There is a buzz in the air about beacons. Hyperbolic adjectives like “transformative,” “game-changing,” even “revolutionary” have been used to describe the effect beacons will have on retail. So what’s all the fuss about?

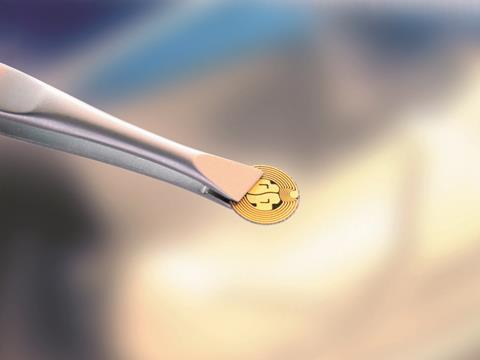

For the uninitiated, beacons are nifty little gadgets no bigger than a 50p piece that interact with smartphones using technology pioneered by apple. Retailers site them next to products in stores and, when a shopper equipped with a smartphone gets near a beacon, it senses their presence and springs into action, pinging vouchers or information to the phone to tempt the individual into making a purchase.

For instance, a shopper could wander into Tesco, picking up a Scan as you Shop device to save time at the till. When they entered the store a beacon at the entrance opened up the Tesco app on their iPhone, sent them a personalised ‘Welcome to Tesco’ message, then alerted hundreds of other beacons dotted around the store of the shopper’s presence. They then monitor the shopper’s progress, silently tracking them as they steer their trolley around the aisles.

RFID

A now infamous IGD ad from 2006 showing a shopper wheeling a trolley full of goods out of a store without stopping opened up a vision of a hi-tech grocery world where RFID (radio frequency identification system) tags would allow a seamless shop.

Things stalled when the price of tags remained prohibitive, although it’s generally accepted that the price of tags is falling - and retailers including Tesco and M&S have started using them on clothing. So rather than in-store, RFID tech is finding a place in the supply chain thanks to the visibility it offers at every stage

All of Tesco’s technologies communicate with each other, so Clubcard also knows the shopper has arrived and is steadily feeding snippets of information regarding their shopping habits to the beacons. As a result, when the shopper approaches the crisps and snacks aisle, the beacon positioned there knows that the shopper is heading its way, and that this particular customer has a weak spot for McCoy’s.

It also knows their preference is a classic flavour multipack; that 90% of their purchases are when McCoy’s are on a half-price deal; and, based on the date of their last purchase overlaid with previous purchasing patterns, that they are probably running low on McCoy’s at home.

What Tesco doesn’t know is that they’re also watching their waistline (this week), so they are trying to resist temptation. Besides, the McCoy’s are at full price. So, after thinking about it, the shopper decides to leave it. And in real time, or more accurately no time at all, the beacon comes alive.

It can be fairly certain the shopper internally debated McCoy’s versus waistline because the beacon’s dwell time calculator knows the shopper was standing in front of them for 34 seconds. What it knows for sure, thanks to its seamless interaction with the Scan as you Shop device, which hasn’t registered a purchase, is that the same shopper is wheeling their trolley away without having picked a multipack of McCoy’s.

So, before they get too far, their phone buzzes. It’s Tesco, offering them a half-price deal on a classic flavour multipack of McCoy’s. That means - at the very least - they are drawn back into considering a purchase. And it’s quite likely that their personalised offer means they will go ahead.

QRC

Quick Response codes like those Guinness added to their pint glasses (above) are a pull technology, requiring the consumer to actively engage and participate with a pack by scanning a QR code with a smartphone to access more information about the product in question. Compared to either NFC or Beacons, QR codes seem simplistic, possibly even outdated. However that simplicity is a key strength, making them easy for shoppers to understand and accessible to even the tiniest independent retailer without the need for any technology other than a simple QR code generator (available online for free) and a printer

That’s the theory, anyway. So, in theory, it’s easy to see why beacon enthusiasts are predicting big things for beacons, hailing them as the missing piece in the smartphone/shopping/promotional puzzle. And it’s easy to be swayed by the argument that beacons can act as powerful conduits, drawing consumers towards a product during the all-important make your mind up time.

