Ritter Sport UK & Ireland managing director Benedict Daniels believes the grocery sector can unlock mutual transformative growth via deeper partnerships between brands and retailers, consumer centricity and value creation.

UK grocery is no stranger to turbulence. Inflationary pressures, supply chain instability, AI-driven disruption, labour shortages and the ongoing uncertainty around HFSS regulation are just some of the factors shaping the industry. For many retailers, the instinctive response has been to double down on efficiency measures, cost-cutting, and short-term tactics to stay competitive.

But in focusing narrowly on survival, the sector risks overlooking one of its biggest opportunities for growth: stronger, more consistent and genuinely collaborative relationships between brands and retailers. According to Benedict Daniels, managing director of Ritter Sport UK & Ireland, the hidden value inside the current model could be transformative, if both sides are prepared to re-think how they work together.

“With resource cuts in stores, the onus is increasingly pushed onto suppliers to fill the gaps”

Benedict Daniels, UK & Ireland managing director, Ritter Sport UK

The execution gap in grocery retail

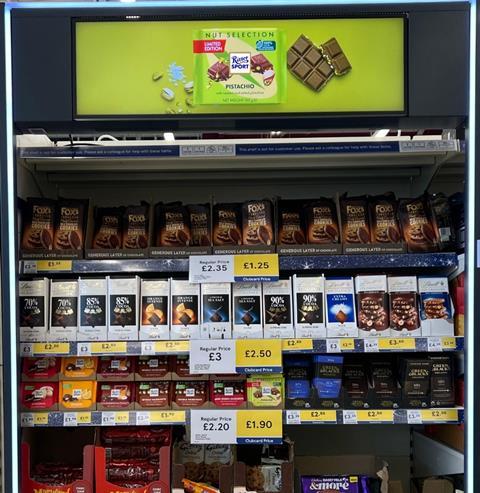

“One of the most pressing challenges is the state of in-store execution,” says Daniels, who has worked in FMCG for more than three decades, adding there is significant room to raise standards and to unlock value for both retailers and brands. “With resource cuts in stores, the onus is increasingly pushed onto suppliers to fill the gaps through retail-ready packaging and field merchandising teams. But this is a false economy,” he explains. “At the point of purchase, standards are not where they need to be – and that represents huge, unrealised value for both retailers and brands.”

Shoppers make decisions in seconds. If shelves are messy, stock is missing or displays fail to land, the category suffers. It’s a shared loss that neither side can afford.

Why consistency matters

Beyond the shop floor, greater continuity in key retailer roles could unlock even more potential. While buyer turnover is a familiar challenge, Daniels notes that consistency across category planning, marketing and data teams makes a real difference. “Where we have consistency of contact, we grow,” he says. “We grow their category, we grow our sales and we provide new value to the consumer. Stronger continuity helps us build momentum, deepen collaboration, and accelerate growth.”

Knowledge takes time to build. A revolving door of stakeholders leaves suppliers repeatedly starting from scratch, while retailers miss out on the benefits of accumulated expertise. “It’s a myth that keeping people in a category too long creates cosy relationships,” Daniels argues. “In reality, it creates better-informed plans, deeper collaboration, and more innovation.”

Too many brand and retailer interactions remain heavily transactional, driven by promotions, negotiations, and focusing most of the time on short-term wins. While inevitable to a degree, this approach often undermines the bigger picture. “A true joint business plan isn’t about win-lose outcomes,” Daniels explains. “It’s about creating a position where both parties feel their agendas are satisfied, not just in the short term, but in a way that is sustainable over the long term. That’s how you build real value for customers.”

“Do brands really understand their retail partners’ must-win battles”

Benedict Daniels, UK & Ireland managing director, Ritter Sport UK

Trust through delivery

That doesn’t mean ambition has to be curbed. But it does mean promises have to be credible. “Listening is more important than talking,” says Daniels. “Do brands really understand their retail partners’ must-win battles? Do they tailor their plans accordingly? And, crucially, do they deliver what they’ve committed to?”

Over-promising erodes trust. But a consistent record of delivery builds credibility and trust. Once that trust is established, it makes it easier for retailers to back a brand’s ideas and overall long-term vision.

Customer-centric value

The need for credible, insight-led collaboration has never been greater. The cost base of the chocolate industry has shifted permanently, with cocoa prices now around four times higher than historical averages. At the same time, HFSS restrictions are reshaping store layouts and promotional levers, reducing flexibility for both retailers and suppliers.

In this environment, discounting alone cannot sustain category growth. Instead, Daniels believes, the future lies in redefining what value looks like for consumers. “Packaging, merchandising and store theatre are fundamental. Mental and physical availability, and brand salience are the things that really matter. That’s how categories stay vibrant, even in tougher conditions.”

Innovation at the shelf-edge, compelling brand propositions and consumer-centric initiatives all have a role to play in maintaining relevance and driving perceived value, even when budgets are tight.

Looking ahead

What does the ideal grocery-retailer relationship of the future look like? For Daniels, it comes back to people, consistency and collaboration. “I’d like to see more frequent, longer-duration face-to-face time with a broader set of retailer stakeholders, from commercial to supply chain to marketing. AI has its place, but the human element remains critical.”

The opportunity is clear: by addressing execution gaps and investing in long -term consistency, grocery can unlock growth that goes beyond price promotions and short-term tactics.

UK grocery is under immense pressure, but focusing solely on efficiency and cost control risks missing the bigger opportunity. From Daniels’ perspective, in-store excellence, consistent human relationships, and long-term collaboration between brands and retailers are the levers that will unlock growth in the years ahead.

The future of the industry will be shaped not just by macroeconomic forces or regulatory shifts, but by the quality of its partnerships. In a market where margins are thin and competition is fierce, the difference between stagnation and success may well come down to one question: how well do brands and retailers work together?