PerfectTed has secured a seven-figure venture capital investment at a blockbuster valuation as the rapidly growing brand seeks to capitalise on booming demand for matcha, The Grocer can reveal.

The energy drinks challenger, which is backed by Steven Bartlett, sold a minority stake to London-based Felix Capital, according to new filings at Companies House. The filings also showed the business raised £8m in fresh capital.

It’s not clear from the Companies House filings how much of the £8m came from Felix or if any other backers took part in the round. However, City sources confirmed Felix took a small minority stake in the business as part of the deal.

The investment round values PerfectTed at around £140m. This represents a staggering increase from the £500k price put on the brand when Bartlett and Peter Jones agreed to each take 5% in equity in return for £50k when co-founders Marisa Poster and Teddie Levenfiche appeared on BBC One’s Dragons’ Den in 2023.

Antoine Nussenbaum, a founding partner at Felix, now has a seat on the PerfectTed’s board following the investment. PerfectTed is also listed on Felix’s website as part of the VC firm’s portfolio, along with personal care brand AKT, Oatly, HungryPanda and natural dogfood maker Pure Pet Food.

Back in May, Bartlett claimed, in a LinkedIn post, that PerfectTed was forecasting £30m in annual revenues and “growing rapidly toward £100m”. PerfectTed has yet to file full accounts at Companies House, but an abbreviated results for 2024 showed the brand made a profit for the year of just more than £700k.

In June, PerfectTed was named the fastest-growing founder-led startup in the UK by For Entrepreneurs, By Entrepreneurs (FEBE) in partnership with Virgin. The rankings revealed the matcha brand had grown more than 25-fold over the past two years, with a two-year compound annual growth rate (CAGR) of 532% and £8.2m in revenues in 2024.

One VC source told The Grocer: “Every so often a category needs a challenger to come along and create a new market. Big groups are not the best suited to do that. And PerfectTed is the driving force behind the matcha trend in the UK.”

Another dealmaker added: “PerfectTed has benefited massively from first-mover advantage to sit at the heart of the matcha category. It has an enviable supply chain thanks to building strong relationships with growers in Japan.”

PerfectTed launched in 2021 with a range of matcha green tea energy drinks, quickly winning listings with Tesco and Holland & Barrett.

It now claims to be the fastest-growing natural energy drink in the UK and the largest matcha brand in Europe.

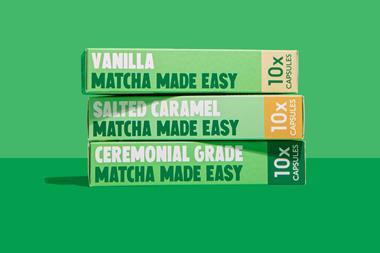

PerfectTed extended its range into branded matcha powder for retailers such as Sainsbury’s and Waitrose. It also launched flavoured RTD matcha lattes earlier this year.

Alongside the retail products, the business also supplies partners in foodservice with matcha powder, including Caffè Nero, Joe & the Juice and Black Sheep Coffee, as well as partnering with Waitrose to sell matcha lattes in the chain’s in-store cafés.

It is understood foodservice accounts for about 60% of group sales, with the remainder generated by the branded drinks and powder.

PerfectTed last raised money in 2024 when Bartlett invested a further £1m into the brand via his Flight Story fund, as revealed by The Grocer at the time.

Since then, matcha has hit the mainstream and is one of the biggest trends in fmcg in 2025 as café chains such as Gail’s and Nero rolled out lines over the summer, with the latter estimating the global market for match will grow from $2.3bn (£1.7bn) to $2.9bn (£2.1bn) by 2028.

A feature exploring “matcha mania” in The Grocer in July reported year-on-year sales of matcha rose 91% to £1.6m in the first quarter of 2025 [IRI 12 w/e 17 May 2025], with PerfectTed claiming to be responsible for 83% of that growth.

PerfectTed and Felix have been contacted for comment.

No comments yet