Yet perhaps the most surprising thing about beacons is that it’s not the big supermarkets currently taking advantage. Not publicly anyway. Instead, smaller players like Bestway, Londis and One Stop are at the forefront when it comes to putting them into stores.

Bestway is planning to use beacon technology to guide customers through its vast depots - the biggest is 150,000 sq ft - and alert them to deals along the way.“When a customer enters the car park they will get an alert saying ‘Hello Mr Smith, welcome to Bestway,’” says group ecommerce manager Jamil Mohammed. “Then, when they hit reception the app will say ‘please scan your membership card’ - which will be on the app itself - and then they will be asked ‘do you want the beacons experience?’”

NFC

It may seem like NFC (Near Field Communications) has something to fear from beacons, given that both interact with shoppers using proximity sensors. Yet the two could become complementary, rather than competitive, believe industry experts like NFC company Proxama. “NFC is a ‘pull’ technology, where the consumer has to do something to opt in to engage with a brand, while beacons are a ‘push’ technology, where the consumer simply has to walk past one to trigger messaging,” says Proxama CEO Neil Garner. Apple has also added NFC technology to its latest crop of iPhones and the new iWatch.

If they do, Mohammed says the average depot will have around 30 beacons to guide customers around the store, offering them deals, and all the while building up a picture of their personal preferences in order to send them increasingly relevant offers.

Not that their mobiles need to be buzzing non-stop. Mohammed says the app will also feature audio, so as they walk past the Coca-Cola, “it will be like a little angel sitting on your shoulder, saying look, Coca-Cola, £1.99. I don’t know how it’s going to pan out, but if you never try, you never know. We want to do the basics first, put a handful in a depot, see what uptake we have and develop it further. And it’s going to be fun trying.”

While Tesco per se isn’t using beacon technology, subsidiary One Stop is. From 1 September the c-store started offering discounts on magazines across its 740-store estate. “Beacons allow us to engage our customers on their mobile, in particular as they walk in store, and to understand more about their shopping habits,” says head of marketing Lizzie Roberts.

“It also encourages them to increase use of our app, allowing us to create an ongoing dialogue with customers. This way we can ensure customers can benefit the most from this technology by getting the right offers at the right time.”

In the future, Roberts says she sees beacons playing a “larger role in the consumer shopping journey, for instance as customers increasingly use their mobile phones for payment and coupons. It’s all about bridging bricks & clicks to build mobile seamlessly into the physical store environment.”

Meanwhile in August, Londis joined forces with BigDL, whose CEO Matt Norbury says Londis is now able to deliver “personalised alerts to consumers passing by the front of a store to drive impulse buys, communicate within stores when shoppers are near a specific promotion, measure footfall into store, record dwell times and reward loyalty.” Although a Londis spokesman says it’s “still trialling the platform,” he adds “the early results are incredibly positive.”

Cheap as chips

Beacons are also incredibly cheap. An individual beacon currently costs around £20 but it is “likely the unit cost will reduce substantially over a relatively short period of time,” says Rob Mannion, MD of RNF Digital, which is part of the development team for the Bestway beacons. “There are also different pricing models emerging where some providers offer the beacons on a low unit cost per month basis, and some are offering additional software to manage the beacons.”

For instance, using BigDL beacons costs Londis a flat £7.50 a week with no upfront cost (the actual beacons themselves are provided free of charge). Appflare also provides beacons to clients, like One Stop, for free.

“The beacons cost nothing from us,” says Geddes. “If retailers have to make a case for capital expenditure it can get tricky and take time. If they can put it in place with no upfront costs and they pay as they use it, it’s generally a lot easier and can come out of a regular marketing budget. Our billing model starts when their customers start engaging with the beacon.”

