Delivered wholesale is growing at a rate of knots but fast adaptation, modernisation, and consolidation is signalling a fightback

This summer there have been three main narratives in the wholesale sector. First, the CO2 crisis leading to major shortages of soft drinks and alcohol. Second, the merger of buying groups Today’s and Landmark (confirmed last week). And the third, rumours of the death of the cash & carry.

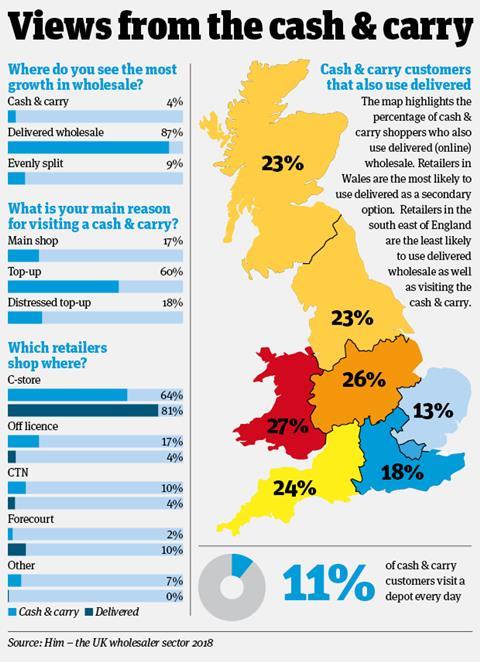

The rumours were sparked by research from Him, which asked if we were witnessing the ‘death of the depot’. While it didn’t actually conclude the days of the cash & carry were numbered, it did flag up some potentially concerning figures for cash & carry operators.

Data, depots and ‘dramatic’ growth at Time

It’s not a view held by many, but Time Wholesale MD Sony Bihal believes cash & carry will actually grow faster than delivered wholesale over the next few years.

While the perceived wisdom is that delivered is the future, Bihal is a cash & carry evangelist and in June moved to a new depot in Barking, which has almost trebled the sales space of his original site in the same area.

Bihal’s argument is a simple one – it all comes down to price. “All wholesalers are being squeezed in terms of margins and operating costs,” he explains. “Retailers want the best prices, price-marked packs and to protect their own margins. The best possible way to do this is by going to the cash & carry. I can actually see C&C overtaking delivered sales.”

Cash & carry has been seen as a bit old-fashioned but Bihal is anything but. He’s all about the data. He has crunched his numbers every which way on business planning and modelling, so his expansion plans are based on robust evidence – which is why while he does offer delivered, the focus is primarily the depot.

He sees click & collect as the key to bridging the gap between retailers who want both price and convenience. “We can do picking and packing, which can add 5p-10p to the cost of a case, but with fully delivered you’re adding 60p per case.”

From April, Bihal is looking to push its click & collect strategy through new collection hubs away from his depot, which will dramatically expand Time’s reach.

This year, however, the focus is on bedding in the new depot and growing sales to its existing customers. Bihal has grown the range from 8,500 product lines to 10,000.

Time has 1,300 registered customers who visit the depot regularly and Bihal says that rather than stripping out range as some rivals are doing, he is looking to stock a core 80% of these customers’ regular shopping lists.

“I love data,” he admits. “But some operators get too hung up on it when it comes to reducing range. More and more of our customers are doing a full shop here and our rate of sale has massively increased.”

Bihal says he expects Time to turn over around £80m-£85m in the current financial year but is aiming to break £100m next year. As far as Time is concerned, cash & carry is alive and well.

According to the Him data, which polled 6,000 retailers and foodservice operators, the percentage of retailers using delivered wholesale for their main shopping mission has risen 22 percentage points to 89% in the past year. In contrast, the growth within cash & carry has been on the top-up mission side, and the distress top-up has overtaken main shop as the second most popular mission.

The conclusion was that the traditional cash & carry depot had been relegated to the role of a top-up shop, with the bulk of business moving to the delivered channel. With the research released around the time AF Blakemore was struggling to offload its depots, having made the decision to exit cash & carry and focus on its delivered operations, the fact that only four of Blakemore’s 13 cash & carry depots were picked up by rivals seemed to confirm this was indeed a watershed moment for cash & carry.

