Supermarket prices have fallen on an annual basis for the fourth month in succession, but the pace of deflation is slowing.

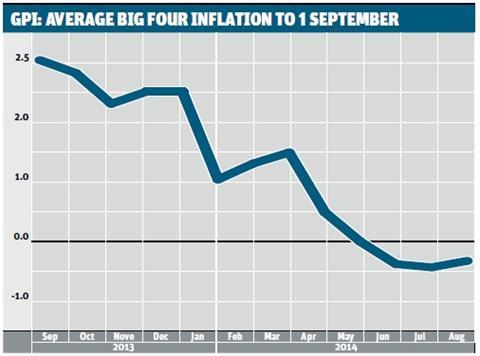

The average rate of annual inflation as measured by The Grocer Price Index (GPI) stood at -0.56% in the month to 1 September. This marks the third consecutive month in which prices have fallen by more than 0.5%, but represents a slowdown from the 0.66% fall recorded in July and the 0.61% drop in April.

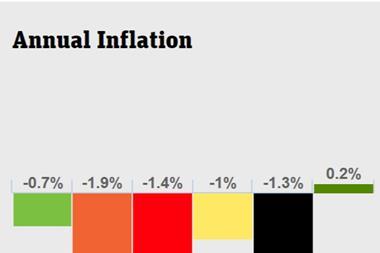

In the lastest GPI, all of the big four supermarkets have returned to negative annual inflation. In the month to 1 August, Tesco was the only supermarket to see prices increase, by 0.34% , but this month its prices are down marginally year on year, by 0.08%.

After Dalton Philips’ concerted efforts to drive down prices, Morrisons showed the largest price deflation of the big four, with its annual average rate of inflation standing at -1.08%. Asda, whose prices dropped by 2.02% last month, saw inflation ease to 0.71%.

However, in terms of total average price cuts, the big four were all topped by Waitrose, which saw year-on-year price deflation of -1.34% - the only time in the past 12 months it has recorded more significant deflation than all its competitors.

Across all retailers, deflation was driven by fruit & veg, which fell by an average of 3.29%. All of the big four saw deflation here, but cuts were particularly evident at Morrisons, where fruit & veg prices fell by 8.32%.

Elsewhere, there was significant disparity across the various categories. At Asda, for example, dairy prices fell by 4.82%, while Morrisons recorded dairy inflation of 2.74% to leave the category overall 0.43% lower year on year. Conversely, Asda saw chilled goods rise in price by 3.02%, while Morrisons recorded 2.87% price deflation in the category.

Although the overall rate of deflation appears to be easing, there is little sign that the competitive price environment that has helped hold down food inflation over the past year is becoming less intense.

In fact, inflation is likely to creep back towards positive territory because easier year-on-year comparatives begin to kick in after the summer. Inflation was running at 2.56% a year ago, but this had already eased to 0.71% on 1 January.

At the same time, new Tesco boss Dave Lewis’ early pronouncements that he will concentrate on Tesco’s “core business” have been seen as a sign that he will more fully commit to the price war, which will inevitably draw a response from rivals and help keep a lid on inflation in the months ahead.

No comments yet