Here’s a testament to the power of brands. They’ve fared better than own label cereals in the tough conditions of the past year, despite costing £2.47 more per kilo on average.

They’re down just 0.8% in value, while own label has fallen 5.1%. That’s not just down to price rises, either. While branded volumes have declined 5.2%, own label volumes have slumped much faster at 9.2%.

Even more impressively, that comes against a rise in average prices during our data period – by 5.3% in total cereals – and the start of the cost of living crisis. So far, there’s little evidence of shoppers trading down.

That explains the bullish attitude of cereal giants like Nestlé and Kellogg’s. The former argues “consumers value trusted brands with a long-standing strong reputation”. And the latter says “we don’t expect this to change”.

Kellogg’s has reason to feel confident. It has some of this year’s fastest-growing lines: Wheats, up £9.7m following its trio of new SKUs in 2021, and Frosties, up £3.4m.

Weetabix is similarly upbeat. The leading cereal brand has maintained its value and is down 4.2% in volume – less than the category-wide decline of 6.7%.

Weetabix Original has outperformed the category despite “strong own label sales” in recent weeks, the brand says. It’s also keen to highlight the affordable nature of cereal as a whole, being “by far the cheapest solution for morning fuelling”.

However, the move by shoppers to own label will pose a challenge for big brands over the next year, acknowledges Chris Dubois, head of category & in-store excellence at Weetabix. “Well-known brands are more trusted, but what we need to show in these tough times is that we are worth that trust.”

For Kellogg’s, that means “continuing to drive innovation, delivering on taste and creating excitement with new launches” says Williams. Those new launches included Special K Granola in June – said to contain 30% less sugar than other granolas – which helped the wider brand hold on to its value.

Quaker also points to innovation as a key survival strategy. Its Simply No Added Sugar range was the number one hot cereal NPD of 2022, according to NielsenIQ. “The range answers the growing demand for healthier options,” says Corinne Chant, Quaker marketing director at PepsiCo. Plus, the majority of its portfolio is now non-HFSS.

Still, the giants will have to work hard to keep the attention of the health-conscious crowd. Startup Surreal has its eye on becoming a household name with its protein credentials (see Top Launch, below). Gut health challenger Bio&Me recently secured a seven-figure investment to fuel further expansion.

It looks like a fight is on for the nation’s breakfast spoons.

Top Launch 2022

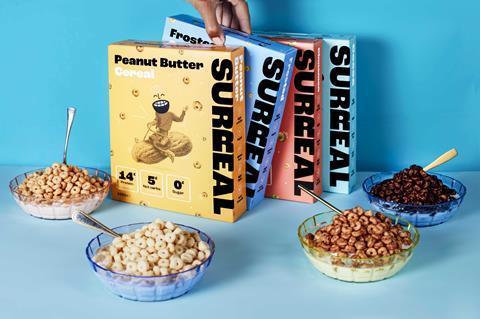

Surreal cereal | Surreal

Surreal stormed onto the scene in January with the promise of being “a protein bar disguised as a cereal”. Its four flavours – Cocoa, Peanut Butter, Frosted and Cinnamon (rsp: £6/240g) – provide 14g of plant-based protein per bowl and zero sugar, in a bid to tackle cereal’s unhealthy rep. They also deliver on taste, co-founder Jac Chetland stresses. Having started out exclusively DTC, savvy marketing (including ads teasing Kellogg’s) has helped Surreal gain listings in 1,000 outlets across the UK and Ireland.

The Grocer Top Products Survey 2022: How can brands stay in focus?

Commodity price hikes, the war in Ukraine and inflation have changed the way Brits shop in the past year, while also piling pressure on suppliers and retailers. Which brands and categories have negotiated the system shock best?

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

Currently

reading

Currently

reading

Cereal 2022: Giants Kellogg’s and Nestle win against own label

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

![Cheese ]GettyImages-664658023](https://www.thegrocer.co.uk/Pictures/80x50/1/8/6/282186_cheesegettyimages664658023_540979.jpg)

![Cheese ]GettyImages-664658023](https://dmrqkbkq8el9i.cloudfront.net/Pictures/80x50/1/8/6/282186_cheesegettyimages664658023_540979.jpg)

No comments yet