Publishing: 16 April

Advertising deadline: 31 March

Submissions deadline: 24 March

Contact: Andrew Lusher (andrew.lusher@gmail.com)

The story:

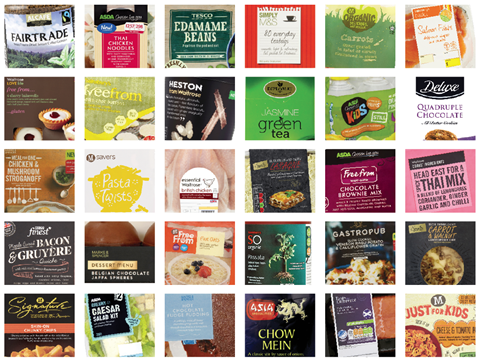

As the price war has escalated, retailers have slashed prices on branded grocery, resulting in a transformation in the fortunes of own label. Own label sales are falling across the grocery sector, with analysis by The Grocer putting the total loss at nearly £1billion, or 2.6%. So which sectors have been hardest hit? How is the performance of own label varying from retailer to retailer? Are there any sectors or specific ranges where own label is in growth?

Key themes:

Retailers: Central to this feature will be an exploration of how different retailers – from the big four, Waitrose and the Co-op through to the discounters – are approaching own label and brands. How have retailers developed their ranges over the past year? Who’s pushing brands at the expense of own label, and vice versa?

Pricing: With the wider grocery market gripped by deflation, how are prices holding up in own label? With retailers increasingly pushing upper tier, specialist and tertiary lines are prices holding up or are they in decline as the supermarkets are forced to compete on price with the discounters? How have the discounters’ own label prices changed in the past year?

Tiering: Ever since Tesco introduced the concept of ‘good, better, best’ tiering of own label offers in the mid-90s, more and more players have been developing tiered own label ranges. The discounters are increasingly doing so too. What effect is this having on the market? Who’s doing what?

Promotions: This feature will explore how the promotional strategies of retailers and brands have changed over the past year. We are particularly interested in how ‘Dine In For £10’ type deals are affecting the market and driving growth.

Health & functionality: Retailers are continuing to develop own label lines centred on health and functionality. How successful have these lines been and why? What’s next in this area? Is free from ripe for development?

Tertiary brands: This feature will pay close attention to so-called ‘tertiary’ brands and their significance in the price war. Which tertiary brands have been most successful and why?

Innovation: This will be key to this feature. We will be investigating how new product development has shaped the category over the past year and what is in store for shoppers in 2016. We will be profiling four of the most interesting launches in a separate innovation panel.

PLMA – show preview : The vital details (what, where, when) and a short run down of what’s in store

Key questions the feature is likely to address:

- What consumer trends have impacted the category over the past year?

- How have promotional strategies (both in terms of price and marketing) evolved?

- How have individual retailers’ strategies impacted the market?

- How has merchandising changed in the market?

- What’s next for the category?

Downloads

Focus On Own Label 2016

PDF, Size 0.28 mb

No comments yet