Further tax rises in the next budget will lead to higher prices and job losses, retail leaders have warned.

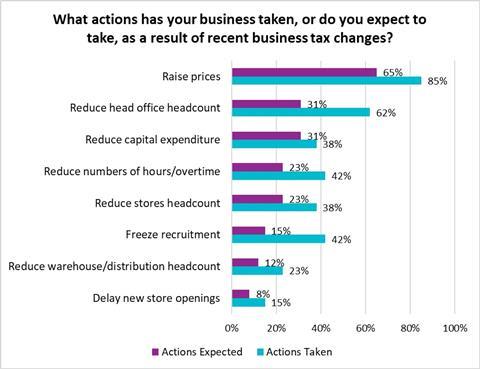

A BRC survey of chief financial officers and finance directors at retailers representing more than 9,000 stores found 85% had already raised prices following tax increases in last year’s budget, and 65% expected to.

Some 62% had reduced head office headcount and 31% expected they would do so. Meanwhile, 42% had frozen recruitment.

Headcount in stores had been reduced by 38% and in warehouses by 23%.

Store openings had been delayed by 15%.

Almost nine out of 10 said “tax and regulatory burden” was one of their three biggest financial fears, including concerns around National Insurance, business rates, the national living wage and the new packaging tax (EPR).

Read more:

Lidl proposes axing 70 head office roles in restructure

Heron Foods sheds 250 shopworkers and warehouse staff while opening new stores

One Beyond chairman blames budget for halting chain’s expansion

Tesco and Sainsbury’s chiefs join calls for Rachel Reeves to rethink business rates reforms

“Retail was squarely in the firing line of the last budget, with the industry hit by £7bn in new costs and taxes,” said BRC CEO Helen Dickinson.

“Retailers have done everything they can to shield their customers from higher costs, but given their slim margins and the rising cost of employing staff, price rises were inevitable.

“The consequences are now being felt by households as many struggle to cope with the rising cost of their weekly shop. It is up to the Chancellor to decide whether to fan the flames of inflation, or to support the everyday economy by backing the high street and the local jobs they provide.”

Dickinson added: “Retail accounts for 5% of the economy yet currently pays 7.4% of business taxes and a whopping 21% of all business rates. It is vital the upcoming [business rates] reforms offer a meaningful reduction in retailers’ rates bill, and ensures no store pays more as a result of the changes.

“If instead, the Chancellor chooses to add further costs to retailers and high streets, it will be the British public who suffer from the knock-on impact on inflation.”

No comments yet