‘Engaging’ is jargon for a beacon successfully sending a message to a smartphone. “We keep that charge as low as possible, but it ranges from half a penny to a few pence, depending on volume or what the campaign is,” says Geddes.

Obviously it charges when redemptions are made. “It’s again variable, typically anything from 3p to 10p per redemption. But that price also comes bundled with information. There is added value in the analysis, especially for an independent store. We get a huge insight into what consumers are going to which store, what their dwell time is, what their path through a store is, what redemptions were made. And if we take a social login we get gender, age and interests.”

Any retailer wishing to use beacons also needs to create an accompanying app, which obviously costs money, but Mannion says this could be “relatively low” if the app only offers simple functionality. And the other part of the equation - the smartphone - is already paid for by the shopper.

Given their simplicity and low cost of entry, beacons look like a no-brainer, which begs the question, why aren’t the major multiples already getting in on the act? The fact is they already are. It’s just that they are still in a lengthy trial phase. “There is a lot going on behind closed doors at the supermarkets,” says Geddes. “Obviously Tesco is watching very closely what we are doing at One Stop. They use it as an organisation where they can try things out on the market.”

Changing the in-store experience

Appflare is also working with one “top six” grocer that is “really trying to change the in-store experience,” he adds. Appflare usually puts one beacon in the entrance to “engage the consumer when they walk over the threshold,” he says, but at this particular supermarket Appflare has installed “multiple beacons per aisle” to allow the supermarket to wait until customers are at a “precise location in store” before they send them a deal.

Supermarkets are also lagging because beacons are a more “complex proposition” for a Tesco or a Sainsbury’s compared with independents because of the need to integrate beacons into a system that already crunches “huge amounts of existing data,” says Geddes.

“Indies tend to have zero information to incorporate, so adding new technology is simple and quick. That’s a big reason for the speed difference. Also getting a lot of attention from brands is new and very appealing to indies. We can say ‘we have a queue of brands that would love to run innovative promotions with you, it’s going to give you a lot of customer data that you never had before and it’s going to drive footfall and increase basket size.’ So it makes a lot of sense to them.”

There are potential pitfalls, however. “The technology is still in its infancy,” says Mannion. “Although 2014 was coined as the ‘year of the beacon,’ it has probably panned out as the ‘year of the pilot beacon.’ We have trialled many different beacon options over the last six months, which have ultimately proven to be unreliable, and it has taken considerable research and development to identify robust offerings that work alongside a well designed app.”

Even once a robust system is in place, the temptation to bombard customers with offers is a dangerous one. “Businesses need to behave responsibly in how they’re used,” says Norbury. “If that trust is abused and consumers’ lives aren’t materially enhanced by beacons, they’ll vote with their fingers and quickly opt out. Use them sparingly and make them a pleasant surprise to consumers - make them feel special. Over-use or lack of relevance will lead to consumer fatigue and backlash.”

The best way to use beacons is in a “coordinated fashion to reinforce existing marketing messaging,” says i2c CEO James Moir.

“If you look at direct mail, or in-store couponing, their inherent weakness is that customers have to remember to take them into stores.

“With beacons you can recognise a customer when they enter a store and remind them of all the offers they have already received, then offer them an electronic method of redemption. That way you make the customer’s life easier. It will also make the investment in the original campaign work harder, by reinforcing it at the point of purchase, when that individual is in store and in the buying mindset.”

This approach delivers a “much more joined up, and therefore engaging, offer to the consumer,” he adds. “It should always start with the customer.”

Currently the customers enjoying those engaging offers are all in indies like One Stop and Londis, but it’s unlikely it will stay that way for long. “We are likely to witness full production deployments of beacon technology in major businesses from 2015 onwards,” believes Mannion. Although for the time being at least, when it comes to buzzing about beacons, it’s the indies making all the noise.

No comments yet