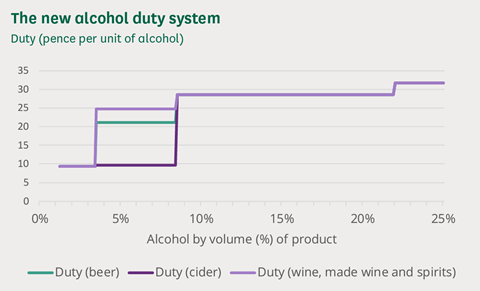

The UK government’s new alcohol duty rates system will tax alcohol based on abv, not a drink’s classification as per the current method which will end on 31 July 2023.

Alcohol duty’s new regime was announced in 2021 during the then chancellor’s (Rishi Sunak) autumn budget. He called it “the most radical simplification of alcohol duties for over 140 years”.

During the period between the announced changes and their implementation, the government froze alcohol duties due to Covid and the cost of living. However, the duty freeze is thawing and a 10.1% tax on all off-trade booze comes into force on 1 August 2023.

Prior to the rule change, alcoholic drinks were taxed based on the category they fell into:

- Beer

- Cider and perry (still and sparkling differentiators)

- Wine and made-wine (still and sparkling differentiators)

- Spirits

The new system will “simplify” alcohol duty structure by broadly taxing alcoholic products at higher rates the stronger they become. However, different rates will be set for made beers and ciders with lower duty rates for between 3.5% and 8.4%.

Application of the new rules for Northern Ireland will work in line with the Windsor Framework, the government’s recently agreed amendment to the Northern Ireland Protocol.

New alcohol duty system relief and exemptions:

- The current Small Brewers’ Relief will be enhanced through the Small Producer Relief to include producers of all alcoholic beverages up to 8.5%. However, unlike SBR which is calculated on overall hectolitres, SPR will be decided based on hectolitres of pure alcohol

- A new relief for drinks below 8.5% in the on-trade, ‘the draught relief’ will cut alcohol duty by 9.2% for beer and cider and 23% for wines, spirits and other fermented products

- A temporary easement for some wine products will come into place from 1 August to help producers manage the new rates. All wine ‘of fresh grape’ between 11.5% and 14.5% will be treated as 12.5% wine when duty is calculated

- A consultation will begin later this year to define cider, focusing on the retention of the 8.5% abv, minimum juice requirements as well as fruit additives/flavourings

Government will miss £115m of tax for 2023/24, however by 2027/28 an additional £155m will be raised. This equates to £15.8bn, which is £2.7bn more than expected this period and £3.4bn more than 2022/23.

Alcohol duty receipts in brief:

- £12.4bn – 2022/23

- £13.1bn – 2023/24

- £15.8bn – 2027/28

It was claimed the reforms, first mooted in the Conservative Party’s 2019 general election manifesto, were created to ensure the tax system was “supporting British drinks producers” and to rid it of “complex and full historical anomalies”.

Under the new system, some products will see a technical tax reduction based on the current system and duty rates. For example, a glass of prosecco would cost 20p less and a pint of beer in the pub 3p less.

However, as the duty freeze ends at the same time the new system is enforced, leading to a 10.1% duty rise, there will be variations.

Red wine and a pint of cider at home will see a 11p and 2p rise respectively, while a pint of beer and a glass of gin and tonic at home remain unchanged.

Brewers took the tax hit in 2023

UK brewers had taken the brunt of 2023’s rising costs to ensure consumer impact was limited as British Beer & Pub Association chief executive Emma McClarkin OBE said at the time: ”UK brewers have been absorbing costs to protect consumers from price rises during an already tough cost-of-living crisis; sacrificing profit or in some cases making small changes to save just pennies, with recent reporting highlighting how some brewers have made minor reductions in ABV, for example.”

Such a decision hadn’t been made lightly as taste, quality and assurance was paramount to brewers and their processes, she continued. However, costs continued to rise and alcohol tax rule changes would further compound that.

”Brewers urgently need let up in inflation and a stop to unsustainable cost increases,” said McClarkin. ”But in the absence of government taking control of the issue, our brewers will continue to innovate to brew delicious beers and simultaneously ensure customers aren’t paying over the odds for their favourite beers.”

No comments yet