Tesco-Booker deal could trigger consolidation in the Big 30 on an entirely new level. So what does the future hold?

Is the Booker merger a magic bullet for low-growth Tesco? While the merits (or otherwise) of the deal have been discussed extensively, the ramifications for the wholesale sector have barely even begun to be considered.

Consolidation has always been a big factor in wholesale. Last year’s Big 30 feature focused on a number of key deals in the previous 12 months including the £200m takeover of Matthew Clark by Conviviality Group and activity from Kitwave, but the most talked about deal that year was Booker’s £40m takeover of Musgrave’s GB operations, comprising the Budgens and Londis franchise.

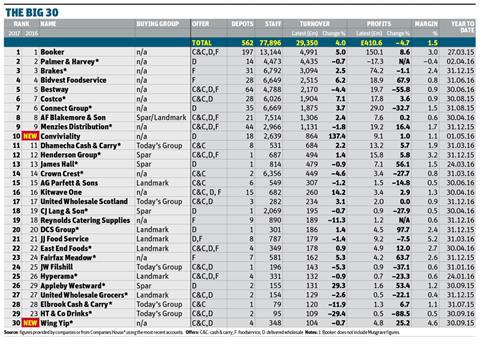

Click or tap here to download the table

It would have been very hard, then, to believe that Booker, wholesale’s consolidator-in-chief, would be the subject of consolidation just a year later. And while few will say it publicly, as the dust settles, rivals in both grocery and foodservice are losing a considerable amount of sleep over the idea of the UK’s biggest wholesaler joining forces with the UK’s biggest retailer.

Well they might. Booker has been increasingly dominant in the sector under CEO Charles Wilson, as The Grocer’s 2017 Big 30 ranking shows. As the only national cash & carry operator, it owns around 50% of the Big 30’s C&C depots. And with its pre-tax profits increasing 8.6% to £151m it accounts for 37% of the Big 30’s £411m pre-tax profits total - not including Budgens/Londis numbers.

As the integration of Budgens and Londis starts to pay dividends, the Tesco deal looks set to take it to another level again. Of course we are yet to hear what the Competition & Markets Authority will make of the merger, but the combined business would have sales of over £60bn, and expects to deliver EBITDA of £2.4bn - 10 times the profits of the remaining Big 30 wholesalers.

As well as Tesco’s supermarkets, Tesco-Booker would supply well over 7,000 convenience stores between the Tesco’s Express and One Stop operations and Booker’s Premier, Family Shopper, Londis and Budgens fascias.

Not surprisingly, many independent retailers are concerned. Booker is effectively sleeping with the enemy, says indie champion Andrew Thornton, who previously welcomed joining Booker following the Musgrave deal. “Shocked by news that Tesco buying our wholesaler Booker,” he tweeted. “Will fight for all we stand for and to retain our independence.”

And in the short term wholesale rivals believe they can capitalise on thse fears.

“The synergies are obvious,” says a rival wholesale CEO. “They’ll certainly have some success, I imagine, in [achieving] these. But it poses Booker quite a few issues with their customers,” he argues.

“Independent retailers see the multiples as the enemy. If I were Bestway or P&H I’d be saying do you really want to be putting money into the coffers of your biggest competitor? Obviously, there is the CMA and whether they are allowed to keep it all, Budgens and Londis for example, but in terms of their independent customer base, it allows their competitors to make some mischief.”

“Independent retailers see the multiples as the enemy”

While rivals make mischief, however, another leading wholesale MD warns this could ultimately be a false hope. “In the short term this could be good news for us with some retailers looking to move, but it’s more of a threat to us in the medium and long term.”

That is certainly what Booker CEO Charles Wilson is banking on. While attention is currently focused on retention - via a well-publicised national roadshow - on the day of the big announcement he was keen to dismiss any talk of betrayal and suggested instead that the deal was more likely to act as a magnet for retailers.

“Our recruitment was very strong in the wake of the Budgens and Londis deal and it wouldn’t surprise me if this proved a driver for independents to sign up,” he says. “I’d be disappointed if they didn’t think we were the wholesaler of choice.”

There is logic in his thinking. As the lines between convenience retailing, food to go and foodservice continue to blur and competition becomes even fiercer, traditional independent retailers will no doubt be attracted not only by the promise of lower prices but by in-store tech services. Wilson is promising independent retailers access to Tesco banking facilities, Tesco Mobile and the new PayQwiq service, all of which could make a real difference in the Amazon era.

But another leading wholesale boss believes Tesco-Booker’s combined buying power could warp the market in a number of ways. “Tesco can sell baked beans cheaper than we can even buy them. Even if they merely demand consistency of trade terms along Tesco’s current lines, suppliers will lose an awful lot of money and might even go bust.

