While Brits enjoy the sun, food and drink brands are well into making their lists for what they’ll be putting out at Christmas time. How does the process work?

For most Brits, the next few months are likely to include some or all of the following: a week or two away; as many barbecues as humanly possible; plentiful pub garden visits; summer strolls galore; perhaps even a music festival. For the hardy souls at beloved brands such as Cadbury, Mr Kipling and Dr Oetker, however, this summer will be dominated by one thing: planning for Christmas 2026.

The golden quarter only bestows its lustre once a year, but for most of the UK’s best-loved food and drink brands, seeing their festive products hit the shelves is the culmination of months, sometimes years, of work. So, when do they get started? How do they decide between sticking with tried-and-tested favourites and launching new flavours and NPD? What’s going on behind the scenes? How do brands work with the retailers, and when do Christmas lines go into store?

Nicole Partridge, brand manager (Christmas and Halloween) at Mondelez International, describes the process as “very long”. They work two, three or sometimes even five years in advance for important projects: “For example, bringing back Cadbury Dairy Milk Coins in 2023 was five years in the making.”

The production side is often all-consuming, given the quantities required for certain products, with Cadbury Heroes and Roses being made all year round in order to satisfy Christmas demand.

It’s a similar story at Mars Wrigley UK, where the team starts working on Christmas about 18 months in advance. “The development stage takes about a year, during which we research trends, develop products, taste-test them and create packaging that stands out,” says Laura O’Neill, senior brand manager, Christmas.

And 18 months is the golden ticket at Premier Foods, too, where Naomi Shooman, global marketing director for sweet treats at Premier Foods (Mr Kipling), says “preparation is already well underway for Christmas 2026”. It’s a “very collaborative approach” with marketing, category, R&D and factory teams “all working closely together to develop the initial concept, informed by data”.

It’s fair to say challenger brands are more nimble. Sauce Shop, for example, launched its Brussels Sprouts Ketchup in 2019 (see box, p29) in double-quick time. It helps that the brand does the majority of its trading through its DTC website at Christmas, says co-founder Pam Digva. “For a small run like that, the whole NPD process from concept to launch might only take a few months.”

Sauce Shop: Brussels Sprout Ketchup

Launched in 2019, the brand has since sold over 200k bottles of this funky festive flavour.

Perhaps unsurprisingly, it was a PR smash hit at the time. “It was before everyone started making wacky Christmas condiments, so I guess we hit the market at the right time,” says co-founder Pam Digva.

And having had experience of the corporate world, “we definitely work faster than larger brands”. But it depends. Last year The Sauce Shop partnered with Aldi to launch two similarly “controversial” festive flavours – Brussels Sprout Kimchi Hot Sauce and Spiced Cranberry Hot Honey Sauce. That took a little longer.

“If we’re working with a retailer in mind, we’ll work to much longer timescales, with Christmas ideation starting early in the year,” she says.

Speed is of the essence for peanut butter challenger ManiLife. Since launching its limited-edition Mince Pienut Butter in 2023 (see box, p28), it’s brought production in-house, investing more than £1m late last year in its own factory and production hub.

“It means we can be a lot more agile and reactive when it comes to NPD,” says founder Stu Macdonald. “We have that flexibility to just get in there and experiment. For that reason, seasonal and trends-based NPD will play a much bigger role in the ManiLife product strategy. We’re trying to plan ahead better to make sure we’re ready for those key moments.”

Dr Oetker: Deck the Halls Christmas Sprinkles

Jen Johnson, head of marketing, cake, at Dr Oetker Baking, highlights the brand’s Deck the Halls Christmas Sprinkles.

That SKU has delivered £495k in the past two years alone, while the brand’s Christmas Glittery Decorating Icing isn’t far behind, bringing in £468k over the same period.

Where do the ideas come from?

Even with all the lead time in the world, nailing Christmas NPD is no mean feat. It’s a risk, too, of course, with up to 80% of new grocery launches fail, according to a Harvard study. Add to this the swathes of Christmas products jostling for shelf space and consumer eyeballs, and brands know they must leave no stone unturned in their attempts to unearth a hit.

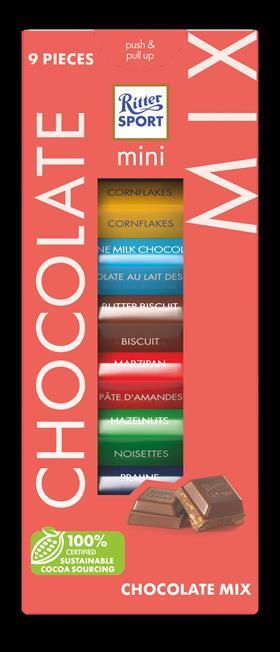

At Ritter Sport, the UK arm of the business leverages its position as part of a global team to tap into worldwide trends and successful ideas from other markets. And while there’s “definitely still a place for gut feel”, according to MD Benedict Daniels, “we’re combining that instinct with increasingly sophisticated tools”.

