Sainsbury’s has overhauled its pricing strategy and revamped its Brand Match scheme to compare prices against Asda and not Tesco as it looks to address the new reality in UK grocery.

The retailer said it had moved to a mid-low pricing strategy after reducing the price of about 12,000 products over the past 18 months, and would launch a new campaign across TV, print and in-store to explain its new approach.

Sainsbury’s marketing director Sarah Warby said customer feedback was at the heart of the new strategy. “Customers tell us they find supermarket prices and promotions confusing and don’t always know who to trust when it comes to getting good value.

“So we’re making it easier for customers to buy the products they love, safe in the knowledge they can get good value all the time on all products, without having to wait for promotions.”

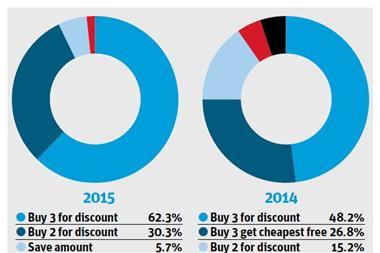

The retailer will continue to run the same number of promotions but the difference between on and off-promotion pricing would not be as great, meaning shoppers would be able to buy more products off-deal, added a spokeswoman.

In certain categories, such as laundry, personal care and household, shoppers were simply waiting for deals to buy products because the difference in price was so great, she said.

Sainsbury’s is also making it easier to understand prices by introducing clear shelf-edge labels, fewer shelf barkers and fewer fractions and percentages on labels. Instead of an SEL claiming ‘one third off’ it will say ‘was £3 now £2.’ It will also be using more round-pound pricing.

Starting from next Thursday, Brand Match will only compare the price of branded items against Asda and not Tesco. “We have reached a point where telling shoppers we match or are cheaper than Tesco is not a surprise anymore,” the spokeswoman said. “It is saying that in relation to Asda that’s important.”

After nine years of growth, Sainsbury’s sales performance has struggled in recent months, with its first fall in like-for-likes announced before the departure of former CEO Justin King this summer.

According to Kantar Worldpanel data for the 12 weeks to 14 September, Sainsbury’s market share has fallen from 16.6% to 16.2%, with sales down 1.8%. Of the big four, only Asda, which has been focusing on an EDLP strategy for the last couple of years, managed to grow sales, up 0.8%.

3 Readers' comments