At JW Filshill, which operates both delivered and cash & carry, retail sales director Craig Brown is preaching to independent retailers to “concentrate on the standards, availability and service in your stores and allow us to do the buying, the deliveries and control the margins inbound. That’s what will reap benefits.”

“The most profitable retailers are cutting down on time spent out in a van, filling up,” he adds, “because the less time they spend on that the more time they can spend in their stores. As costs increase for these business owners, they are going to have to do that to be competitive.

It seems to be a strategy that’s working for Filshill because “we’ve got double-digit growth in the half year and we should rack up numbers in the financial year this year,” he adds.

However, while there’s no doubt delivered is an increasingly attractive option (as it is among consumers), there are many cash & carry operators thriving and even planning for growth. How are they doing that?

The short answer is, by working harder and adapting quicker than ever before. An example is Parfetts, a seven-depot C&C operator in the north west, which recently reported a 17% jump in sales (excl tobacco).

It now offers delivery to all its fascia stores, but it’s improving the cash & carry experience too, offering click & collect, and will also now load from trolleys directly into retailers’ vans. “Many customers are still happy to shop themselves. So we have invested in creating pleasant environments to facilitate this,” explains joint MD Greg Suszczenia.

The big 30 wholesalers: can traditional players survive?

But much of its success comes down to how it views the cash & carry depot. “A good cash & carry is not just a big metal shed,” he explains. “And we are a long way from just a top-up shop. We are a business hub for small businesses in the local community.

“We have always accepted that our customers shop around and that works well for them in obtaining best price and service and availability from various businesses. Our aim is to be the biggest supplier among a basket of many, and with the return of a lot of alcohol business thanks to the Alcohol Wholesalers Registration Scheme (AWRS) and consolidation in the marketplace, we are a bigger supplier to our customers than we have been for many years.”

Blurred lines

The biggest beneficiary of industry consolidation has been its chief architect. Sales at Booker, the UK’s biggest wholesaler (and by far the biggest cash & carry operator, with 199 depots), soared 14.3% in the first quarter following its £3.7bn merger with Tesco. But CEO Charles Wilson no longer looks at cash & carry and delivered as distinct channels.

“Back in 2006 we switched from being Booker Cash & Carry to Booker Wholesale,” he explains. “Then our sales were around £2.8bn cash & carry, £0.2bn delivered. Today our sales are £3.1bn cash & carry and £2.7bn delivered. Most of our deliveries are from our C&C business centres. And many of our customers come in and collect and receive deliveries. Therefore we do not really see a cash & carry sector - instead it’s part of a vibrant wholesale sector. There’s plenty of opportunity for players that deliver the choice, prices and service retailers and caterers require.”

But the collapse of Palmer & Harvey, the UK’s biggest delivered wholesaler, last November, has been an opportunity for cash & carries large and small, sending not just independent retailers but even major symbol groups such as Costcutter off to make emergency cash & carry runs on behalf of retailers.

“We are finding the cash & carry sector very good at the moment,” says Mundev Wouhra, director of East End Foods, a Midlands-based three-strong chain. “Our year-on-year sales growth has been strong and we are seeing margin strength maintained as well. The consolidation means players that were in decent positions have been able to increase traffic.”

It’s not easy, though. “Customers are sharp, they are the king. If you’re not doing a good job they are not going to come to you. As a wholesaler you need to be in touch with what the retailers want from you and try to adapt because there are a number of people lined up waiting to pounce if you are not performing well.”

Wouhra is focused on sustainable growth. And like London-based Time Wholesale that’s meant staying close to home.

“One of the key things we’ve done is not over-expand by acquiring multiple sites or trying to spread ourselves too thin,” he explains. “Concentration on a fairly narrow geographical base has been beneficial.”

One cash & carry operator that is expanding its base, however, is United Wholesale Grocers. The Glasgow-based wholesaler was one of the few to acquire a Blakemore depot when it snapped up the Gateshead depot in May. This took the number of sites it operates up to three and while the current focus is on the new depot, it isn’t ruling out further growth.

UWG director Rahan Ali-Irshad acknowledges that the wider sector conditions are challenging but a lot of hard work behind the scenes had brought the business to a position where it could start looking at expansion.

“In the cash & carry sector nowadays everyone works twice as hard to stand still,” he argues. “That doesn’t mean the sector is dead. It’s challenging and you have to adapt your business model.”

