods analyst Martin Deboo foresees “the emergence of new business models”. A food assembly specialist such as Greencore, he suggests, could use its expertise to shift from ready-to-eat categories like sandwiches to meal kits.

Online growth is another area forcing suppliers to adapt. Its share of grocery has risen from 7% pre-pandemic up to 14% over the summer, according to Nielsen. So many suppliers are now tailoring their marketing and promotions strategies to the online shopper.

Premier Foods, for example, grew online sales by 115% in its Q1. “Online is an area we’ve been doing a lot of work on this year,” says chief customer officer Richard Martin. “We’ve tried to focus on getting the basics right, making sure products have the right hero image that works on mobile, for example, or that the product descriptions contain the right keywords.”

OC&C suggests suppliers can also become more creative around basket matching or bidding for banner ads.

Or they could go one step further and go directly to consumers. That’s been an area of huge growth during the crisis, says Houlihan Lokey co-head of UK corporate finance Shaun Browne. “The virus has accelerated trends we already had and in particular some of the growth of DTC consumer businesses,” he says

As well as providing a sales spike for existing DTC specialists like Mindful Chef, Abel & Cole and Allplants, a number of traditional brands such as Heinz have launched successful home delivery services.

Akeel Sachak, Rothschild & Co’s global head of consumer, doubts DTC will be a game-changer for brand owners, however. “I just don’t think the volume is there to make home delivery cost-effective for an individual branded supplier,” he says. “People going online for food and drink want to bundle purchases together.”

Recession

Ultimately, perhaps the most notable market dynamic shift triggered by Covid is a UK recession. Last month, the Office for National Statistics revealed the UK was in its worst recession since quarterly records began 65 years ago, with second quarter GDP down 19.8%. Consensus estimates suggest the economy will not recover to pre-Covid levels until 2022-23.

It’s already having an impact. Asda’s income tracker suggests a 3.6% drop in disposable incomes, despite the furlough scheme so far limiting job losses.

The mainstream grocers seem determined not to be caught out by this recessionary cycle, which last time ushered in the growth of the discounters. Tesco led the way, launching a price-matching scheme against Aldi as early as March, and as it’s scaled it up over the summer, others have followed, which could squeeze supplier margins once more.

Suntory’s Robert, for one, is in favour of the move towards everyday low pricing. “During the last recession there was a trend to shift focus to volume ahead of value, she says. “That’s a dangerous game and most of us have learned the lesson, to focus on everyday value rather than spikes of high and low pricing.”

However, Sachak points out this recession is different, in that it has been “artificially induced” by lockdowns and the virus. Some therefore expect there will be opportunities to drive consumers up the value curve towards high-margin, added-value products.

Hayllar adds: “There is a risk that if you jump straight into the value agenda you miss the opportunity to capture a higher share of consumer spending.”

Indeed, Covid-19 has dramatically dampened other areas of spend, such as holidays, travel expenses and eating out. That potentially leaves consumers with more room for affordable luxuries in food and drink.

“There is a risk that if you jump straight into the value agenda you miss the opportunity to capture a higher share of consumer spending”

For that reason, Deboo doubts there will be “much recessionary impact” on UK food spend. “And when you overlay Covid on that to keep the focus on the at-home market, you could see plenty of opportunity for quite aggressive premiumisation,” he adds.

Premier’s Martin similarly spots an opportunity here. “Consumers spending more time at home will get bored of having the same meals all the time,” he says. “We’re thinking carefully about how we can offer inspiration through the innovation we’re bringing to market”.

Covid is also a tailwind behind another typically margin-accretive trend: healthy eating. Boris Johnson has unveiled his obesity strategy, and the public is paying attention. “People have seen the link between obesity and illness,” says Browne. “It’s inevitable there will be an acceleration in demand for healthier and better-for-you products.”

To succeed in the recession, OC&C associate partner Nilpesh Patel says suppliers need to ensure they are positioned to tap into these areas of consumer demand. “If you are on the right side of some of those trends, such as affordable luxuries and healthier products, there is certainly an ability to benefit,” he adds.

So far, it seems Covid will be a surmountable threat. But let’s not forget the ongoing threat facing suppliers, even before the virus hit: the rising cost of labour. At present it is unclear how Covid has affected this picture. The extra costs associated with factory operations during the virus were perhaps mitigated by range simplification and a dialling back of promotions.

