Indulgent ice cream sales have exploded as Brits treat themselves more at home. So where does this leave better-for-you lines?

Downloads

-

Focus On Ice Cream

PDF, Size 11.05 mb

How’s your waistband holding out? If you’re still slipping into your pre-pandemic wardrobe one year on, you’re doing well. While scores of Brits embraced healthier lifestyles during lockdowns, others boosted their morale by tucking into treats.

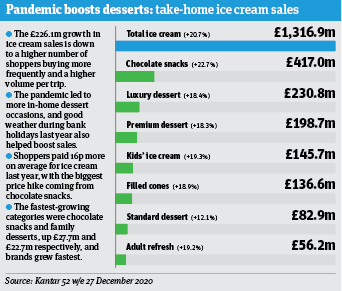

That’s shown by the extra 54 million litres of ice cream that went through the tills last year, adding £226.1m to the take-home market [Kantar 52 w/e 27 December 2020]. And, as consumers sought out comfort in calories, indulgent lines were the biggest winners. To sum up the nation’s mood: Magnum was the fastest-growing brand and better-for-you sensation Halo Top was the fastest-falling [Nielsen].

“Well over a third of consumers are treating themselves now more than ever, and are looking for comfort and indulgence,” says Kat Jones, marketing manager at Häagen-Dazs.

So where does all this indulgence leave low-calorie lines? Was ‘healthy’ ice cream just a flash in the tub? And with lockdown restrictions easing and people venturing out, what’s the forecast for ice cream this year?

“Well over a third of consumers are treating themselves now more than ever”

In one sense, little has changed. “Even prior to Covid, indulgence has always been the number one driver behind the growth of the category,” explains Jennifer Dyne, ice cream brand experience director at Unilever.

That was simply accelerated by the pandemic. The exponential growth of Unilever’s Magnum brand, up £38.4m to £207.4m [Nielsen 52 w/e 5 September 2020], highlights the level of appetite. It capitalised on that with the launch of a highly indulgent Double Gold Caramel Billionaire flavour this month.

Magnum isn’t the only winner in this space. The luxury and premium ice cream categories saw sales shoot up 18.4% and 18.3% respectively last year [Kantar]. And handheld formats grew ahead of tubs. So if you could combine handheld with luxury, you were in for a sales boom.

See Froneri’s Nuii range of chocolate sticks, which more than doubled in value to £13.7m [Nielsen]. “With this increase in snacking at home, handheld formats have generally been more suited to the change in situation,” says Henry Craven, customer marketing controller at Froneri. “But throughout the pandemic, many of us have looked for little ways to treat ourselves, so it’s the more indulgent sectors such as chocolate sticks that have performed especially well.”

Indulgent tubs haven’t done too badly either. Take luxury brand Mackie’s, which grew 22% to £15.4m [Nielsen]. “Consumers have been looking for an indulgent product that they can enjoy in moderation,” says sales director Stuart Common. “They have been looking for a mood booster and real dairy ice cream has always proved an effective and affordable way of doing this.”

Another winner from this trend was Häagen-Dazs, which saw its tub sales increase 8.9% to £56.2m [Nielsen]. Owner General Mills says those who previously would have bought more everyday brands are now trading up for a moment of luxury. It is looking to repeat that performance in 2021 with the launch of Duo variant – a tub combining a split of two contrasting flavours.

Häagen-Dazs’ success wasn’t just about flavours, though. It also demonstrated some savvy marketing by evolving its partnership with virtual film club Secret Cinema to present Secret Sofa. “We made a call quite early on [in the pandemic] to change some of our marketing strategies and pivot some of our other partnerships,” says Jones. “We tried to be sympathetic to what was happening in consumers’ lives and find ways to bring little moments of joy and luxury when it’s been needed.”

Better-for-you slump

But in an environment so focused on luxury, not everyone benefited. Halo Top is a case in point. Its core claim – that it contains less sugar and calories than the leading brands without any compromise on taste – generated a wave of publicity when it launched on UK shores in 2018.

By contrast, that claim seemed to fall on deaf ears last year. Halo Top’s sales fell by 39.8% or £9.3m [Nielsen 52 w/e 5 September 2020], representing the largest loss of the top 50 ice cream brands.

EMEA divisional director David Taylor believes that was simply a blip. “With many promotional activities being cancelled and consumers prioritising freezer staples, there were understandably some challenges in the first half of the year,” he says.

“The second half of 2020 was particularly strong for the Halo Top brand, where ‘health’ occasions rapidly grew among consumers.”

With that in mind, the brand has big ambitions for the year ahead, including a new plant-based range made from oat milk that will roll out in March (see p64).

General Mills’ Jones agrees better-for-you options will start to regain their mojo. “As the pandemic took hold, there was a really big resurgence of growth in indulgence, and maybe wellness took a temporary dip in growth,” she says. “But it’s still a big consumer trend that’s here to stay and we expect to see that segment pick up again, particularly as we come into the new year.”

“As the pandemic took hold there was a really big resurgence of growth in indulgence”

If low-calorie brand Oppo is anything to go by, there is certainly mileage left in the proposition. Sales of its tubs grew 30% last year to hit nearly £2.5m.

Co-founders Charlie and Harry Thuillier believe that success is down to Oppo’s focus on “quality of product and premium, natural ingredients” in its range. “We understand consumers are unwilling to compromise on taste,” they add.

That’s one thing Unilever is mindful of in its work to tackle sugar levels across its ice cream portfolio. It’s arguably the right time to do it, given that the government obesity strategy is set to shine a spotlight on HFSS foods like never before.

With that in mind, it has committed to ensuring 95% of its global ice cream portfolio contains no more than 22g sugar or 250 calories per serving by 2025. Progress so far includes reducing the sugar in Cornetto Classic by 21% and a double-digit reduction in Magnum Almond and Mint variants.

Getting it right requires a fine balance, says Unilever’s Dyne. “Structurally, sugar is really important to how we create ice cream, so how we reduce that without compromising taste is one of our biggest challenges.”

Virtuous cues

Still, reducing sugar isn’t the only way an ice cream brands can appear more virtuous. No one knows this better than Unilever stablemate Ben & Jerry’s, whose tub sales increased 28.5% to £126.6m last year [Nielsen].

Clearly, it was well placed to capitalise on the indulgence trend. But Unilever believes Ben & Jerry’s also benefited from its activist campaigns. That included renaming its plant-based Coconutterly Caramel’d flavour to Save Our Swirled Now, in a bid to raise awareness of climate change, and challenging the government on refugee rights.

“For the fans, it’s more about the values behind the brand, which really reinforces the importance that, as an industry leader, we need to make sure we bring the excitement that makes a sustainable change to the world – that’s what people are looking for,” says Dyne.

In a similar vein, Jude’s says it reaped the rewards of becoming Britain’s first carbon-negative ice cream company, with sales up £3.2m (76.2%) [Nielsen]. “From the overwhelmingly positive response, it is clear shoppers are increasingly considering the environmental impact of the ice cream they buy,” says MD Chow Mezger. “There is a huge move towards sustainable, local, relatable brands that connect with consumers.”

Meanwhile, marrying the demand for indulgence with sustainability proved a winner for Northern Bloc, which last year became the first brand in the UK to launch fully biodegradable packaging of its 500ml tubs, replacing the plastic coating with a natural alternative. Its sales grew 76% to just shy of £500k [Nielsen].

So it seems the desire for healthier options isn’t going anywhere. Even if that means healthier for the planet, rather than healthier for our waistlines.

Innovations in ice cream 2021

Downloads

Focus On Ice Cream

PDF, Size 11.05 mb

No comments yet