Made famous – or infamous – by the huge success of bitcoin, could blockchain technology enable the food industry to keep track of food in the supply chain and thereby champion its provenance?

An outbreak of E.coli in the US last year made hundreds of people across 36 states seriously ill. Ninety-six were hospitalised. Five died. The summer outbreak, the worst in a decade, was eventually linked to an irrigation canal used by romaine lettuce growers in Yuma, Arizona. But it took health officials weeks to identify the culprit foodstuff.

With each entity in the supply chain having only ‘one step back’ oversight, following the trail to its origin took time. Matters were further complicated by the fact “the majority of the records collected in this investigation were either paper or handwritten,” according to then-Food and Drug Administration commissioner Scott Gottlieb.

So in the wake of the outbreak, Walmart - one of the worst-hit retailers - took decisive action. Declaring the “one step up and one step back model” of food traceability as “outdated” last September, the retailer ordered all of its suppliers of fresh, leafy greens to introduce blockchain technology. “There is no question that there is a strong public health and business case for enhanced food traceability,” the company wrote in a letter to all its suppliers.

The blockchain-based solution, which Walmart had been quietly working on with IBM for the previous 18 months, had already been piloted on mangoes sold in the US and pork sold in China. It enables the company to track a food item from a store shelf “back to source in seconds” - rather than weeks. As Walmart’s then-food safety chief Frank Yiannas put it: “That’s food traceability at the speed of thought.”

Walmart isn’t alone in experimenting with blockchain technology. Major retailers including Carrefour, Sainsbury’s, Co-op, Alibaba, Auchan and Kroger and suppliers such as Dole, Driscoll’s, Nestlé, Princes, Tyson Foods and Unilever have all run blockchain trials and initiatives in the past 18 months.

Smaller brands are also using the technology, with blockchain-traceable olive oil, beer, coffee, chocolate, tuna, pork and bread now available on shelves.

So what exactly is blockchain? Who’s using it? And could the technology become standard practice across the industry any time soon?

How it all started

In late 2008, a paper published on an obscure online forum described the workings of a peer-to-peer electronic cash system called bitcoin. The document, written by a still-unidentified author under the pseudonym Satoshi Nakamoto, described a way to send units of the cryptocurrency from user to user without the need of a bank’s oversight.

Normally, banks keep a master ledger to serve as the truth on who holds what money at any time. Bitcoin uses a publicly distributed ledger - which Nakamoto named the blockchain. Multiple users hold and maintain the ledger, and all transactions added to it are broadcast to all users and verified by consensus.

After what is considered the first commercial bitcoin transaction in 2010 - in which a computer programmer paid 10,000 bitcoin for two Papa John’s pizzas - the reputation and value of the cryptocurrency has fluctuated wildly. It is used to buy drugs on the dark net and the space is swarming with scammers.

But the underlying concept - a tamper-proof, time-stamped, shared ledger - has far wider applications.

When applied to a supply chain, blockchain serves as a shared, immutable and auditable record of information from, and transactions between, the different stakeholders along it.

“Clearly this is early days for the technology, and a lot of work remains to be able to unlock its full potential”

The information might arrive from a farmer via a smartphone app, direct from internet-connected temperature sensors in a delivery truck, inputted from handheld scanners in a production facility or through link-ups to existing supplier software. Transactions could be approval of invoices, changes of custody or payments. Such transactions can be automated, for example a payment issued when a batch has been scanned at a depot.

“Clearly this is early days for the technology, and a lot of work remains to be able to unlock its full potential. But the experience we have gathered over the last two years leads us to see blockchain as a key enabler for our vision of a connected enterprise,” says Nestlé digital transformation manager Benjamin Dubois.

More than half of executives globally in a recent Deloitte survey said the blockchain was a top five strategic priority. By 2025, according to Gartner forecasts, business value added by blockchain across all sectors will grow to more than $176bn, then surge to exceed $3.1tn by 2030. Gartner predicts that in the next five years, a fifth of the top 10 global grocers by revenue will be using blockchain for food safety and traceability, and to bring visibility to production, quality and freshness.

