The impact of the Make America Healthy Again (MAHA) movement was clear to see in Natural Products Expo West this year. During the election cycle, roughly 2% of US media outlets covered MAHA, but post-election this jumped to just under 4%, with more than 70% of Americans across all generations stating they are prioritising their health [The New Consumer survey].

During my time at Expo West, I learned how the natural food world is responding to this newfound bipartisan mission. I saw the top natural food and supplement trends that are permeating American culture and, more importantly, what the UK and Europe can learn from them.

For context, I am an American living in the UK now for 13 years and I’m the general manager of Zoe, the science and nutrition company primarily based in London and Boston. I grew up in Massachusetts on the government-subsidised lunches that Jamie Oliver sought to change: chocolate milk, Cheetos and chicken nuggets, and did my fair share of marketing for Coca-Cola and big food when I lived in New York City for the first five years of my career.

Zoe changed the way I eat and think about food forever. Travelling between London, Boston and Los Angeles for Zoe on a regular basis, I see wild differences in portion sizes, sugar content and fibre inclusion. Here’s what I noted at Expo West.

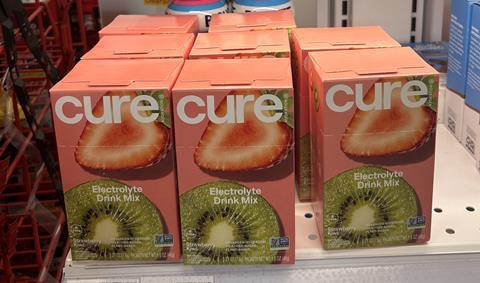

1. Guilt-free, Pollyanna branding with functional ingredients

Barbie’s cultural capital and nostalgic vibes have cast a rose-tinted influence on visual cues, type and product colourways more than we could have imagined.

That’s powerful at a time when there is plenty of guilt around snacking in both the US and the UK, according to Mintel. The US market truly plays into making its audience feel good about indulging, with active ingredient claims that overshadow nutrition facts. We’ve seen this in the UK market already with “brain health” on packs of sugary bars and drinks that are unlikely to support either your brain or overall health.

Pretty-in-pink semiotic signals bring a childish innocence to products aimed at both adults and kids. Smart Sweets, Goodles mac & cheese and Happy Pop all used this Pollyanna branding to make consumers feel good about their ultra-processed wares.

Brands with products that felt truly better for you like Skinny Dip almonds – in the dark chocolate flavours rather than the whole range with added sugars – and Good Idea water also followed this trend, with the brand showcasing glucose charts to show the efficacy of its product on blood sugar.

2. Probiotics and prebiotics in unexpected categories

Have you ever seen a probiotic prune? From dried fruit to almonds to ice cream, probiotic ingredient inclusion dominated products more than gut health as a lead message.

Alec’s Culture Cup was capitalising on US consumer dairy growth once again with probiotic ice cream in nostalgic American flavours like peach cobbler and peanut butter cup.

Bear’s Fruit showcased delicious sparkling water with added probiotics. I also saw a multitude of freeze-dried yogurt products, for both adults and kids, with billions of probiotic cultures per serving. Sprouted nuts and seeds were prevalent across the show, with added probiotics, prebiotic qualities and marketed as easier to digest.

Fruit purées from Gutzy and pasta from 3 Farm Daughters touted prebiotic wares that were “better for you” alternatives to their generic counterparts.

3. Pulses and plant proteins reimagined

I was delighted to see a growing cohort of purveyors of pulses and plant proteins like tempeh and seitan, as well as freeze-dried alternatives to pot noodles and oatmeal made from lentils and chickpeas.

As on-the-go food continues to rise in the US and the UK, pulses and certain fermented plant proteins can play an important role in reshaping our health and fibre deficiencies. More than 90% of us in the UK and US are deficient in fibre and we love brands like Bold Beans leading the way in making pulses delicious and convenient.

Graza olive oil launched a social-first collaboration with Ithaca houmous – an excellent collaboration of healthy fats and pules. But my favourite brands and innovations from Expo included Lentilful – a pot noodle reimagined with freeze-dried veg ready in minutes, and ChiChi – an alternative to oatmeal chock-full of chickpeas. And finally, steamed packs of bean snacks from Brami Lupini and (my favourite) Eat More Beans from Japan.

What’s next?

In The New Consumer’s latest survey on American health concerns related to food, at the top of the list is ultra-processed foods. I believe in the next few cycles of Expo West we’ll see food brands launching ranges of “low” or “less” processed ranges.

However, consumers should be mindful that even “simpler” is not always better. The move towards simple ingredients can result in beneficial additives, like vitamins and fibre, being taken out.

It’s a sign of how health halos are creating more and more confusion, creating space for much-needed guidance and tools around processed foods to help everyday people cut through the marketing.

Sara Gordon is the general manager at Zoe

No comments yet