Hain Celestial has acquired Orchard House Foods from Wellness Foods for an undisclosed price as it seeks to make its portfolio healthier.

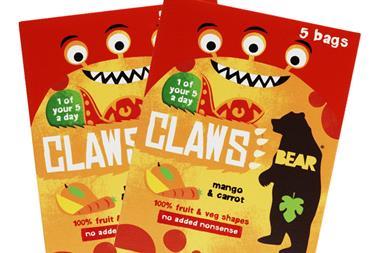

The US food group behind Ella’s Kitchen, New Covent Garden and Tilda completed the deal through its UK subsidiary Hain Daniels. Hain was one of the food group’s competing to snap up Urban Fresh, owner of Bear and Urban Fruit, this month, eventually losing out to Lotus Bakeries. It comes as businesses around the world seek to cater for growing consumer demand of healthier snacks.

Orchard House, a prepared fruit, juices, fruit desserts and ingredients business with facilities in Corby and Gateshead, was one of the two remaining brands in Wellness, along with Fruit Bowl, following the sales of Rowse Honey to Valeo Foods and Dorset Cereals to Associated British Foods 2014. It supplies retailers, food-to-go outlets, food service providers and manufacturers across the UK.

“This is a truly exciting acquisition, increasing our product offerings to meet consumers’ desire for a healthier lifestyle and the ‘five a day’ initiative in the UK, Hain Daniels Group CEO Jeremy Hudson said.

“Orchard House brings new capacity and opportunities for accelerated growth across a number of categories, including the development of our existing branded ranges and new brands presently being prepared for launch.”

Orchard House MD James Skidmore will report to Hudson as the business undergoes expansion across the UK and breaks into Europe, added Irwin Simon, founder, president and CEO of Hain Celestial.

“We are excited about the acquisition of Orchard House, which expands our presence in the on-trend fresh category with prepared fruit, drinks and desserts,” Simon said. “Orchard House provides us with the opportunity to expand fruit product offerings into continental Europe, as well as new product development with cold pressed juice and branded fruit product offerings in the UK.

“Additionally, we expect sales and operating efficiencies in terms of fruit procurement across our businesses around the world.”

The acquisition gives Hain new processing technology to expand the shelf life of fresh fruit and juices. Hain also plans to leverage Orchard House’s expertise into new branded product offerings in fruit, juice and bars under the Ella’s Kitchen, Hartley’s, Johnson’s Juice Co and Sun-Ripe brands, Simon added.

Orchard Foods is expected to generate between $60m (£40.4m) and $65m (£43.8m) in net sales in the 2016 fiscal year, as well as a modest accretion to earnings.

The acquisition still needs to get clearance from the Competition Market Authority, with Hain Daniels and Orchard House set to operate independently until the deal gets the regulatory green light.

Orchard House, founded in 1985, was owned by healthy food group Wellness Foods, which is backed by Irish horseracing tycoons John Magnier and JP McManus. The Grocer revealed earlier this year that Wellness made net proceeds of £155.9m in 2014 from the sales of Rowse and Dorset, helping to clear historic bank debts of more than £125m and leaving the group with a cash balance of £20.1m at the year end.

No comments yet