Supplier margins have always been a bone of contention for supermarkets. When Mike Coupe laid out his ill-fated plans for the Sainsbury’s-Asda merger, the then Sainsbury’s boss vowed to extract £1bn in savings for customers by targeting the supplier base.

Immediately, Coupe was forced on to the back foot as an army of vocal farmers and small suppliers took umbrage.

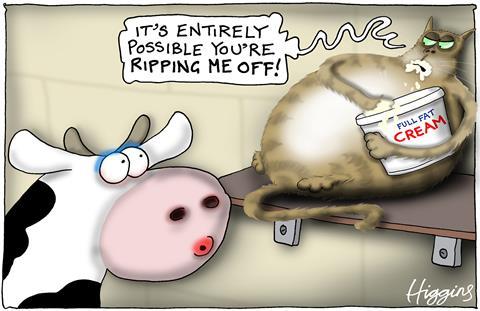

Something similar happened with John Allan’s inflammatory comments at the weekend. It was “entirely possible”, the Tesco chairman told the BBC’s Laura Kuenssberg, that suppliers were making CPI claims that were not legitimate.

His comments caused outrage. Minette Batters at the NFU said the Tesco boss was living in a parallel universe if he didn’t see how much pressure suppliers were under.

But Allan wasn’t accusing farmers of profiteering. Or indeed the thousands of small suppliers it uses. His insinuations were targeted quite deliberately at suppliers every bit as big as Tesco. And one in particular: Kraft Heinz.

Last summer, as we all know, Kraft Heinz whacked up its prices by a considerable margin. When Tesco refused to accept them, Kraft Heinz stopped the trucks. After a few weeks of empty shelves and lost sales, Tesco caved in.

Now Heinz has pushed through another big price hike. A hike that Tesco has once again been powerless to resist. And that is clearly rankling with Allan and his colleagues.

Allan said Tesco was trying “very hard to challenge” cost price increases to ensure they’re fair. “Most are [legitimate],” he conceded, “because there have been some dramatic increases in commodity costs, energy costs and labour costs.”

“On the other hand,” he added, pointedly, “if you don’t want to pay £1.70 for Heinz soup in Tesco, there are own-label alternatives, [or] Crosse & Blackwell, for less than £1.”

These “alternatives” have also increased in price this year. But not at the same rate. And the fact the gap is getting wider is what makes Tesco suspect Heinz is profiteering. Own-label baked beans, for example, are now 81p cheaper on average than Heinz at Tesco, up from 76p two weeks ago.

Hundreds of suppliers are pushing through price hikes on thousands of items, and inevitably, somewhere along the line, some will take advantage if there’s an opportunity. The hard part is trying to work out how much is justified, and who’s bean having you on.

All the supermarkets have their ‘justification sheets’, as Karen Betts from the Food & Drink Federation pointed out. And negotiations have been rigorous, to say the least.

Indeed, there are plenty who believe it’s the supermarkets who are profiteering. Suppliers have dozens of tales to tell of retail prices rising far faster than any CPIs they’ve negotiated, with clear cases to answer over eggs and fuel, for example.

On the other hand, Tesco can point to an expected fall in profits – from £2.7bn to £2.4bn-2.5bn – as well as group savings of £500m, as evidence it’s absorbing costs. With accusations of ‘greedflation’ coming thick and fast, for anyone in the food and drink sector reporting an increase in profits and margins, some difficult questions may soon be coming your way – though it’s as well to add that Kraft-Heinz gross profits fell from $9.2bn in 2020 to $8.7bn in 2021 to $7.9bn in 2022.

No comments yet