The brand is “investing heavily in category and retailer data” and uses “robust consumer research to back up our choices”, he adds. “Tech is playing a growing role, too, helping us analyse what’s worked, what hasn’t and where the real opportunities are to add incremental value to the category.”

free-from chocolate brand Nomo, meanwhile, has an innovation process that is “fundamentally insight-led and rooted in inclusivity”, according to Emma Perrett, marketing controller at Zertus, which owns Nomo’s parent brand Kinnerton Confectionery.

“We listen carefully to our community, stay attuned to market shifts and track mainstream trends to adapt them to the free-from category,” she says.

Nomo: Cookie Dough Reindeer

Owned by Kinnerton Confectionery, Nomo’s Cookie Dough Reindeer has become the brand’s standout performer during the festive season and was worth £532k in 2024 alone.

The introduction of the limited-edition Mint Reindeer — worth £265k — meant Nomo’s total self-eat reindeer range grew 43% in value and 28% in volume year on year.

Cadbury has more history than most at producing Christmas favourites, and focuses on leveraging that experience.

“Our first action is always to find out what’s sold well from previous years, and we use this information alongside our understanding of trends that we can see coming up in the future,” says Partridge. “We’re also always listening to consumers on our social channels. Cadbury fans are very vocal about what they want, and we love to hear what they’re interested in.”

Still, smaller brands with their own e-commerce sites have a “huge advantage” in terms of being able to draw on data, according Digva. At Sauce Shop, they use that to back up the gut feel that “there’s often room (and a need) for in a scale-up business”.

“For example, Brussels Sprout Ketchup was a suggestion we initially hated but ended up deciding we could do something great with it,” she says. “There are so many classic Christmas ingredients, it’s quite easy to innovate around the season. Having said that, every brand and his dog is now making gravy mayo and things featuring cranberry sauce or brussels sprouts, so we’re rethinking things a little this year.”

While there is “always space” for gut feel, ManiLife’s Macdonald adds another element into the mix: luck. “Our salted caramel peanut butter collaboration with Joe & Seph’s, for example, came about when we were on the stand next to them at Taste of London. Everyone got a bit merry, one thing led to another and the next morning I woke up next to a knockout product with a note saying, ‘Must Launch’ next to it!”

The Christmas 20-month timeline

Kinnerton Confectionery’s Xmas 2025 milestones:

Apr-May 2024

- Strategic review and concept mapping

Jun-Sep 2024

- NPD development, kitchen samples, initial packaging samples

- Ingredient sourcing

Sep-Dec 2024

- Review manufacturing launches for Christmas 2024

- Finalisation of product and packaging; trials

- Finalise designs

- Review costings

Dec 2024-Jan 2025

- Finalise costs and sell in materials

- Review performance of Christmas 2024

- Revise range if applicable

- Begin sell into trade

Feb-Apr 2025

- Sell into trade

- Artwork of packaging

- Lay down materials

- Begin planning Christmas campaign

Apr-Jun 2025

- Agree initial packaging buys; printing packaging

- International production and shipping

Jun-Oct 2025

- Manufacturing launches

Aug-Sep 2025

- Outload to retailers and distribution

- In-store activation

Oct-Dec 2025

- Christmas marketing campaigns live

- Competitor reviews

Jan 2026

- Post-season sales analysis

Behind the scenes

While most Christmas NPD is not likely conceived off the back of serendipitous collaborations at food festivals, the consensus among brands big and small is that the work taking place behind the scenes is usually fun – if a little fraught.

“The process of launching a new product into market is most definitely enjoyable, as the SKUs are fun and festive,” says Jen Johnson, head of marketing – cake, at Dr Oetker Baking. “The number of products launching at the same time does make the environment a little lively due to competing deadlines and varying timelines. However, it’s always an exciting feeling to get a product to market.”

Mars Wrigley’s O’Neill cites taste tests as a highlight of the process, which usually entails creative brainstorming, data reviews and numerous meetings to discuss trends and test packaging ideas.

“The taste test is always a highlight – everyone in the team is eager to try the new products and give feedback,” she says. “It’s a fun and collaborative atmosphere, but also a lot of hard work.”

Ritter Sport: Colourful Variety Tower

Ritter Sport’s Colourful Variety Tower, which brings together six flavours, is the brand’s best seller at Christmas time.