“You end up with a potentially enormous competitive edge. If they use it, it could decimate the industry. And if there is no other competitor, and you’ve got all the data for all the independent retailers, you can use differential pricing to take the best stores. It’s a massive theory of harm effect.”

Wafer thin

It’s certainly true the industry is on a knife edge. While Palmer & Harvey was the only wholesaler in this year’s Big 30 to make a loss (and its ebitda fell from £35m to £21m), overall margins remain wafer thin, and fell 50 basis points to 1.48%, with almost half the Big 30 experiencing margin dilution.

P&H MD Martin Ward admits it has been a challenging 12 months in the sector, due to greater competition - not to mention the ever increasing regulatory burden in the form of the national living wage (NLW), auto-enrolment pension schemes and the huge changes to the selling of tobacco.

“The entire grocery market continues to feel the effects of price wars between major multiples and discounters, yet the convenience sector is still growing and we are well placed to take advantage of that growth,” he says.

Ward also acknowledges the potential threat of Amazon, as it continues to muscle into the UK grocery sector. “Amazon is really interesting and could bring big changes for convenience shopping. We are yet to see the full impact of what Amazon will do.”

“Small retailers need to be a lot more aware of who their customer base is and what they are looking for”

His advice to retailers in these changing times is that they “need to be a lot more aware of who their customer base is and what they are looking for”. In the meantime, P&H has been working closely with another big four retailer - Morrisons - on a distribution jv for its Morrisons Daily forecourt trials, and is widely rumoured to be in talks to do the same for Morrisons when it unveils its Safeway range for independents, expected later this spring.

Another wholesaler to see a hefty decline in profits has been Bestway. Announcing a 56% decline in profits last year, it was its willingness to invest in better prices for its customers that saved many of them from going under, one senior director suggested.

New MD Martin Race remains optimistic, however, insisting giving customers what they want means a greater focus on delivered wholesale - and he too singles out online as a growth area, noting that the blurring of the lines between business and consumer customers works both ways.

“Online has been a great success for Bestway, with 15% of all our wholesale business coming through this channel,” says Race. “The online business continues to grow month on month as many customers have now embraced digital. Spend per visit is also significantly higher online and, in addition to having a mobile app, which has been downloaded over 27,000 times, we now have a huge deployment of iBeacons across the estate to interact with customers in depots.”

Why mults are getting a taste for wholesale

There has been a big shift in the way major mults view wholesale.

Until recently supermarkets were focused on challenging their dominance in the convenience channel. With their cash, scale, and chilled expertise they fully expected to blow independents out of the water. And they’ve clearly made major inroads.

However many canny and hard-working operators within wholesale and convenience have been able to survive and even prosper, thanks to a mixture of their greater understanding of the channel and their agility.

But Tesco’s merger with Booker is about much more than buying up convenience share and expertise. It’s about acting more as a supplier, something it’s been trying for some time through its One Stop franchise. Bolting on Booker’s fascias delivers huge scale at a stroke, while it can also serve foodservice customers, essentially as a logistics-based supplier, “cutting carbon out of the equation” as Charles Wilson put it.

Morrisons too is focused too on harnessing its supplier-based capabilities. With its integrated supply chain, it’s always supplied the trade (including Booker) on excess stock. It was to achieve better utilisation that it entered into a supply agreement last year with Amazon Fresh. The imminent launch of the Safeway own label range takes that one step further, as it’s been developed specifically for independent retailers who, as My Local found, have been unable to match the chilled expertise of the major mults.

There is still no news as to who its distribution partner will be for Safeway, but it is widely expected to be P&H. Ties with the UK’s second biggest wholesaler have been strengthened through the Rontec supply deal. And with P&H set to lose its Tesco’s tobacco supply deal, there are even rumours Morrisons will acquire it.

Of course, the Booker-Tesco deal doesn’t just challenge cash & carries and delivered wholesalers. The idea of supplying 480,000 catering customers was every bit as appealing for the multiple. In fact it has had ambitions in food service for some time, but while its dabbling with the Giraffe restaurant chain (now sold to Boparan), Harris + Hoole coffee chain (now sold to Caffè Nero), Euphorium bakeries and Mexican burrito/taco outlets (among others) demonstrably didn’t work, the approach this time is different.

The appeal of Booker was its “complementary nature”, Tesco CEO Dave Lewis explained. “I don’t want to go into the restaurant business. I’m not interested in food conversion. I want us to be a supplier of great food across multiple channels. Booker’s low capital, cash efficient supply is complementary to what we do, and it’s where I want us to be.”