“As grocers are being held to higher standards of visibility and traceability they will lead the way with the development of blockchain,” says Gartner senior research director Joanne Joliet.

The sector is not wasting any time in trying the technology out. An analysis of live pilots applying distributed ledger technology to the supply chain by UCL Centre for Blockchain Technologies earlier this year counted 105, nearly half of which were in the grocery sector.

“Grocers are being held to higher standards of traceability. They will lead the way with blockchain”

Most blockchain initiatives in grocery are focused not on tracing products for faster recalls, but on giving consumers more trust in their food, where it’s come from and how. Projects are given names like ‘farm to fork’, ‘source to shelf’ or ‘bait to plate’.

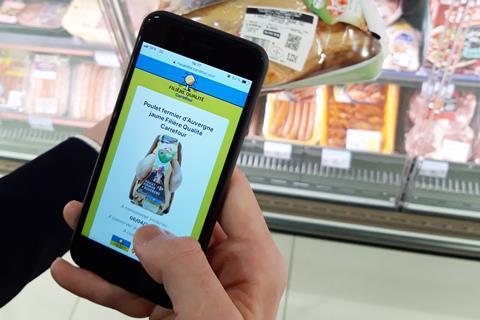

Carrefour launched what it claims to be Europe’s first food blockchain in 2018. Scanning a QR code on the packaging of Carrefour’s Filières Qualité free-range Auvergne chicken - of which the supermarket sells a million each year - reveals some of the data held on its blockchain, like where and how that individual chicken was reared, the name of the farmer that did so, what feed was used (be it French cereals, soyabeans, or GMO-free), where and when it was slaughtered and when it arrived at store.

“Consumers always want more transparency and assurances regarding the products they purchase. The food blockchain meets this customer requirement,” says Emmanuel Delerm, Carrefour’s blockchain programme chief.

Nestlé in April put its French brand Mousline instant mashed potato on blockchain.

“It puts the spotlights on brands, both for being innovative in how we engage with our consumers, but also for stepping up our transparency efforts and leading the way for our consumers,” Dubois adds.

Sainsbury’s and Unilever in September closed a pilot - working with London startup Provenance and a consortium of banking institutions - called Trado, which used blockchain to make data from 225 smallholder tea farmers in Malawi more accessible. In return for their data, farmers get financing sooner and on better terms.

Director of Sainsbury’s brand Judith Batchelar said blockchain had “real potential” for companies like Sainsbury’s with “global, complex and fragmented value chains where absolute transparency has been traditionally difficult to achieve”.

There is also a slew of small and specialist brands using blockchain to prove their ethical and environmental credentials, and the provenance of their products.

For example, when Austral Fisheries catch a Patagonian toothfish in the Southern Ocean, the crew attach an RFID tag to its flesh containing the GPS co-ordinates and time of the catch, as well as a unique identification number. At each juncture of the fish’s journey, more data is added.

By the time a QR code on a restaurant menu or fishmonger packaging is scanned by a consumer, the blockchain contains the date of the fish’s arrival at a port in Mauritius; the time it was cut into two fillets in Perth, Australia; a digital certificate for sustainable fishing from the Marine Stewardship Council proven through analysis of the ship’s location and speed; and an entry for the moment it arrived at the restaurant or fishmonger.

The blockchain, says Austral Fisheries and its project partners OpenSC and WWF Australia, means consumers can “be confident about what they are eating, where it came from, and how it got to them”.

Challenges

But blockchain has big challenges. While Walmart’s might has allowed it to enforce new protocols on leafy greens suppliers (they were “required to conform” by January), for others diplomacy is needed.

“We have taken care not to impose anything, and have worked together with our partners to adapt to their functioning and degree of digitalisation in order to not add for them, under any circumstances, an additional task that could be heavy both in terms of workload and finances,” says Delerm.

Carrefour is so far sticking to its Filières Qualité line because of the long-term relationships it has with producers - “the easiest way to start”, Delerm adds.

