Young’s Seafood and Karro Food Group owner Sofina Foods Europe has slid into the red, off the back of a “very challenging macro environment” and “significant cost inflation” across its key fish and pork categories.

A £300k operating profit at the business in 2023/24 swung to a loss of £7.1m in the year to 29 March 2025, according to newly filed accounts posted with Companies House for holding company UK 111 Ltd – which is a subsidiary of Canadian protein giant Sofina Foods.

Revenues also took a significant hit at the supplier, falling by 7% to £1.9bn, while pre-tax losses grew further year on year, from £4.3m to £10.8m. EBITDA was down 12.9% to £110.5m, while it posted a loss after tax of £19.6m (compared with £15.7m in its previous accounting period).

Sofina attributed its fall in profitability to pork commodity volatility, with farmgate prices now “on the rise” after a period of stability, while cod prices hit a five year record-high. The cost of utilities storage and transportation also showed “no signs of weakness”, the supplier’s annual report revealed.

However, Sofina stressed it’s “relentless attention to continuous improvement and controlling the controllables remain our prime focus in continuing to mitigate cost inflation”, pointing to ongoing investment to “drive increased capacity, thoughput and efficiencies”.

And as a result, the business was “well placed to deal with ongoing industry-wide challenges and strong competitive pressures the UK and European pork and seafood industries”.

Read more

-

Sofina Foods acquires Northern Irish meat company Finnebrogue

-

Young’s and Karro owner Sofina eyes growth as sales top £2bn

The group further stated that positive operating cash flow had allowed it to invest over £30m in capital improvement projects across its operations, which are expected to have a “significant beneficial impact on the future profitability of the group”.

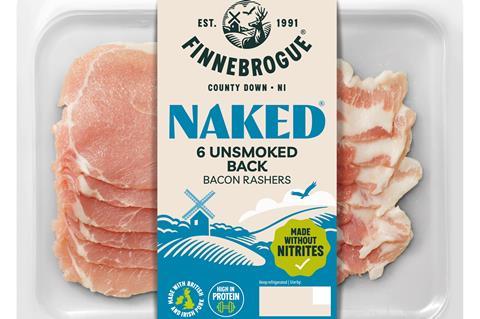

It comes as Finnebrogue, which was acquired by Sofina in June, saw an increase across core metrics in its most recent accounts, also published this week.

For the year ending 22 February 2025, the company recorded a turnover of £170.1m, up 6.8% compared with 2024’s £159.2m, while operating profit increased from £8.6m to £10.4m, a jump of more than 20%.

“Both the level of business and the year-end financial position of the company were considered satisfactory”, Finnebrogue’s strategic report said. “The directors expect that the current level of activity will be sustained for the foreseeable future.”

However, the Northern Ireland-based supplier did note that “economic uncertainty, inflation, and interest rates have put pressure on consumer disposable incomes”.

At the time of its acquisition of Finnebrogue, Sofina said its purchase of the supplier, which owns the Naked nitrite-free ham brand, would bolster its “ambitious growth plan” for Europe.

Sofina Foods acquired Young’s and Karro from private equity owner Capvest in March 2021.

No comments yet