Supermarket shoppers are spending more of their time in the frozen aisle. So reports Carol Ratcliffe, NIQ senior insights analyst.

The reason? Ratcliffe points to the “typically lower prices, reduced wastage and longer shelf lives” of frozen food. These have helped frozen stand out as “one of the most resilient super-categories in the face of current market pressures”.

Certainly, volume declines have slowed considerably across many frozen sectors since last year’s Top Products report. Rupert Ashby, CEO of the British Frozen Food Federation, credits retailers for adapting to changing shopper habits. “All of them are tweaking their frozen offering. Their aisles are becoming more attractive. More of them are moving to chest freezers with better branding, rather than just faceless doors,” he says. “They’re using the space better… and making it look a lot more attractive.”

This has helped recoup volumes for frozen potatoes, Fish, pastries and veg. Their respective performances are 0.6%, –7.7%, –1.5% and –0.9%, the declines all slower that last year’s. Put simply, shoppers are prioritising “the basic staples that mean they can have a good square meal”, Ashby says.

Those priorities have especially benefited own-label lines. In frozen potato products, for instance, private label is up 6.1% – equating to an extra 10.3 million kilos of chips, wedges, waffles and the like. That’s compared to a 3.9% volume decline for brands.

Frozen food brands bucking downward sales trend

In frozen veg, own label has held on to its volumes while brands are down 4.8%. And in frozen fish, own label volumes have declined at a notably slower rate. They’re down 4.3%, while brands have fallen 10.8%.

A number of brands are bucking the downward trend, however. The most successful “are those that are able to demonstrate they are worth paying more for, either through product quality, clear differentiation from own label, or through a strong brand connection with shoppers”, says Ratcliffe.

Take frozen potatoes leader McCain. It’s shifted 1.1 million extra packs. That’s partly down to the brand’s “quality and value”, claims Naomi Tinkler, retail category director for McCain Foods. “However, it is our brand purpose that truly sets us apart.”

For instance, McCain began 2023 by doubling support for charity partner Family Fund, which supports families raising disabled and seriously ill children. It then partnered with pop singer and presenter Kimberley Walsh on ‘Teatime to Talk’, “a series of digital and audio conversation cards to help bring families together over mealtimes”.

Finally, in August, McCain launched ‘Let’s All Chip In’ to highlight its commitment to globally transition to 100% regenerative agriculture by 2030.

There’s been product innovation, too: the following month, the brand added Salt & Pepper Baby Hasselbacks for “midweek inspiration”.

Another winner in this space is Strong Roots. The Irish brand seen a 30.1% uplift in volume sales of its frozen potato lines.

That follows its “largest ever” campaign in London at the start of 2023, which involved running ads on the Tube and digital screens across the city. In the summer, it ran sampling at major UK shopping centres.

“This marketing push was successful in bringing new consumers into the brand and highlighting the goodness of our platform by likening it to grocery veggies,” says Strong Roots CEO Samuel Dennigan. “We wanted to showcase that fresh is good, but ‘fresh frozen’ can be better.”

Jim Shearer, marketing director at Nomad Foods, is also keen to highlight the “essential” role of frozen in everyday life.

As such, Birds Eye, Nomad’s powerhouse frozen fish brand, will play up its nutritional credentials in coming months. This plays to health being “one of the most important purchase drivers for consumers”, he says. And it could certainly do with pepping up purchases: Birds Eye volumes are down 10.2%.

That’s comparable to the 10.1% loss for closest rival Young’s. Mark Adams, senior category manager at Young’s Seafood, says “rather than trading out of the category completely, consumers are instead choosing to buy frozen seafood less often”.

Frozen food struggling to compete for space

“It has been harder for brands to compete for space in shoppers’ baskets, but at Young’s we are responding by continuing to cater for a variety of consumers by offering a choice of different ranges and price points,” he adds.

A similar strategy is at play at Aunt Bessie’s. The Nomad brand suffered volume losses across frozen potatoes, veg and desserts, and is now “looking for ways in which we can emphasise shoppers are getting value for their money”, says Shearer.

“Particularly in the run-up to Christmas, where budgets are even tighter, we’ll be focusing on offering value to our customers through a variety of initiatives.”

Not everyone is going so heavily on price, though. For Pukka Pies, the priority has been adding excitement to its sector. “Following research, we knew frozen shoppers weren’t getting what they wanted from frozen pastry,” says MD Isaac Fisher.

In response, Pukka launched frozen Bakes and sausage rolls in November 2022, aimed at remote workers. Available in Steak, Chicken, Vegan Applewood & Onion and Sausage & Bean, the Bakes were inspired by some of Pukka’s most popular pies. They were supported by TV and radio push ‘Pukka for the People’ this summer.

It aimed to remind shoppers of Pukka’s “quality, versatility and full-on flavour”. And to ensure the frozen aisle will remain a hot destination in the year to come.

Top Launch 2023

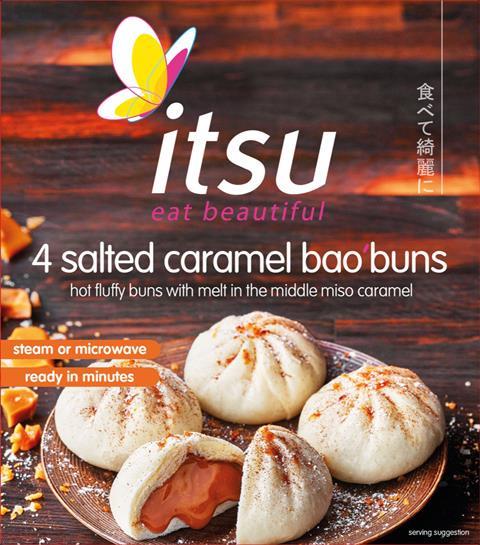

Itsu sweet bao buns | Itsu Grocery

Itsu launched its “game-changing” frozen sweet bao buns in March. The two vegan variants – Chocolate and Salted Caramel (rsp: £3.50/four) – are packed with melt in the middle fillings. They can be steamed or microwaved from frozen, meeting demand for convenient restaurant-quality treats at home, says Itsu. The buns took a year to develop. “After more than 50 trials, we managed to get rich chocolate and miso salted caramel to flow from a fluffy bao bun,” explains founder Julian Metcalfe.

Topics

Face off: Top Products Survey 2023 pits brands vs own-label

![Beans Face Off_RGB[18]](https://dmrqkbkq8el9i.cloudfront.net/Pictures/261x166/9/5/1/311951_beansfaceoff_rgb18_56926_crop.jpg)

It’s no longer a battle of the brands. The bigger battle, after two years of inflation, is between brands and own label. Who’s winning?

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

Currently

reading

Currently

reading

Frozen food 2023: Frozen grabs attention as inflation hits

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

![Beans Face Off_RGB[18]](https://www.thegrocer.co.uk/Pictures/80x50/9/5/1/311951_beansfaceoff_rgb18_56926_crop.jpg)

![Beans Face Off_RGB[18]](https://dmrqkbkq8el9i.cloudfront.net/Pictures/80x50/9/5/1/311951_beansfaceoff_rgb18_56926_crop.jpg)

No comments yet