Brexit costs

The industry is now facing those extra costs alongside Brexit. Until now, the UK’s delayed exit from the EU has punted the potential labour crisis down the road. The 7.3% reduction in EU immigration in the three years to March 2020 was in effect replaced by a 13.5% uptick in non-EU immigration. So costs have been relatively stable. Last year, revenue per employee grew by 2%, though staff costs per employee rose 3%.

The upcoming direction of movement on labour costs – given the national minimum wage and likely Brexit impact – is likely to produce much more dramatic change. With that in mind, producers have continued to invest in production and automation.

That is evidenced by the Top 150 report, which shows capex as a proportion of revenues rose again last year to 3.6% – from 3.5% in 2018 and 3.1% in 2017. Suntory is a case in point. Roberts points to a £13m investment in its Coleford factory “to drive value and take costs out”.

Browne believes the movement towards capex instead of spend on people will “probably happen as a result of Brexit, as cheap labour will be harder to come by. But Covid could switch everything on its head and make cheap labour available domestically.”

Indeed, an uptick in unemployment could relax the UK labour market, giving the industry more opportunity to recruit British workers.

”The transition period has given us more time to get this right and we feel we’ve planned for every eventuality”

It’s a good thing, considering the biggest threat of Brexit – punishing tariffs and border disruption – is getting very real. As The Grocer went to press, Boris Johnson claimed to have walked away from talks and has called on UK business to prepare for a ‘no-deal’.

Luckily, businesses have had plenty of experience in preparing over the past year. “The transition period has give us more time to get this right and we feel we’ve planned for every eventuality,” Robert says.

There have already been industry efforts to increase stocks and diversify transport routes away from Dover, says Hayllar. That suggests – other than specific cases such as the import of fresh fruit & vegetables – suppliers are fairly confident in handling border disruption.

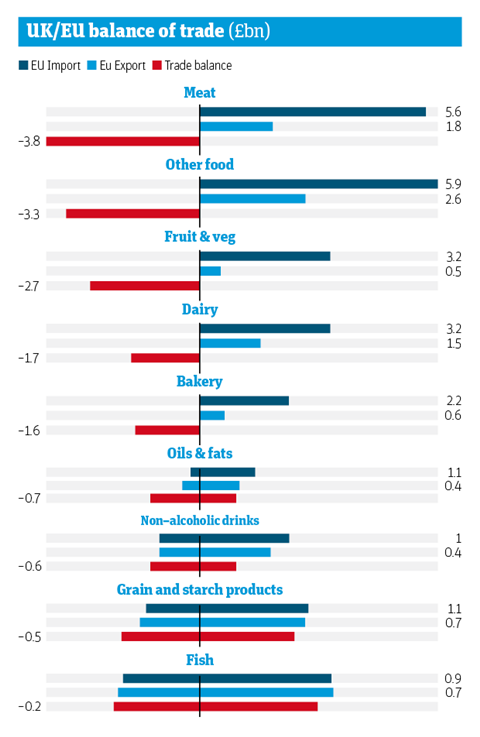

Of more concern is uncertainty around tariffs, which will affect over 85% of food imports. Average tariffs are likely to be around 20% but could hit 57% on cheddar and 48% on beef mince in a no deal. Exports are likely to face EU tariffs of similar magnitudes.

That uncertainty already appears to have had an effect on trade. First-half food and drink exports have slumped 14%, while total Top 150 export growth was 2.8% in 2019 compared with domestic growth of 1.1%, this was heavily driven by international M&A.

Food price inflation

The most notable effect of tariffs would be to supercharge food price inflation amid more pressure on the pound. Hayllar says producers have little headroom to absorb these extra costs, meaning “it is either passed on or major efficiencies have to be found elsewhere”.

Any structural input inflation would conflict with the grocers’ desire to compete with the discounters, and could put supplier margins under pressure. “Pushing through price increases in this political environment will be challenging to say the least,” he adds.

Still, the overriding message amid all this turmoil is one of optimism. “There is an opportunity here to reappraise how important this sector is in UK life,” says Hayllar. “We have seen such an impressive effort to adapt under all sorts of pressure and there is a real chance to capitalise on that in relations with government and to boost the level of talent coming into the industry.” Because if the food and drink industry has proven one thing over the past 12 months, it’s that it knows how to rise to a challenge.

Downloads

OC&C table

PDF, Size 0.3 mb

No comments yet