There are also different flavours of blockchain to assess. Each has limitations. Enterprise offerings from IBM, SAP, Microsoft and Oracle are known as permissioned or private distributed ledgers - shared only between supply chain participants. That makes them more palatable for business, but counter to the open ideals of blockchain.

The likes of Provenance, OpenSC and VeChain run on public blockchains, which are accessible to anyone. Although more open and transparent, there are technical hurdles to be overcome.

“The technology is still early in its development. Some of the fundamental issues with scaling public blockchains have still not been solved,” says Provenance CEO and founder Jessi Baker.

“They still hold a lot of promise as a potential future for how we trust things peer to peer around the web, but more work is still to be done,” she says.

Some players - like Walmart and Nestlé - are hedging their bets and experimenting with both.

Do consumers buy blockchain’s benefits, and will they pay for it? A focus group for Sainsbury’s and Unilever’s Trado pilot said the tea’s blockchain-enabled perks for smallholders sparked a preference for the product, but only after “price, quality, brand loyalty and taste”.

Nestlé’s Dubois says “quantification of uplift sales is difficult” so soon into its blockchain initiatives.

Retailers like Carrefour have taken to educating shoppers in stores on the reasons the blockchain system is so “impossible to forge”.

“We note that products with the blockchain are experiencing an increase in sales but it’s hard for us to tell if it’s only thanks to the blockchain - it may be only one of the factors,” Delerm says.

Those already involved with blockchain initiatives figure it a big part of their future. Carrefour is deploying blockchain across the 100 items in its premium own-brand range by 2022. It is up to 11, after its Normandy Camembert was put on the blockchain in September. Walmart too is rolling it out to new lines, with a shrimp tracing pilot launched in October. Alibaba says its blockchain-based Food Trust Framework “could form the basis of a global supply chain model applied across all of Alibaba Group’s e-commerce markets”.

Nestlé’s Dubois says blockchain, in combination with connected sensors and artificial intelligence, will create “a perfect storm” of opportunity for the business and its consumers. “We believe it is only the beginning of the journey and [are] extremely excited about it.”

For everyone else, Gartner advises to “remain cautious” and “not to rush”.

“I’m excited, smart minds are working on it,” says Provenance’s Baker, “but with any step-change technology it’s going to take decades, not a few years.”

Blockchain & Bellucci

“An authentic, credible extra virgin olive oil has to come from Italy,” says Susan Testa, director of culinary innovation at Certified Origins.

Makers of Bellucci olive oil, the company has built its brand on the provenance of its produce. Certified Origins worked with Oracle on a blockchain proof-of-concept last year, which tracked some of the oil’s journey and made it accessible to consumers who scanned a label QR code.

“Consumers are not going to turn away from wanting to know where their food’s coming from. That’s coming and it’s here to stay when it comes. There’s an audience for that and it’s not a niche audience. You’ve got to open the doors and open the process,” Testa says.

The blockchain currently covers the Bellucci supply chain from its Italian bottling facility to arrival in the US. The Tuscany-based company is now seeking to extend its use to the multiple mills and farmers with which it works.

The aim is for consumers to be able to trace each bottle - via a smartphone app - down to the exact grove in which the olives were harvested. The effort requires close collaboration with each player in the supply chain.

“We’re not just saying ‘do this’. It’s not just throwing a spreadsheet at somebody or saying ‘hi, get this software’. It’s not just a transactional focus, there must be relationships. When you want to bring technology to an agricultural sector, that takes time and relationships,” Testa says.

Testa admits while blockchain doesn’t register with end consumers, and buyers are “still learning”, traceability and provenance is of growing importance to both.

“The value will soon come but we are at the beginning of it,” she says. “Blockchain is the future for sure. In five or 10 years, everybody’s going to be on blockchain and saying ‘what’s the big deal?’”

On the ’chain: 10 global companies blazing the trail in blockchain technology

Walmart

On the ’chain: Leafy greens and mangos in the US. Plans to test 100 product lines in China by the end of the year.

