Despite the cost-of-living crisis beginning to bite, the opportunity for premiumisation in lager and beer will continue to be strong.

The cost-of-living crisis is already hitting people hard and, as we approach winter, it’s only going to get tougher, says Oliver Devon, commercial director, premium retail at AB-InBev. “We’re already seeing consumers make savings where possible so for retailers, it raises questions about what stock they should prioritise on-shelf,” he says.

“We’ve seen the trend for premiumisation grow in recent years; in the off-trade specifically, the premium and super-premium categories now equate to 61.7% of total beer value1. As the cost-of-living crisis continues to bite, is this trend set to continue?

“The short answer is yes,” says Devon. “Whilst shoppers are attempting to make savings across large expenditures, such as household bills, eating out and home furniture, smaller ‘treat’ purchases such as alcohol are one area where consumers are happy to trade up. At Budweiser Brewing Group, we’re forecasting that, by 2025, 65% of total beer consumption will be from brands in the premium or super-premium category2.”

Premiumisation cemented itself as a growing category throughout the pandemic, notes Devon. “During the first lockdown of 2020, almost two-thirds of shoppers claimed to be treating themselves at home, and alcohol was one area where they chose to splash out, with 52% willing to pay extra for quality when buying alcoholic drinks3,” he says.

“Even with pubs and bars having reopened, we are seeing demand for premium at-home occasions continue. Before the pandemic, many at-home drinking occasions were driven by social moments, however, during lockdowns, this changed, with shoppers purchasing alcohol to enjoy at home after a busy week. This trend has continued even after lockdown restrictions have been lifted, with consumers having become more accustomed to at-home drinking occasions.”

Capitalising on the growth of world beer and craft

The super-premium category is being driven by the world beer and craft sector, as shoppers look to broaden their drinking repertoire, reveals Devon. These sectors grew 2.4% share of total beer in the last 12 weeks4, he notes. “With the cost of a pint continuing to grow in the on-trade, we are seeing discovery happening at home as shoppers are more willing to try something new from a supermarket. This presents an exciting growth opportunity for retailers to broaden their beer offerings and entice customers to experiment. In response, earlier this year we launched Stella Artois Unfiltered, offering consumers a super-premium, craft beer-inspired alternative from the UK’s number one beer brand5,” he says.

Growing demand for craft options is represented through the evolution of pack formats for the category, explains Devon. “Whereas craft beer used to be predominantly sold in single can/bottle formats to encourage trial, we are seeing a move towards larger pack formats in the sector. For example, we recently launched Camden Hells and Camden Pale Ale in 12-packs, both of which are selling strongly, reaching a combined 1.1% market share of the craft segment within the total off-trade6.

“We’re predicting the trend towards craft and world beer is here to stay,” he adds. “Both categories currently make up 14% of total beer sales and we’re forecasting this growth to continue. As the trend for premiumisation continues, world beer and craft will continue to gain popularity over ale and standard lager, so retailers should ensure they are prioritising these options on shelves and in secondary locations to cater to evolving consumer preferences.”

Premium no and low options in beer

Demand for premium options is also being replicated in the low & no category, which has continued to grow despite the cost-of-living crisis, with sales up 7.9% in the last 12 weeks compared to last year7, notes Devon. “When consumers are looking for an alcohol-free alternative to drink at home, they want to treat themselves to a more premium option that delivers the same taste and quality they would expect from a traditional beer.

Because of this, brand is the most important factor for consumers when deciding which no & low product to buy – ahead of calories, ingredients, taste claim and ABV3, cementing the opportunity around premium low & no options.

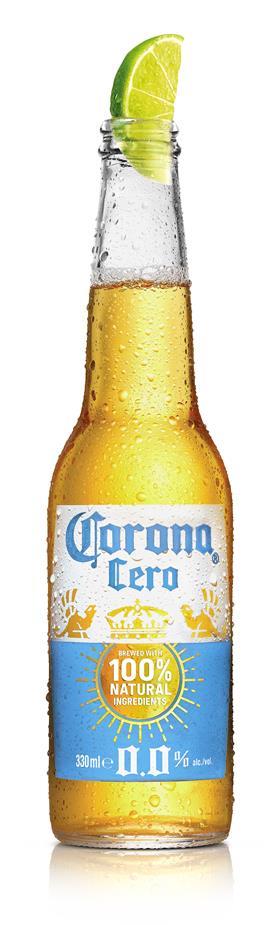

“In response to this, we launched Corona Cero, a super-premium alcohol-free version of Corona that allows everyone to enjoy their favourite beer anywhere, anytime. True to the Corona ethos, Corona Cero is brewed with the same 100% natural ingredients – water, barley malt, maize and hops – and is best served ice-cold with a wedge of lime.” The original brewing method and ingredients allow Corona Cero to keep its classic refreshing taste minus the alcohol, he says.

“Despite an abundance of NPD in the low & no category, we recognised a gap in the market for a super-premium alternative. Corona is renowned for its high-quality flavour, so we’re pleased to be able to offer an alcohol-free version for consumers looking to treat themselves to a beer at home but without the alcohol.”

Devon concludes: “It’s clear that the premiumisation trend isn’t going away anytime soon, so retailers should ensure they are prioritising premium options on-shelf. This also presents a unique sales opportunity to encourage consumers to trade up, therefore boosting profits. It’s a win-win situation.”

Find out more, visit: https://budweiserbrewinggroup.co.uk/site/contact/enquiries/

Oliver Devon, commercial director, premium retail at AB-InBev

Sources

[1] Kantar/BBG AlcovisionOccasion Studynew

[2] Budweiser Brewing Group Forecasting October 2021

[3] Kantar Alcovision; 2 ME 31 May 2020

[4] Nielsen GB Total Coverage WE 20 August 2022

[5] ABInbev Report, 2019

[6] Nielsen iSights Total Craft L12W WE 03 Sep 2022

[7] Nielsen GB Total Coverage WE 20 August 2022