Only eight of the UK’s top 50 spirits brands added value this year. Not that distillers are worried. Take Pernod Ricard, whose Jameson, Absolut and Malibu brands have fallen into the red. The supplier’s UK commercial director Ian Peart remains upbeat.

“The underlying trends on spirits are really positive,” he says. “If you look at the total market, on-trade and off-trade combined, it has grown 7% compared to three years ago.”

Viewed through that pre-pandemic lens, the 9.7% decline in value sales of spirits is arguably no disaster.

But for gin, it’s harder to put a positive spin on the figures. The UK’s biggest gin brand, Gordon’s, has alone lost £74.4m across its core, Pink and Sicilian Lemon variants.

While owner Diageo’s head of category development for off-trade Lauren Priestly remains “confident there is still room for growth”, others are less certain.

Barhatch & Box founder Chris Ellis believes the gin boom is over. “Gin is in relatively significant decline now, driven by a reduction in space, a reduction in range, and consumers starting to move into vodka and particularly flavoured vodka”, he says.

Indeed, a flavoured vodka has been the star of the show this year. Smirnoff Raspberry Crush is the fastest grower in the top 50, adding £17.4m to reach a total sales value of £22.9m as volumes quadrupled.

Vodka has benefited from Brits’ growing love of cocktails, explains Peart. In lockdowns, Brits “dialled up their inner Tom Cruise” – meaning nearly 50% of households now own a cocktail shaker.

Priestly points out vodka forms “the base for many simple and classic serves that consumers can easily create”, so it’s no surprise the spirit has stolen gin’s thunder.

The rest has been pinched, it seems, by affordable whisky – both blended and single malt. Johnnie Walker Red Label, Glenfiddich 12 and Whyte & Mackay have added value by 64.1%, 4.4% and 3.9% respectively – upping volumes by as much as 72.8%. “As the cost of living crisis bites and consumers are looking for little luxuries at home, malt whisky fits the bill perfectly,” says Glenfiddich UK brand manager & off trade lead Rebecca Cresswell.

The whisky market has “continued to make itself better understood by shoppers, clarifying subcategories and quality cues”, Cresswell adds.

The RTD sector, on the other hand, is noticeably splitting into tiers, says Peart. “As well as spirits and mixers, you’ve now got cocktail cans, which tend to attract a higher price, and premium brands.” Which helps explain the extra £26.3m, almost entirely driven by a higher average price.

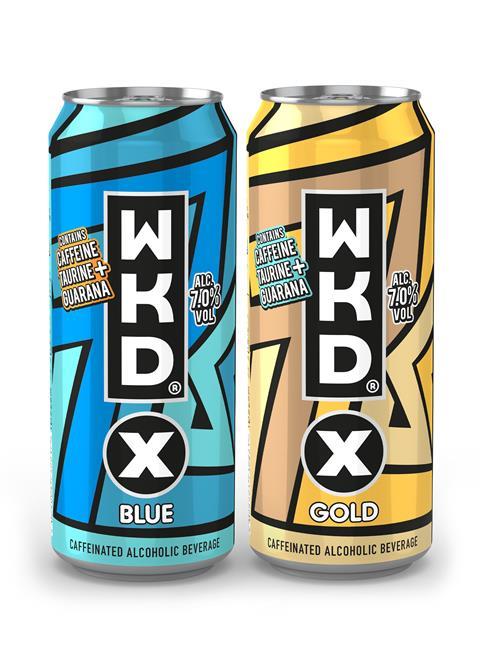

Top Launch 2022

WKD X | SHS Drinks

Caffeinated alcoholic RTDs were fairly niche and dominated by Dragon Soop – until this bevvy hit shelves in March. Packing 150mg of caffeine and an abv of 7%, WKD’s “enhanced” alcopop is available in Blue and Gold (rsp: £3.39/500ml). Both are fruit-flavoured and contain taurine and guarana. The duo would “draw on the soft drinks category’s success and present a credible and nationally supported alcoholic version to a receptive 18 to 24-year-old target market” WKD said at the time of launch.

The Grocer Top Products Survey 2022: How can brands stay in focus?

Commodity price hikes, the war in Ukraine and inflation have changed the way Brits shop in the past year, while also piling pressure on suppliers and retailers. Which brands and categories have negotiated the system shock best?

- 1

- 2

- 3

Currently

reading

Currently

reading

Alcohol – spirits & RTDs 2022: Vodka and whisky steal gin’s thunder

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

![Cheese ]GettyImages-664658023](https://www.thegrocer.co.uk/Pictures/80x50/1/8/6/282186_cheesegettyimages664658023_540979.jpg)

![Cheese ]GettyImages-664658023](https://dmrqkbkq8el9i.cloudfront.net/Pictures/80x50/1/8/6/282186_cheesegettyimages664658023_540979.jpg)

No comments yet