“We’ve gone through a difficult period. As a company we have [undertaken] a little bit of an MOT over the past five years or so. We’ve identified everything we are really strong at as well as some of our weaknesses and tried to turn them into our strengths.”

Like Parfetts, UWG is not trying to be a one-stop shop. “Any business model where you rely on customers to give you their entire business, you are asking for problems because they could change their mind overnight.

“Glasgow is very competitive, so we try to get a fair slice of the cake but there are certain things we can do. The emphasis is on retail clubs and more enhanced offers. On the one hand, we give retailers fantastic, aggressive promos and support and development opportunities, as well as credit facilities - and in the current climate there are not many wholesalers who offer that. On the other, we expect a little bit of loyalty from customers, but it is a difficult ask because at the end of the day, custom will be dictated by availability, service and price. If a major line is a bit cheaper somewhere else, inevitably the retailer will decide to shop where they can enhance their margin. So we work hard on the PR side and try to really develop our relationship with our customers.”

Modernisation

Cash & carry has increasingly been seen as the old-fashioned way of doing business, but wholesalers are investing in technology to modernise systems and improve the offer. UWG has an IT team based in Lahore, supporting its availability and other processes.

And Bestway, after investing in apps and iBeacons, has recently tested eye-tracking software in depots to see how customers shop. This helps the wholesaler understand how receptive customers are to promotions, says MD Martin Race, and “will give us a key insight moving forward to provide better service but also give us opportunities to disrupt the shopper with more impulsive activity”.

Today’s and Landmark merge as Unitas Wholesale: What we know and what it means

Race admits investment is more focused on the delivered side of Bestway’s business right now “but only because we have more work to do in that area”.

But sales from Bestway’s 62-depot cash & carry business are again up, independent of its recent acquisition of Conviviality’s retail operations. “Unaffiliated retail is a major share of Bestway’s sales and is still in growth. It’s no secret independent retailers are facing challenging times, but we must do everything we can to help them compete. In July our sales were strong and depot footfall was up, aided by the good weather and retailers searching out problem products caused by the CO2 issue and poor supplier availability. In the major cities and conurbations, depot sales remain strong.”

“A good cash & carry is not just a big metal shed. We are a business hub for small businesses in the local community”

Race adds: “Let’s not forget many retailers love coming to cash & carry. They can assure themselves that they are getting the best deals, they can sample products and be the first to get NPD, meet reps, talk to other retailers and talk face to face with the managers and staff. There are loads more benefits than simply saving time.”Data, depots and ‘dramatic’ growth at Time

It’s not a view held by many, but Time Wholesale MD Sony Bihal believes cash & carry will actually grow faster than delivered wholesale over the next few years.

While the perceived wisdom is that delivered is the future, Bihal is a cash & carry evangelist and in June moved to a new depot in Barking, which has almost trebled the sales space of his original site in the same area.

Bihal’s argument is a simple one - it all comes down to price. “All wholesalers are being squeezed in terms of margins and operating costs,” he explains. “Retailers want the best prices, price-marked packs and to protect their own margins. The best possible way to do this is by going to the cash & carry. I can actually see C&C overtaking delivered sales.”

Cash & carry has been seen as a bit old-fashioned but Bihal is anything but. He’s all about the data. He has crunched his numbers every which way on business planning and modelling, so his expansion plans are based on robust evidence - which is why while he does offer delivered, the focus is primarily the depot.

He sees click & collect as the key to bridging the gap between retailers who want both price and convenience. “We can do picking and packing, which can add 5p-10p to the cost of a case, but with fully delivered you’re adding 60p per case.”

From April, Bihal is looking to push its click & collect strategy through new collection hubs away from his depot, which will dramatically expand Time’s reach.

This year, however, the focus is on bedding in the new depot and growing sales to its existing customers. Bihal has grown the range from 8,500 product lines to 10,000.

Time has 1,300 registered customers who visit the depot regularly and Bihal says that rather than stripping out range as some rivals are doing, he is looking to stock a core 80% of these customers’ regular shopping lists.

“I love data,” he admits. “But some operators get too hung up on it when it comes to reducing range. More and more of our customers are doing a full shop here and our rate of sale has massively increased.”

Bihal says he expects Time to turn over around £80m-£85m in the current financial year but is aiming to break £100m next year. As far as Time is concerned, cash & carry is alive and well.

No comments yet