Top story

Irn-Bru owner AG Barr has added to its portfolio with a £32m acquisition of energy drinks brand Boost.

The group said the deal would boost profits and demonstrated its ongoing strategy to develop in high-growth and functional categories.

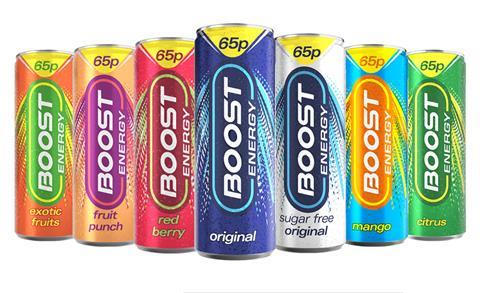

Founded in 2001, Boost sells a range of energy and sports drinks through convenience stores, independent retail chains and petrol forecourts.

AG Barr paid £20m upfront for the brand - funded from its cash reserves - to Boost founder Simon Gray and his wife Alison, with an additional £12m agreed depending on sales and profitability targets over the next two years.

Boost generated revenues of £42.1m and pre-tax profits of £1.9m in 2021.

AG Barr, which also own the Funkin and Rubicon brands, said there was “significant” potential for further growth and development of the Boost product portfolio.

The group planned to leverage its established scale to help Boost with NPD, access new routes to market and expand distribution in new channels.

Boost will continue to be led by Gray and operate within AG Barr as a standalone business unit.

AG Barr CEO Roger White said the deal was further evidence of the group’s strategy to continue to grow through targeted acquisitions.

“Boost is one of the UK’s most recognisable functional drinks brands, and we are delighted to welcome the team into the AG Barr Group,” he added.

“The Boost portfolio offers premium taste and performance at a competitive price, with a strong market position in the UK independent retail channel. With AG Barr’s proven track record of acquiring and developing attractive brands such as Rubicon and Funkin, I look forward to working with Simon and the team to ensure Boost continues to grow and develop under our ownership.”

Gray said: “I’m hugely excited to embark on the next phase of Boost’s growth with AG Barr.

“Over the past 20 years Boost has proven its popularity with consumers who want great tasting, high-performing functional drinks that offer great value for money and I am sure that as part of the AG Barr Group we will maintain our strong growth trajectory.”

Shares in AG Barr fell by 0.8% to 501p as markets opened this morning to news of the deal.

Morning update

The FTSE 100 moved slightly higher as markets reopened after the weekend, climbing 0.1% to 7,560.50pts.

Early risers in food and drink included PZ Cussons, up 3.6% to 218.5p, PayPoint, up 3.4% to 549p, Deliveroo, up 2.5% to 96.7p and Just Eat Takeaway, up 2.5% to 1,999.4p.

C&C Group, Fever-Tree Drinks and Danone were among the fallers so far, down 2.1% to 178.9p, 1.1% to 1,177.7p and 1.1% to €50.66 respectively.

This week in the City

There is a flurry of activity this week as the Christmas holidays slowly approach.

The final monthly grocery sales figures of the year are due out from Kantar tomorrow, showing the performance of the supermarkets in the 12 weeks to 27 November. Tomorrow also brings the last installment of 2022 of the BRC-KPMG retail sales survey and Barclaycard’s spending data.

Food-to-go operator SSP Group also publishes annual results on Tuesday.

Online greetings card business Moonpig reports interims on Wednesday, along with DTC wine seller Naked Wines, while agriculture and engineering group Carr’s and and pub group Mitchells & Butler post preliminaries.

A full-year trading update from British American Tobacco is scheduled for Thursday, with interims from packaging firm DS Smith.

Associated British Foods will issue a trading update on Friday at its AGM.

No comments yet