Publishing: 6 November 2021

Advertising deadline: 22 October 2021

Submissions deadline: 15 October 2021

Download a synopsis here

Feature one: The future of plant-based ready meals

By Rob Brown rob_j_a_brown@hotmail.com

The plant-based market continues to boom, with more and more consumers trying vegan dishes. Only ready meals are flagging, perhaps due to increased scratch cooking during the pandemic. So how is the category continuing its impressive growth rate? Have any retailers held onto their plant-based ready meal sales? Are Brits becoming more confident in cooking with plants? And what’s next in NPD for one of grocery’s most innovative categories?

Ready meals: Like their counterparts in meat, plant-based ready meals suffered a decline over the last year, down by 12% to £55m. Even so, the signs are that convenience remains a focus for plant-based products. Vegan brand Bosh is launching a range of chilled ready meals into Morrisons, while Pot Noodle has added vegan flavours to its Fusions range. Even Princes, traditionally known for its fish range, has launched canned plant-based ready meals.

Meal centres: Meal centres have grown significantly in the past year. Why is this? Is it down to Brits using them to cook meals? And to what extent has this been driven by innovation?

Sausages and burgers: These have also seen a boom in sales during the pandemic. What’s driving this?

Consumer attitudes: A recent survey from BBC Good Food found that 8% of those aged between 5 and 16 were following vegan diets, with 15% of the rest hoping to go plant-based. 13% of children were also vegetarian, with 21% wishing they were. So are younger generations about to give a boost to the category, potentially taking their parents and grandparents with them?

Snacks: Meat-free shelves are now heaving with plant-based nibbles, such snacks having grown in value sales last year, with volumes rising to 39.4 million packs. So how big can this category get? Is the uptake indicative of changing diets among Brits? And will it be sustained now that lockdown has finished?

Own label absence: Although own label lines have been seen across most of the meat free categories, retailers remain curiously absent from sandwich meats, tofu and free from pizza. Given the respectable offerings in sausages, burgers, pies and much besides, what gives? Why have retailers decided some segments are not for them? And will this change anytime soon?

Sauces: Premier Foods is the latest big player looking to contribute to vegan eating, with many similar products being out of bounds to vegans due to trace amounts of milk or egg. Will these sauces fly off the shelves, or will they be eschewed in favour of home-cooked alternatives?

4 x Innovations: We will profile four new products or ranges that have ideally not appeared in The Grocer before. We need launch date, rsp, and a hi-res picture of each.

Feature two: Plant-based milks

By Jimmy Nicholls jimmy.nicholls@thegrocer.co.uk

Oat milk has had another year of impressive growth, increasing in value sales by 50% to £146.8m. This helped push the free from milk category to £535.4m of value sales on 440.8 million packs, while other milk growth remained comparatively flat. So is this just the start for oat milk, as more people choose to cut back on animal products? Or have we already hit peak oat? And what about the fate of other alternative milks in the category? Who will emerge as the biggest players in alternative milks?

Brands vs own label: Earlier this year Oatly outlined plans for a huge factory in Peterborough, which the company claims will be the biggest in the world, pumping out 300 million litres of oat drink a year when it opens in the first quarter of 2023. Branded alternative milk still makes up three quarters of the category, but will this trend continue going forward? Or will we see own label milks fight back?

New vs old: This year has seen some new entrants into the free from and dairy alternative markets whilst other brands consolidated their positions. Will the new kids supplant the old ones? Or will the traditional players leverage their advantages to see off challengers?

Price crunch: With the economy still reeling from Covid-19, shoppers might be expected to tighten their belts. For free from products which tend to command a premium price, this could be a threat to the category’s future. Will shoppers stop buying fancy milks? Or will environmental and health concerns override budgetary ones? And wow will the industry respond?

Dairy: Plant-based yoghurts, cheeses and creams have been going from strength to strength. Yoghurts, yoghurt drinks and fromage frais clocked value sales of £112.2m in the last year, with cheese worth £170.2m and cream worth £18.7m. With a vegan even competing in the Great British Bake Off this year, have plant-based desserts finally arrived, and where will they go to next?

4 x Innovations: We will profile four new products or ranges that have ideally not appeared in The Grocer before. We need launch date, rsp, and a hi-res picture of each.

Feature three: Fish alternatives

By Megan Tatum wordsbymegantatum@gmail.com

Plant-based manufacturers have been cooking up alternatives to sausages, burgers and much besides for ages. But only recently has much attention gone on plant-based ‘fish’. Now there are alternatives to tuna, shrimp, fish fingers and much besides. So how have innovators been able to capture those fishy textures? Are familiar brands dominating the market, or upstarts? And how are the public responding so far?

Types: The range of fish that can be emulated by plant-based food has expanded impressively. Where once there was a dearth of these products on the shelves, now you can find alternatives to fish fingers, fillets and even tuna or salmon. So which products are proving most popular with consumers? Are we eating it from the frozen, chilled or ambient aisles? And what innovation is likely to come next?

Incumbents vs newcomers: In June Birds Eye’s Green Cuisine range took its first step into plant-based fish alternatives with vegan fish fingers. The following month, plant-based specialists Moving Mountains launched a fish fillet, having had its own alternative fish fingers on the market since December 2020. With heavyweights from the fish and plant-based sectors targeting this market, will either prevail? Or does the future of the category belong to challenger brands?

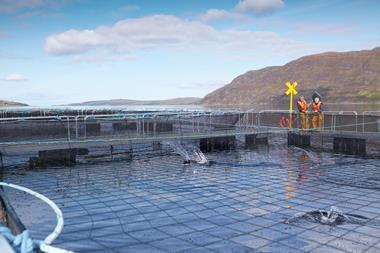

Sustainability: Environmentalists have been slating the fish industry, with the Seaspiracy documentary levelling harsh criticisms against the market. So what role is this playing in terms of plant-based alternatives? Are consumers switching to things like rice protein ‘fish’ instead of the sort that’s caught from the sea? And are the fishing industry’s other regulatory difficulties prompting any shifts?

Out of home: Many pubs have taken to serving vegan fish and chips, with the ‘cod’ made out of tofu. So what other out of home plant-based fish can you get at restaurants? And what lessons can be drawn for the grocery market as it continues to innovate?

4 x Innovations: We will profile four new products or ranges that have ideally not appeared in The Grocer before. We need launch date, rsp, and a hi-res picture of each.

Downloads

GRO Plant Based 2021 v2

PDF, Size 0.15 mb

No comments yet