One wholesale source believes Brakes - acquired this year by US giant Sysco - would have been its first choice, “but the timing wasn’t quite right”.

Even if that’s the case, Booker-Tesco still presents a threat to the five specialist foodservice operators in the Big 30 list - as well as many more offering a smaller scale service to caterers, thanks to its increased buying power. Though for now at least the CEO of one of the main foodservice operators says the Tesco-Booker deal is not a major concern.

“We don’t really come across Booker too much. Whilst they have quite a bit of catering it’s their small caterers and they don’t fit into our sweet spot on delivered wholesale anyway,” he claims. “They have started to pick up some casual dining chains through their Chef Direct business and that competes a little with us but not so much. We don’t see them as one of our day-to-day competitors but we’re happy to take any fall out that comes.

“Long-term, it depends ultimately how they plan to run it - whether they try to have this one huge food company that caters for consumers, caterers and retailers, or whether they just run them separately. If they look to create a food monolith, it would obviously have repercussions across the industry. But you could spend a lot of time worrying about how they might integrate it, what they might do with Tesco home delivery, and also delivering to retailers and caterers, [rather than getting on with running your own business].”

Another wholesaler also questions how compelling Booker’s foodservice operation is. “The catering side is solid and profitable but there’s not much of a growth story. It’s signed a few marquee deals than enable them to market themselves as more than just a cash & carry. But the bit they’re getting credit for in terms of growth is on the logistics side. That’s certainly not where Bidvest makes its money.”

Brexit

And what of Brexit’s impact on the trade? Wholesale - like many business areas - is relatively split as to the impact it will have on their business (see box). Reynolds Foodservice FD Andy Austin believes “uncertainty over the Brexit vote” has been its biggest problem in the last year, whereas United Wholesale Scotland CFO Razvan Syyed does not expect any impact from Brexit as all of its “cash & carry wholesale is done within the UK”.

How tight is the Brexit cost squeeze?

No-one quite knows what impact Brexit will have on the wider economy or the UK wholesale sector in general but one way or another it is exercising the minds of wholesalers.

Parfetts joint-MD Greg Susczenia admits to being sceptical about supplier demands for Brexit-related price hikes. “What we know is that the pound had a sudden and unexpected devaluation last summer. However levels against the euro are now at those of 2012/13 and I don’t remember hearing so much noise then, so I do wonder if there is a bit of opportunism going on among some manufacturers.

He isn’t alone in this thought but the issue of currency-related price increases is shared right across the UK grocery sector, with last year’s Marmitegate spat between Unilever and Tesco the most high profile example yet.

Wholesalers are coming under increasing pressure from suppliers seeking to pass on cost increases - in fact, as we’ve seen among the major mults there is already inflation - but there is a universal feeling that wholesalers should not be seen as a soft target by suppliers facing resistance from the major multiples. “We won’t be accepting carte blanche price increases,” warns P&H wholesale MD Martyn Ward. “Of course some price increases will land, but they will have to be industry-wide.”

Bestway MD Martin Race also promises his company will apply heavy scrutiny to any requests.

Other wholesalers are more sanguine about the Brexit impact. “We believe food prices will rise further with the continued pressure on the pound,” says JJ Food Service group general manager Terry Larkin. “We as a company will need to keep our costs under control.”

JW Filshill MD Simon Hannah predicts “currency fluctuation will have a positive impact in terms of international enquiries but a negative impact in cost of goods for domestic sales.”

But while noting that Brexit is creating uncertainty, FWD chief executive James Bielby, wholesalers are more concerned with more tangible issues such as the NLW, pensions and the new Apprenticeship Levy. “These are all impacting on wholesalers right now.”

And of these the NLW is causing wholesalers the most concern. Writing in The Grocer last year, Bielby warned that the introduction of the NLW would effect 30% of wholesale employees and warned that it would have an even bigger impact on their customers. The current levels has driven up FWD members’ wage bills by 0.7%, and its research suggests the government’s 2020 aspirations would add 3.7% to wholesalers’ wage bills, a cost increase Bielby described as “huge and unmanageable”.

FWD is lobbying government to slow the rate of increases to help businesses better absorb the impact. Either way, jobs are at risk. As this year’s Big 30 shows, staff levels have risen considerably, up 9% to around 78,000 (albeit boosted by the addition of Conviviality, and its non-wholesale numbers, to our list). But with pressure from all sides, the outlook is clear: costs need to come down. And that makes further consolidation inevitable. The only question is will it be the mults picking up the tab?

Downloads

Big 30 Wholesalers table

Image, Size 0.37 mb

No comments yet