At a time where grocers will be monitoring Amazon’s rollout of 260 more till-free Fresh stores over the next three years, it is in fact Amazon’s booming advertising business that highlights a rapidly growing opportunity for grocers around the country.

Written by Andy Stephen, Managing Director UK, Retail Media Supply

With over 15 million UK shoppers currently signed up to Prime, Amazon has now introduced the option for CPG brands to bid on search placements in Amazon’s regular search results, creating enormous brand discovery opportunities. Further advertising opportunities will doubtless follow their expanding physical footprint, from digital signage ads in physical stores to smart shopping trolley screens.

The key thing is that the customer experience is front of mind for Amazon where ads are deployed. It announced 22% overall gross sales growth in 2021 alongside record-breaking advertising revenue of $31bn. As such, Amazon is playing an integral role in the growing wave of interest in ‘retail media’ driven by the appetite for the brand’s safety, relevancy and proximity to the point of sale it offers.

It’s a trend that grocers can and should be a part of, especially given their wealth of offline and online first-party data. Where advertising formats, placement strategy and relevancy rules are well executed, any retail business can benefit from the retail media opportunity. So, too, can brands and consumers.

Smarter product ranking

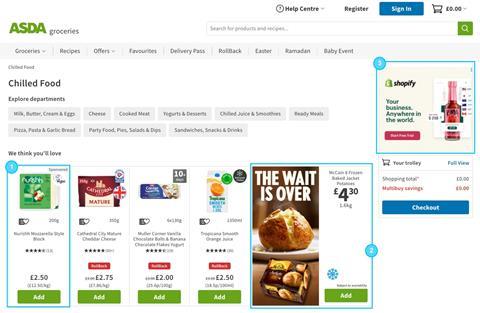

Pioneers such as Asda and Tesco have been doubling down and enhancing their own media businesses for some time. Elsewhere, other grocers with significant online audiences – such as Morrisons - have thrived from surging retail media demand, providing more options for advertisers.

One of the key success drivers in creating a compelling media proposition is offering an open approach to first-party data. By allowing brands to reconcile what they know of their customer base with the insights grocers see in digital interactions, transactions, and loyalty data, smarter targeting and insights can be woven into advertising strategy.

While large advertisers have traditionally led the way in retail media, as retailer media networks mature, it is customer experience – rather than budgets – that determines ranking. Retailers are deploying smarter predictive algorithms and more personalised shopper experiences, giving smaller brands with an understanding of digital marketing, auction dynamics and audience targeting the chance to quickly make themselves as discoverable as their larger counterparts.

In this way, retail media creates ample opportunity to diversify the brands audiences see, enriching the everyday browsing experience.

Opening the door to ALL brands

When we think of retail media, we often think in terms of ‘endemic’ brands i.e. manufacturers who sell products immediately related to the retailer’s category – food and drink if you’re a grocer, for example.

Retailers opening inventory and their audience to non-endemic brands is another way to make the digital shelf more diverse and competitive. If we look to the leaders of the retail media space, like Walmart and Best Buy, they are enabling retail media opportunities for all kinds of brands. Financial services firms, automakers and other businesses all answer to a consumer audience into which they only have a keyhole insight via their own first-party data. Moreover, grocers increasingly offer their own banking, insurance and travel products, meaning they offer advertisers their own pre-existing audience within the market.

1. Native sponsored product ad

2. Dynamic display ad containing product data

3. Static display ad (non-endemic advertiser)

The trick is not to be too prescriptive with retail media and its ‘recommended product’ connotations. As retailers begin exposing ad inventory via programmatic networks and granting advertisers access to their first-party data via audience curation tools, the applicability of retail media (onsite and offsite) to almost any type of advertiser is becoming an exciting reality.

Finding the sweet spot between quality and quantity

By building breadth and depth of advertising demand, retailers can begin delivering ads in higher volumes while enhancing customer experience. Just take a look at Amazon; with brands and sellers queuing up to pay for eyeballs on just about every search term and sub-category imaginable, they can serve predominantly advertising content while maintaining a high level of relevancy.

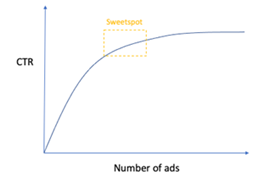

Grocers with less mature programs and a smaller pool of active advertisers should take a data-driven approach to measuring relevancym in order to determine the right number of ads to show. Click-thru rate (CTR) is the best proxy for relevancy; when this begins to flatline, the maximum number of ads has been reached:

Ensuring retail media works to diversify and proliferate the playing field with more manufacturers is paramount when looking to unlock new revenue streams and maximise customer retention. It’s the breadth of products on offer that will ensure ads can continue to display natively in a way that’s entirely inobtrusive to the user experience.

‘Retail Media 3.0’

Reaching the ‘sweet spot’ also relies on the technology to be able to rationalise thousands of audience interests, respond in real-time to ad performance and ultimately better align brands with relevant shoppers. This is where retail media platforms (RMPs) come in - optimising performance, customer experience and yield management synchronously.

In its final form, ’Retail Media 3.0’ is a tool for future decision making. As retailers get more savvy at how they’re looking at their customer from end-to-end and exposing this data, brands will be able to leverage retailer insights based on their retail media investments to inform product and marketing decisions. It’s at this point that exciting opportunities are created for advertisers to transform the digital shelf and, ultimately, the way we shop.

To find out more, click here.

Andy Stephen

Managing Director UK for Retail Media Supply at Criteo