Top story

Aldi’s UK sales surged by 10% over the Christmas week to almost £1bn after its busiest ever week of trading.

The discounter’s sales rose by 10% year-on-year over the week commencing 17 December, driven by strong demand for its premium ranges.

Aldi said it sold more than 17m bottles of wine, Champagne and prosecco in December as well as almost 50m mince pies and 100m sprouts.

Aldi UK chief executive Giles Hurley said: “Our Christmas range was the largest and most innovative yet and caught the imagination of our customers, who visited our stores in record numbers.

“Although we saw strong growth across all key categories, the standout performance was in our Specially Selected brand where shoppers treated themselves to premium products for a fraction of the price they would have paid elsewhere for similar quality products.

“A key factor behind our record performance was the collective commitment, energy and enthusiasm of all our colleagues, and I want to thank them for all their hard work at this exceptionally busy time.”

Aldi opened 65 new stores during 2018, increasing its store estate to 827.

The supermarket said it is on course to hit its long-term target of 1,200 UK stores by the end of 2025.

Morning update

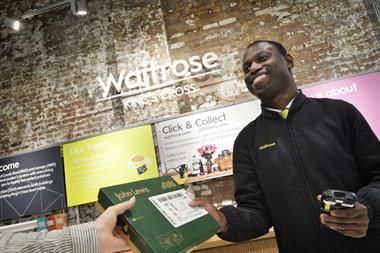

Retail technology provider Eagle Eye Solutions has secured a new five year contract with Waitrose.

The AIM-listed business confirmed that the premium supermarket chain has completed the deal to use Eagle Eye’s AIR platform to improve its digital marketing proposition, it said in a trading update.

The contract extends Eagle Eye’s relationship with John Lewis, after first announcing work with the employee-owned retail group in May 2017.

The initial deal excluded Waitrose, but the technology provider has worked alongside another of multiples including Asda, Sainsbury’s, M&S and Tesco.

The retailer has committed the contract following John Lewis’ use of AIR, a digital platform set up primarily to target smart phone users, to benefit its myJL members.

By targeting customers with personalised offers, the platform promises to drive footfall in-store and offer deeper customer insight.

Eagle Eye has continued to trade in line with expectations, it added as it announced the major contract win.

The new contract is a timely boost for the technology business, which has seen its share value more than half over the past 12 months.

In July 2018 it announced a £2m pre-tax loss for the year, with customer numbers below expectations, despite a 33% in jump in revenues.

“We are delighted to have won this contract with Waitrose & Partners following on from the work we have done with myJL for John Lewis,” commented CEO Tim Mason.

“We look forward to deploying our Eagle Eye AIR platform across their network of stores to drive value through personalised promotions and rewards.”

Eagle Eye validates and redeems digital promotions in real-time for the grocery, retail and hospitality industries.

Shares in Eagle Eye have risen 2.4% to 99p in early morning trading.

Elsewhere, healthy recipe box supplier Mindful Chef has secured £6m in private equity funding to underpin its ambitious growth plans.

PE house Piper has backed the direct-to-consumer brand amid of period of significant investment fo UK meal kit brands.

The Wandworth-based business was launched by Rob Grieg-Gran, Giles Humphries and Myles Hopper in 2015 to make healthy eating easier for time-conscious consumers.

Tim Lee, previously Head of Food and Online Strategy at Marks & Spencer, joined the business earlier this year as CEO.

“With 2018 ending on a high, this major investment from Piper signifies the great confidence they have in our business, and will help support our established marketing programme as well as our exciting NPD pipeline,” said Tim Lee.

“The global recipe box market is ripe for distribution and we believe that Mindful Chef’s proposition ticks all the boxes for people who want to live healthier lives.”

Rory Gibbs, Piper’s Investment Director who led the deal, said: “Mindful Chef is well placed to continue accelerating the growth of the recipe box market with its highly differentiated health focused positioning.

“We are backing a young, dynamic team who are passionate about making healthy eating easier for their customers. We are excited to be joining them and helping them to realise their ambitions.”

Fellow UK meal kit provider Gousto has also secured a significant cash injection, receiving £18m in funding from a number of venture capital groups as well as fitness guru Joe Wicks.

This morning, the FTSE 100 has stayed flat at 6,839pts, after the resumption of trade talks between the US and China helped to boost Asian markets.

The early risers this morning include PayPoint (PAY), up 3.2% to 825.4p, Fevertree Drinks (FEVR), up 2.7% to 2,410p, and Carr’s Group (CARR), up 2.5% to 164p.

The fallers include Hilton Food Group (HFG), down 2.8% to 916p, Reckitt Benckiser (RB.), down 1.3% to 5,887p and Unilever (ULVR), down 1% to 4,111p.

This week in the city

A slew of major retailers will be revealing how well they performed during the key Christmas period, in a busy week of announcements.

Morrisons (MRW) will be the first of the mults to update investors on its festive performance, when it delivers a trading update on Tuesday.

UBS has trimmed its forecasts for Morrisons on the back of slower-than-predicted industry data for the period.

On the same day, agricultural giant Carr’s Group (CARR) and brewer Greene King (GNK) will laos provide performance updates.

Wednesday will kick off with another big four supermarket revealing how well it did over Christmas, as Sainsburys (SBRY) announces its figures.

Analysts have suggested a “robust” performance is likely, but that clothing and general merchandising sales could have performed below par.

Majestic Wine (WINE) will also be hoping for some festive cheer on Wednesday, as it looks to bounce back from weak first-half results after swinging to a £0.2m pre-tax loss.

Vegan sausage roll maker Greggs (GRG) and B&M European Value Retail (BME) will also provide updates on the same day.

On Thursday, Tesco (TSCO) leads the announcements as it looks cheer up investors following a 10% slide in shares since its last update in October.

UBS analysts appear positive though, suggesting there is a good chance that Dave Lewis and Co may have performed well.

Retail bellweather Marks & Spencer (MKS) will also provide its update on Thursday, with analysts predicting decline in both its food and clothing divisions.

No comments yet