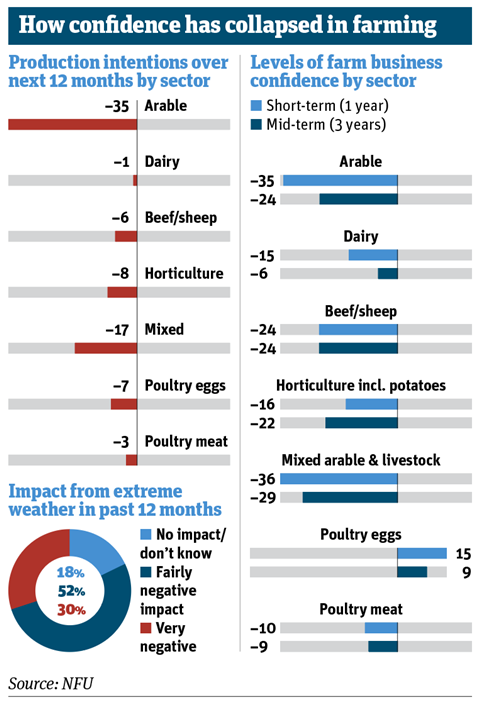

The NFU’s annual confidence survey shows farmers are expecting production to fall by significant numbers over the next year with confidence at ‘all time lows’

If there was any remaining doubt about the outlook for British farmers, the bleak results of the NFU’s latest annual confidence survey this week washed them away.

The wettest 18 months since 1836, after two years of rampant inflation, low retailer returns and much more had led to a “collapse” in farmer confidence to “all-time lows”, the farming union said.

And as a result of this lack of confidence, production intentions had also plummeted across all categories, it warned.

The revelations follow recent analysis by thinktank the Energy & Climate Intelligence Unit, which found grain production this year could be down by almost 20% due to the impact of wet weather, while crops such as potatoes are due to see big yield declines too.

Based on interviews with 797 NFU farmer and grower members in England and Wales from 21 November to 5 January, the survey results might have been even worse given the “relentless” rain since the turn of the year, says NFU president Tom Bradshaw.

“These figures paint a really stark picture,” he adds. “Confidence has collapsed after months of devastating flooding, unsustainably high production costs and low market returns, and against a backdrop of reduced farm support as we transition to a new domestic agriculture policy and associated farm support.”

He’s not wrong. Short-term business confidence (over one year) has dropped from an already low –8 by a further 17 points to –25 on the NFU’s business confidence index. This marks the lowest level of confidence within the farming sector since the NFU’s records began in 2010.

Mid-term confidence (over three years) was only slightly better, falling from –8 points to –22.

The incessant rain seen since last autumn played a significant role, with 82% of respondents saying their farm businesses had suffered fairly negatively (52%) or very negatively (30%) as a result. Mixed, arable and dairy farms took the biggest hits.

But while the weather has dominated headlines in recent months, even more businesses were concerned about the phasing out of farm subsidies via the Basic Payment Scheme, with 86% expecting it would have a negative effect.

Linked to the demise of the BPS, a further 55% thought the government’s much criticised replacement subsidy framework in England, the Environmental Land Management Schemes (ELMS), and Wales’ Sustainable Farming Scheme (SFS) had a negative effect on confidence.

Some 80% felt challenges over high input costs, plus regulation & legislation, would negatively impact them, while 59% felt the same over output prices and 44% had concerns over the negative effect the market they sold into had on their businesses.

Survival doubts

All but one of seven categories (eggs) had negative business confidence, with mixed arable and livestock farmers indexing at a significant –35 in the short-term and –29 for the mid-term.

Arable farmer confidence stood at –35 in the short-term while beef and sheep farmer confidence stood at –24 over the same period.

Profitability had also seen an alarming fall, with 49% of respondents saying it was decreasing and 16% saying it had dropped to such an extent their business may not survive.

This, again, represented the highest level recorded by the NFU since it launched the survey in 2020 – rising to almost a third (28%) of horticulture growers.

Given these gloomy findings, it should come as no surprise all farming sectors expected a cut in production in the next year, with average intentions down six points to index at –14.

Broken down per sector, both arable (-35) with mixed arable & livestock -17.expected significant reductions, the survey revealed.

This week’s commitment from the government to a five-year seasonal worker visa extension came too late to prevent anticipated low or very low availability of permanent and seasonal labour, both domestic and from overseas.

The NFU is calling on the government to recognise the severity of the crisis “and safeguard homegrown food production” by improving flood defences and smoothing the transition to the troubled ELMS by pausing the phasing out of the BPS.

It also wants to establish minimum standards “to promote a fair and functioning supply chain” and core production standards on agri-food imports – something 88% of respondents called for in the survey.

“Any business owner knows that without confidence and steady cashflow, businesses will struggle to reinvest and remain viable,” Bradshaw says.

His comments are echoed by Commons Environment, Food and Rural Affairs Committee chair Sir Robert Goodwill, who adds government could do more to ensure farmers “receive a decent return for their work” while also giving them “fair and long-term notice of changes to farming incentives and regulations”.

Read more: Government announces long-term seasonal labour scheme and £50m automation push

The current issues facing the sector mean many farmers are “under significant pressures through negligible profit margins, a changing policy landscape and climate change”, Goodwill says.

“This is damaging to mental health and to the viability of the sector, and, particularly when it comes to a lack of profitability, driving overly intensive farming, which is harming our environment,” he adds.

But in a counter-argument, ex-Defra secretary George Eustice says the current crisis faced by the sector “follows a sustained run of high profits for farming in the years following the 2016 referendum result, so agriculture is in a fairly resilient position to weather the downturn”.

Eustice tells The Grocer one way that farmers can reduce their costs and exposure to weather risk is by joining ELMS’ Sustainable Farming Incentive, which “improves farm resilience and gives enterprises some guaranteed income”.

Self-sufficiency threat

Ultimately, though, Bradshaw stresses the survey results demonstrate a real threat to the UK’s self-sufficiency.

“Britain cannot afford to lose its ability to feed itself”, he adds.

“We have already lost more than 7,000 agricultural businesses since 2019 – no one wants to see that increase least of all our customers who really value the high quality, sustainable food British farmers produce. With climate change wreaking havoc on food systems across the world and geo-political tensions high.”

However, Bradshaw’s most pointed question for government is whether it even cares enough to act – a point made even more pertinent in the wake of recent criticism around the limited scope of its fund for flooded farms. “Do they really recognise how bad the situation is?” he asks.

Between its new pledge to extend the seasonal worker visa scheme, and next week’s Food Summit at Number 10, the government argues it is listening. But given the fast-developing crisis in British farming, could it be too little too late?

No comments yet