Walmart first piloted the technology in 2016, working with IBM to trace mangoes back to source in 2.2 seconds.

What they say: “We have to go further than offering great food at an everyday low price. Our customers need to know they can trust us to help ensure that food is safe.” - Charles Redfield, executive VP of food, Walmart US

AB InBev

On the ’chain: Cassava crop. The global brewer has worked with blockchain startup BanQu since 2018 to track crops from thousands of small holder farmers in Zambia, Uganda and India.

What they say: “Through this work, we are helping to create a digital ledger of farmers’ transactions that will create an economic identity and enable access to financial services.” - Maisie Devine, global director for the 100+ Accelerator at AB InBev

Auchan

On the ’chain: Auchan partnered with German startup Te-Food in 2017 to develop a blockchain tool to track pigs, chickens and eggs in Ho Chi Minh City. It’s since been rolled out across Vietnam as well as France, Italy, Spain, Portugal and Senegal for different products.

What they say: “Consumers are now aware of the precise origin and journey of the products they consume, in a fully transparent manner.” - Company press release

Topco

On the ’chain: Salmon, cod and shrimp. The US food co-operative announced in October it is partnering with Mastercard and Envisible to provide transparency on seafood sold in Food City stores.

What they say: “Our grocers will be able to stock shelves with confidence and also be able to pinpoint issues in the food chain during any unfortunate events such as recalls.” - Dan Glei, executive VP, merchandising and marketing, Food City

Unilever & Sainsbury’s

On the ’chain: Tea from Malawi. In return for providing data, farmers and suppliers were able to access financing from buyers like Unilever once their crop had been produced, rather than wait for confirmation goods had boarded a ship.

What they say: “The pilot showcases how the technology can be applied, illustrating how multiple stakeholders can benefit.” - Judith Batchelar, director of Sainsbury’s brand

Carrefour

On the ’chain: 100-item Filières Qualité range. 11 have been added so far, including eggs, chicken, tomatoes, microfiltered milk, peaches, carrots and camembert. Carrefour says it has decreased the time it takes to trace food to source from up to 15 days to a few minutes.

What they say: “We think all stakeholders, including consumers, will benefit from sharing immutable data, and automating end to end processes.” - Emmanuel Delerm, blockchain lead, Carrefour

Nestlé

On the ’chain: Mousline packet mashed potato, New Zealand milk and palm oil sourced in the Americas. In July, Nestlé launched a pilot to trace milk from producers in New Zealand to Nestlé factories and warehouses in the Middle East.

What they say: “We believe it is another step towards the full disclosure of our supply chains… raising the bar for transparency and responsible production.” - Benjamin Ware, global head of responsible sourcing, Nestlé SA

Alibaba

On the ’chain: Blackmores supplements and Fonterra’s Anchor range.

The Chinese e-commerce giant launched its blockchain-based ‘Food Trust Framework’ in 2018.

What they say: “If the pilot is successful, the framework could form the basis of a global supply chain model across all of Alibaba Group’s e-commerce markets. The framework represents the next step in Alibaba’s vision to build the future infrastructure of commerce.” - Company statement

Moyee Coffee Ireland

On the ‘chain: Ethiopian coffee. Moyee is using blockchain to prove payment to its growers in Ethiopia, and has taken the tech one step further: blockchain-enabled digital tokens can be used by the consumer to ’tip the farmer’ and help fund seeds, tools and training.

What they say: “We’re designing our supply using blockchain to create a digitised value chain with positive impact and 100% transparency.” - Killian Stokes, co-founder, Moyee Coffee Ireland

Food Standards Agency

On the ’chain: Inspection results and certificates. The FSA completed a pilot using the tech last year in a cattle slaughterhouse - “the first time it has been used as a regulatory tool to ensure compliance in the food sector”, it claims.

What they say: “The pilot has demonstrated the opportunities for supply chain stakeholders to use data to improve traceability, minimise avoidable work and identify ways to improve existing processes.” - FSA statement

No comments yet