Record inflation and squeezed incomes have taken a toll on branded food and drink, with Kantar reporting own-label goods now account for a record 63% of grocery volume and 55% of value sales.

These nine graphs and a table show the current shape of the own-label grocery market and how retailers are adapting to demand for unbranded goods

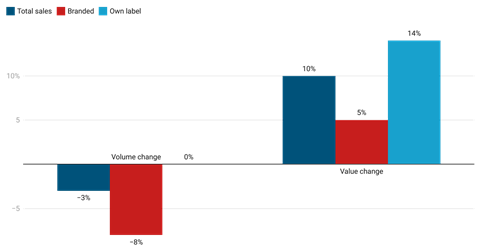

Total grocery value and volume sales change 2022 vs 23

Source: Kantar 16 w/e 16 April 2023

Changes in overall grocery market value and volume sales clearly illustrate the core trend of declining volumes as soaring inflation pushes up prices and, consequently, value sales. In it’s simplest terms, food is more expensive and shoppers are buying less as a result.

The above graph also shows how overall volume sales have fallen 3%. While static volume sales of own-label goods will be giving the industry little to celebrate, in the context of an 8% slump in branded goods they show the importance of own label in the current economic climate.

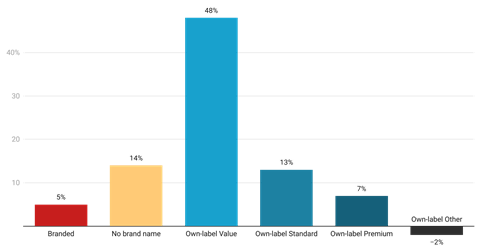

Value growth in grocery by product segment

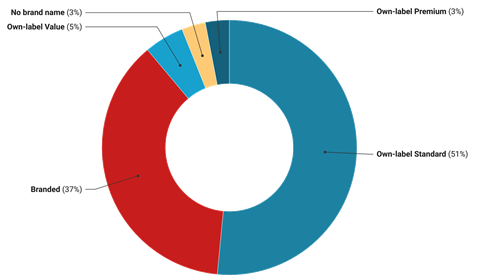

Value share in grocery by product segment

Source: Kantar 16 w/e 16 April 2023

The graph of value sales growth in UK grocery paints a deceptively positive picture, with all segments up year on year. With the exception of economy own label, however, these increases are being driven by the same price hikes that are causing shoppers to buy less.

And, though sales of economy own-label ranges are up almost 50%, it is worth bearing in mind that economy own-label accounts for just 3% of the value of the total UK grocery market. Meanwhile, 90% of grocery market sales are from branded and standard own-label products that have recorded more modest sales growth.

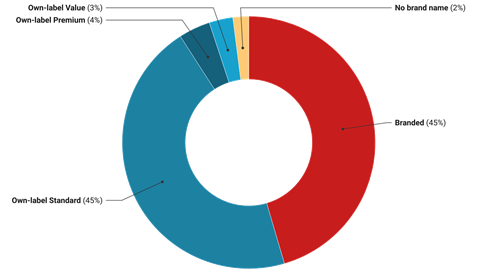

Volume growth in grocery by product segment

Volume share in grocery by product segment

Source: Kantar 16 w/e 16 April 2023

It should be no surprise to see that the products benefiting most from the UK’s economic woes are among the cheapest on supermarket shelves, with own-label value range sales up by a quarter year on year.

At a time of national belt-tightening, shoppers are turning their backs on premium own-label products, though the segment is outperforming branded goods, and even standard own label has taken a hit to volumes.

Read more: The facts and figures behind own-label’s incredible growth

Retailer own-label value growth 2022 vs 2023

Source: Kantar 16 w/e 16 April 2023

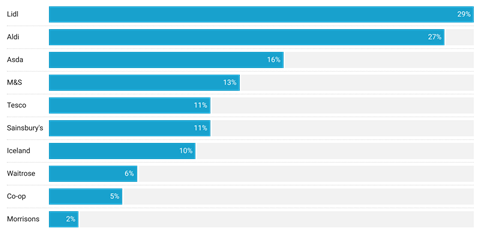

The discounters are own-label specialists, filling their stores with around 90% own-label goods, and it is no surprise to see Aldi and Lidl topping the table of retailers’ own-label sales growth.

Asda has also put in a very strong performance that will have been boosted by last year’s revamp of its economy own-label range as the bright yellow Just Essentials.

And it seems bottom-of-the-table Morrisons has realised its own-label offer needed some TLC, with the retailer recently relaunching its Savers range.

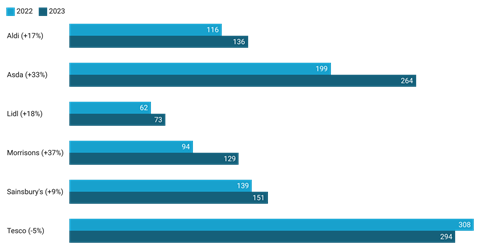

Number of own-label value-tier SKUs stocked

Source: Assosia

Only too aware of how the economic wind is blowing, retailers have been paying attention to their value-tier own-label ranges.

All but Tesco, which already has the greatest number of value-tiers SKUs, have increased the size of their economy offer as shoppers feel the squeeze of the cost of living crisis. Asda and Morrisons have upped the size of their ranges by a third or more.

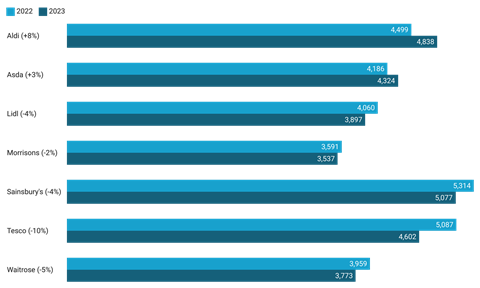

Number of own-label standard-tier SKUs stocked

Source: Assosia

Standard-tier own-label accounts for 45% of the grocery market by value, which is reflected in the large number of SKUs stocked by UK supermarkets.

But, perhaps as a refection of increased focus on value-tier goods, many retailers have reduced the number of standard-tier own-label products they carry. Tesco has had the biggest clear-out, removing 10% of products from its lineup.

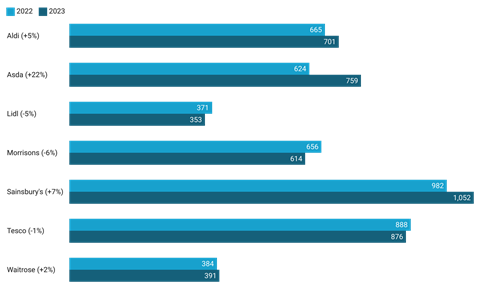

Number of own-label premium-tier SKUs stocked

Source: Assosia

Although overall volume sales of premium products have fallen 4%, many retailers are continuing to innovate in this tier.

By far the greatest activity has come from Asda, which has increased the number of premium SKUs carried by 22% year on year, considerably ahead of Sainsbury’s (+7%) and Aldi (+5%).

Sainsbury’s remains the biggest player in terms of size of range, with the number of premium SKUs breaking the 1,000 barrier.

No comments yet