Consumers spent a record £593m in total on dairy products in the run-up to Christmas, up 2% year on year, according to analysis of NIQ data by AHDB.

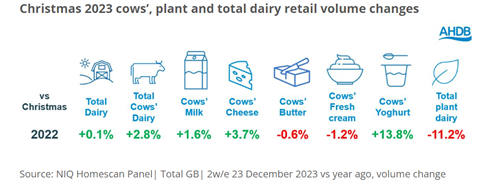

Despite inflationary pressures, there were pockets of volume growth across the category too, including in cows dairy, which saw volume growth match value growth this Christmas – up 2.8% on 2022.

Cows’ dairy also equated to 94% of total dairy volume sales – a two-percentage point increase on the previous year.

However, AHDB said there were also indications of shoppers cutting back in some areas perhaps perceived as non-essential, such as cheeseboards and convenience products.

Overall, cows’ cheese saw an almost 4% increase in volume purchased. However, volumes of cheeseboard staples including stilton and British regionals (including wensleydale and double gloucester) were in decline, as were snacking and convenience cheeses.

And despite greater promotional activity for these cheeses, retailers failed to entice more shoppers than last year, with a decrease in the average cheese volumes purchased per shopper in the Christmas period.

The only ones in growth were cheddar, processed, and speciality and continental cheeses, up 3%, 9% and 5% respectively – enough to offset declines in other varieties.

In other subcategories, cream saw a slight decline. Cows’ cream performance was down 1% on Christmas 2022, but the two-week volume sales still accounted for 10% total cream sales for the year, matching that of 2022.

Double cream and crème fraîche also performed well, supported by a reduction in average price paid and an increase in volumes purchased per shopping trip.

Flavoured cream also continued to perform strongly with a 7% increase primarily driven by an increase in the number of households who purchased and greater promotional purchases.

Read more: Turkey sales bounce back in bumper Christmas for protein

Despite not typically being associated with the festive period, yoghurt saw a strong increase of almost 14% in volumes purchased year on year, with almost one million more households taking yoghurt home in the run-up to Christmas and many increasing frequency of purchase.

On the other side, plant-based dairy alternatives did not perform as strongly with a decrease in both value (–8%) and volume (–11%) of products purchased.

All plant-based dairy alternatives, aside from cream, saw volumes decline in this period. There was also a drop-off in the number of shoppers making purchases in this category.

Average prices for plant-based dairy products increased above that of cows dairy, with cows dairy commanding a 4% lower average price point. Promotional activity was lower over the Christmas period than the rest of the year. All tiers saw volume growth, with premium-tier seeing the largest increase at 7%. As in previous years, premium-tier cows dairy took a bigger share of sales in December compared with the rest of the year.

However, while in December 2022, branded dairy lost out, in 2023 it saw the second-largest increase in volume sales, benefiting from shoppers swapping in from economy, standard and premium tiers.

Prices will have affected this, with standard and economy seeing price decreases year on year, and premium and branded products only experiencing slight increases year on year (up 4% and 2%, respectively).

Most shoppers opted to shop at their regular retailer and were more likely to complete one main shop for Christmas groceries than to shop around, which saw shoppers more likely to use the traditional big four retailers for the bulk of Christmas shops, rather than other retailers.

No comments yet