Unilever has boosted its e-commerce and male grooming footprint with the acquisition of Dollar Shave Club, a direct-to-consumer company that offers subscription services for razor blades and other male grooming products in the US.

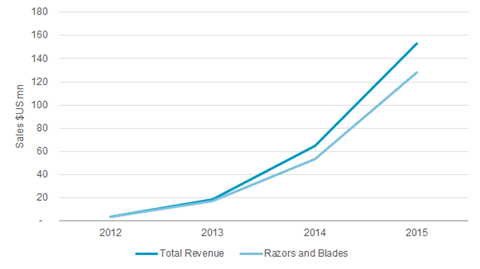

Dollar Shave Club (DSC) was founded in 2012 and is on track to turn over $200 million in 2016. Unilever has not disclosed the value of the deal, but it is rumoured to be around the $1bn (£761.6 million) mark.

DSC is currently operating in the US, Canada and Australia, but further international expansation now looks likely. Unilever said it planned to “leverage the global strength of Unilever to support Dollar Shave Club in achieving its full potential in terms of offering and reach”.

Analysts at Societe Generale said: ”This deal is all about taking DSC global. Currently DSC only operates in three markets, hence an enormous opportunity to globalize the platform given Unilever’s powerful distribution muscle and EM scale. We estimate current profitability is low (single digits) but with Unilever’s economies of scale, the profit upside looks interesting.”

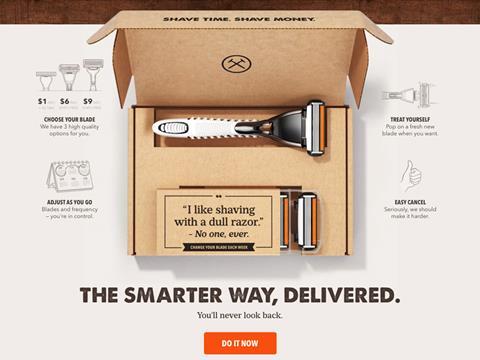

Subscriptions to DSC start from $1 a month for basic blades. In addition to razors and razor blades, the company also sells a range of grooming products including under the Wanderer and Big Cloud brands as well as One Wipe Charlies wipes.

These would bring “to Unilever’s personal care category a unique male grooming perspective”, Unilever said.

“Dollar Shave Club is an innovative and disruptive male grooming brand with incredibly deep connections to its diverse and highly engaged consumers,” added Kees Kruythoff, president of Unilever North America. “In addition to its unique consumer and data insights, Dollar Shave Club is the category leader in its direct-to-consumer space.”

Disintermediation

Direct-to-consumer selling is a booming trend in the male grooming market in the US, where DSC leads the market and competes against Procter & Gamble’s Gillette Shave Club subscription service as well as smaller players like Harry’s.

The trend has been less pronounced in the UK to date, though a Gillette subscription service is available through Amazon UK.

Unilever has been showing increased interest in e-commerce and direct-to-consumer selling more generally, launching a D2C site for its Maille premium mustard in the UK in 2014 and reporting 40% growth in e-commerce sales in 2015.

A survey for The Grocer earlier this year suggested a third of UK shoppers would be willing to buy groceries direct from the supplier, with razor blades of interest to 32% of men.

No comments yet