Sex sells - even at Sainsbury’s. To a flurry of tabloid headlines, the retailer rolled out a range of sex toys in November. In classic supermarket style, there were good, better, and best offerings, priced at £8, £12 and £15 respectively. “We are always on the lookout for new opportunities to help our customers live well for less and they’ve told us that sexual wellbeing is an area they would like to see more choice in,” said Sainsbury’s food commercial director Paul Mills-Hicks.

Data Box

Top 9 SexCare

The fact a supermarket is designing sex toys shows how mainstream they have become. Despite an 11.1% decrease in sales through grocery, they are increasing in popularity more generally - especially for men, says online sex toy retailer Bondara.

“Men’s sex toys have seen a huge leap and are steadily catching up with the women’s market,” says a spokeswoman. “We hope this trend continues and the taboo gradually breaks down. Millions of people have sex toys, yet it’s a topic that remains relatively under the covers.”

Supermarkets may seem unlikely place for this revolution to take place but Jennifer Rann, head of retail commercial at Well Pharmacy, believes it could happen. She says consumers are “seeking choice and variety” in sex care. “A change in mentality is what’s needed to drive this category forward. Bringing it into daily consumer life in a grocery arena will help to remove stigma.”

Toy specialist So Divine is proof it can be done. It jumped from sixth to third place in sex devices after a massive volume hike of 151.4%. It says its toys are now listed in Ocado, Asda, Superdrug, Tesco and Boots.com.

It’s a glimmer of growth in an otherwise quiet year for sex care. Condoms have fallen 1.4% in value on volumes down 6.4%. The top three brands - Durex, Skyn and Mates -all saw sales fall, while number four Pasante was hardest hit with a 43.8% value drop.

Convenient outlets were the only ones winning in condoms, says Nielsen analyst Carina Reynolds. “Growth was mainly achieved through price (up 5.4%), as shoppers will spend more for convenient access.”

Sales of lubricants also fell in volume, but innovative products helped lift value. Durex saw value rise 5.3% on volumes up 1.3% after launching SKUs such as its Intense Orgasmic Gel last year. So Divine is hoping to get in on the action with a new “prosecco-flavoured lubricant” next year, which it predicts will be a “major hit”.

“People are becoming more open about the category,” says a spokeswoman. “Thirty or 40 years ago supermarkets would not have had condoms on shelves and now it is the norm. Times are changing.”

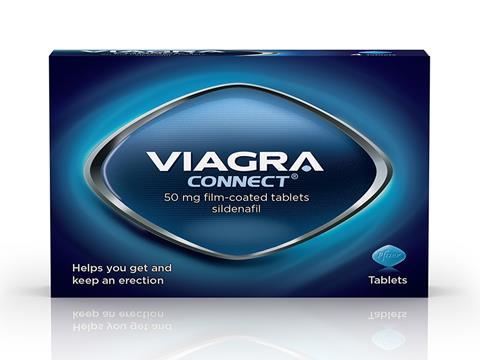

TOP LAUNCH

Viagra Connect, Pfizer

Help for the four million UK men affected by erectile dysfunction has been at hand for years in the shape of Viagra. But until March the little blue diamond was only available on prescription, meaning a potentially awkward conversation with a GP. Thanks to the active ingredient in Viagra – sildenafil citrate – being approved for OTC sales, Pfizer was able to launch this more convenient solution in March. Within three months, the launch had provided a £4.3m boost to supermarket healthcare sales.

![[TePe] EasyFit in packaging, re-scaled](https://dmrqkbkq8el9i.cloudfront.net/Pictures/380x253/0/3/1/387031_tepeeasyfitinpackagingrescaled_671174.jpg)

No comments yet