Over the past three years, the towers have delivered 64% value three-year CAGR, according to MD Benedict Daniels.

At smaller brands, the constant pivoting and wearing of many hats can make for a frantic atmosphere at the best of times, with Christmas only adding to the relative carnage.

“Nothing is ever calm at Sauce Shop!” laughs Digva. “The bulk of Christmas planning falls at our second busiest time – BBQ season – so it can often feel hectic. My husband and co-founder James and I largely own our product development until it’s making its way to the factory – then it’s over to technical and ops, so it can be a struggle to agree recipe changes, etc.

“Luckily, James has an eye – or should that be mouth? – for a great sauce recipe, so there usually aren’t too many iterations of a recipe before it’s ready to go.”

At Mondelez, Partridge lives her Christmas-focused role more than most. “It is crazy, but I love it,” she says. “So many people ask what I do when Christmas is over, but the reality is we’re planning so far in advance, that it really is Christmas all year round for the team. Even in April, I’d be wearing my Cadbury Christmas jumper in meetings about our upcoming plans!”

While most people’s festive knitwear remains stashed away until the onslaught of Christmas parties begins in December, the same cannot be said of the season’s food and drink SKUs. The annual grouching about Christmas products appearing on supermarket shelves “too early” has almost become a tradition in itself.

Cadbury: Dairy Milk Coins

Cadbury Dairy Milk Coins have been a great success for Mondelez since making their return in 2023.

The brand has since sold 4.5 million nets of Coins, and in 2024 they were the number one product in the novelty gifting segment [NIQ total coverage, 23 wks, data to w/e 28 December 2024].

“Cadbury Dairy Milk Coins are a great stocking filler, set to delight shoppers again this year and drive incremental sales for retailers,” says Mondelez.

For food and drink brands, though, the opportunity is so great – sales at the supermarkets surpassed £13bn during the four weeks of December alone for the first time ever in 2024 – that timing and effective collaboration with the retailers is vital.

The earliest time its Christmas products land in-store is late August, says Nomo, with its self-eat and Advent ranges leading the early phasing, followed by larger gifting formats closer to December.

The trickle of Christmas SKUs becomes a flood from September onwards, such as Cadbury’s sharing formats, with momentum building in October as “shoppers start buying small seasonal treats”, according to Partridge.

“November begins our countdown to Christmas, as consumers plan for their festive season,” she adds. “Shoppers are beginning their Christmas planning earlier to help manage spending, so it’s vital we’re prepared to meet their needs. Our Advent calendars are key to this period as families look to count down to the big day. Finally, in December we look to focus our efforts on the gifting segment.”

Alongside early planning for NPD, conversations with retailers can obviously begin just as far in advance. At Dr Oetker, for instance, seasonal opportunities will be discussed with the supermarkets as early as 15 months out. With own label gaining share year on year, landing distribution and maximising space in store is key for brands, according to Johnson.

“It’s important for us to get feedback from retailers to understand how branded seasonal SKUs can work alongside own-label seasonal SKUs,” she says. “Secondary siting is very important during this period, so working with retailers to find opportunities to sit in the seasonal aisle allows more presence on shelf and, most importantly, gets the product out of aisle in a high footfall area.”

The role of secondary space

Quality siting and forging good retailer relationships for Christmas is arguably even more critical for challenger brands, with stock management, in-store execution and maximum time on feature space “more important with our seasonal products than with any other”, according to Manilife’s Macdonald.

Christmas 2024 was the first year its Mince Pienut Butter had appeared in stores, and Macdonald says it taught him a lot.

“A major learning was that spreads are generally a planned purchase, but seasonal flavours are impulse, which makes secondary/shipper space so important,” he says. “After all, no one (unless they’d tried it the year before) is going to the peanut butter aisle looking for Mince Pienut Butter.”

ManiLife: Mince Pienut Butter

ManiLife founder Stu Macdonald says the brand’s Mince Pienut Butter is “without doubt our most successful Christmas product” ever.

Initially released exclusively with Amazon in 2023, it sold out seven weeks before Christmas, so in 2024 the brand sold it DTC as well as through Waitrose, Sainsbury’s and Ocado. “We sold 10 times the volume during Christmas 2024,” adds Macdonald.

The issues are similar for Sauce Shop, though its products usually become available a little later, around the start of November. The brand works closely with retailers as far ahead as February and March, when it presents samples, before refining plans in early summer in order to accurately forecast volumes and then beginning production in August.

“We work with the retailers to ensure products are marketed before they hit shelves and are easy to find when they launch,” says Digva. “With seasonal lines, the main tension is getting the volume right. Too little and shelves are empty, and too much means price reductions. After all, it’s too late to react once we hit December.”

No comments yet