MicroSalt expects to outperform its annual revenue forecasts as the low-sodium salt producer expanded its relationship with one of the world’s largest food, soft drink and snack makers.

Shares soared 12% as markets opened in London this morning as a result.

Unaudited sales for the AIM-listed business totalled $1.7m in the 10 months to 31 October and the board is confident of exceeding its original expectations of $2m in full-year revenues, Microsalt said in a trading update this morning.

It follows Microsalt receiving increased volumes projections from its unnamed North American customer.

The projections for a single new product, on top of the existing sales pipeline with the customer, should result in sales in excess of $5m in 2026 and $11m in 2027.

While Microsalt expected the rollout to start mid-2026, the business has received its first bulk purchase order from the North American customer.

Earlier this week, Microsalt also announced a new relationship with dairy-free group Daiya Foods, with projected volumes in 2026 worth $500k.

Microsalt is now forecasting sales of $10m in 2026 and $15m in 2027.

CEO Rick Guiney said: “Our success in 2025 stems from focused strategic efforts to build a long-lived, sustainable organisation that not only delivers healthier foods, but that also delivers topline revenue and investor returns.

“The projections for 2026, 2027 are based upon our existing volume commitments and as we scale, we expect enhanced efficiencies and additional product development to support continued success. 2025 serves as a foundational building block by providing impeccable reference sales that will solidify our position in the market.”

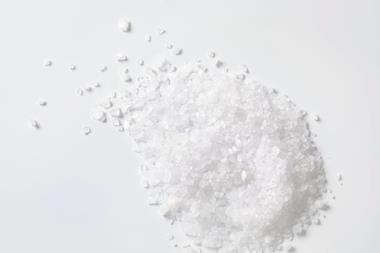

Microsalt produces a patented natural salt containing 50% less sodium than the traditional offering.

The company floated on London’s junior market in early 2024 with a market cap of £18.5m.

Its shares, which today sit at 63p, have been volatile since floating at 43p each, going as high as 114p and as low as 34.5p.

No comments yet