Brits are a sickly lot. But don’t just take our word. Here’s Dr Paula Cowan, medical director for primary care at NHS England North West. “Most of the public have been socially isolated during the last two winters and this appears to have reduced their resistance to infections,” she said earlier this year.

It meant people were “more likely to pick up infections than in previous years” and illnesses would last longer as sufferers picked up “one infection after another”, she warned.

It seems her prediction was spot on: volume sales of cold & flu products are up 4.9%. That’s 9.6 million extra packs, helping to drive a £92.2m gain – which NIQ senior analytics executive Chandni Singh describes as “remarkable”.

As in multiple other categories, own label performance has outpaced that of brands. In cold & flu, own label has grown unit sales 10%, more than twice as fast as brands’ 4.5%.

But there’s been more than enough fever and phlegm to go around, it seems. Seven of the top 10 brands are in volume growth – six of those by double digits.

Category leader Lemsip “continues to assert its dominant position”, Singh notes. It’s grown value 16.9% on volumes up 5.6%.

Healthcare brands showing stronger sales

In second and third places are Benylin and Sudafed. They’re worth an extra £21.1m after selling 3.2 million more packs.

Their success is significant – being their first as brands of Kenvue, spun out from Johnson & Johnson earlier this year. That was a “historic moment” and a “significant milestone”, according to Kenvue’s CEO Thibaut Mongon.

A major event also affected Nurses, the only top 10 in both value and volume decline. Its performance is the direct result of this year’s withdrawal of products containing pholcodine, present in Day Nurse.

“Pholcodine-containing cough and cold medicines are being withdrawn from the UK market as a precaution following a review, which found their benefits do not outweigh the increased risk of the very rare event of anaphylaxis to neuromuscular blocking agents used in general anaesthesia,” the Medicines & Healthcare products Regulatory Agency announced in March.

For pholcodin-free brands, the most successful ones are those that “strike a balance between competitive pricing and unwavering product quality”, says NIQ’s Singh.

Ian Morley, VP sales for P&G northern Europe, confirms “superiority of product” is driving “strong demand creation”. He points to the company’s Vicks brand, which has seen volumes rocket 18.7%.

In vitamins & supplements, P&G’s Seven Seas has recorded the fastest value gain in the top 10. Its 14.4% growth was driven by a “brilliant and unique” combined omega-3 and multivitamin offer, Morley says, “so the consumer doesn’t have to buy two products”.

How big name drugs brands performed

A promise of quality has also benefited brands in hayfever relief, where there has been a shift towards branded products over the past two years. Despite the cost of living crisis, shoppers “are increasingly willing to invest in trusted and recognised brands, prioritising quality and effectiveness over price,” says Singh.

But the big names can’t afford to be complacent in such a competitive space. Piriteze, Piriton and Benadryl have all suffered dips in volume. That’s due to gains by smaller rivals Allevia and Beconase, as well as “tertiary brands like Crescent Pharma and Hayleve, which have experienced remarkable triple-digit growth, primarily attributed to increased distribution”, Singh adds.

Sanofi’s non-drowsy Allevia “has emerged as the standout success of the allergy season”, she notes. It was the “most disruptive among the newly launched products in the last year, driven by extensive distribution, premium pricing, and substantial investment”.

In March, Holland & Barrett unveiled at-home blood tests that promise results within 48 hours. The own label Ivie lineup – developed in partnership with London Medical Laboratory – comprises 13 variants. They include The General Health Blood Test, The Diabetes Blood Test and The Thyroid Blood Test, starting at a price of £39. Users send a finger-prick sample to London Medical Laboratory, which provides results via the Ivie Wellness app.

Own label sex care 2023 sales performance

While shoppers with hayfever have been willing to fork out on brands, the same can’t be said for those with amorous intentions.

“Own label in both condoms and lubricant shows growth this year, benefiting from shoppers switching to lower-priced items to manage costs,” explains NIQ analytics executive Kevin Chen.

In condoms, that’s led to a 23.8% rise in own label volumes, while brands have fallen 5%. Lube & gel data paints a slightly more flattering picture for brands. They up 0.7% in volumes against private label’s 6.2% gain.

Meanwhile, big-name products such as Durex and Mate condoms and Kynect gel have shed units – having failed to arouse shoppers’ interest.

Top Launch 2023

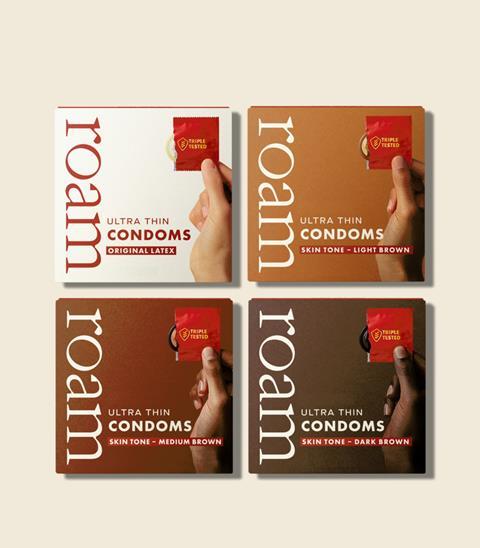

Skin Tone Condoms | Roam

‘Why has this never been done?’ asks Roam’s Marketing material for what it claims are the world’s first skin tone condoms. They launched in April, after the brand found nearly a half of Asian men and almost a third of black men would pick a condom closer to their skin colour. Light Brown, Medium Brown and Dark Brown are available in packs of 12, 24 and 36 (rsps: £14.99-£34.99). For every condom bought, Roam donates one to sexual health charity Brook.

Face off: Top Products Survey 2023 pits brands vs own-label

![Beans Face Off_RGB[18]](https://dmrqkbkq8el9i.cloudfront.net/Pictures/261x166/9/5/1/311951_beansfaceoff_rgb18_56926_crop.jpg)

It’s no longer a battle of the brands. The bigger battle, after two years of inflation, is between brands and own label. Who’s winning?

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

Currently

reading

Currently

reading

Personal care 2023 - health: Sickly Brits drive huge value gains

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

![Beans Face Off_RGB[18]](https://www.thegrocer.co.uk/Pictures/80x50/9/5/1/311951_beansfaceoff_rgb18_56926_crop.jpg)

![Beans Face Off_RGB[18]](https://dmrqkbkq8el9i.cloudfront.net/Pictures/80x50/9/5/1/311951_beansfaceoff_rgb18_56926_crop.jpg)

No comments yet