With almost 9 in 10 post-pandemic shoppers still preferring to drive when shopping for groceries1, retailers could be missing a golden opportunity to pique their interest while on-the-move, potentially driving footfall and sales.

With post-pandemic consumer behaviours having changed substantially, making assumptions on the ways they behave and their motivations can prove to be a misguided tactic.

This is equally valid for the world of drivers and the reasons why they choose to drive and where. Are their motivations still the same or, with the landscape altered as energy costs and inflation hit consumers in their pockets, have these motivations changed?

Moreover, when it comes to grocery missions, do drivers harbour the same ambitions as pre-pandemic and are grocery retailers missing a key opportunity to influence their behaviour in a previously unprecedented way?

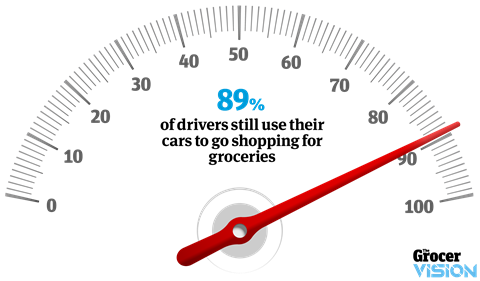

This is what driving app specialist Waze set out to discover in exclusive new research, carried out by Ipsos on its behalf. While it might be assumed that online purchasing has become the key grocery shopping model in a post-pandemic world, Waze’s study found that the vast majority of drivers – 89% – still use their cars to go shopping for groceries.

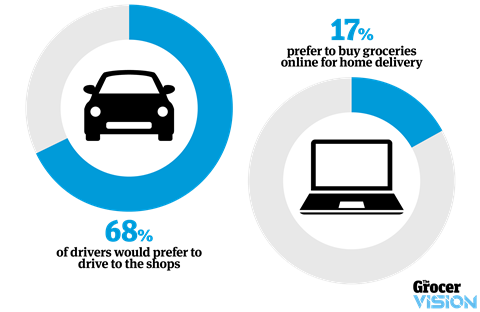

While the UK does have the highest percentage of e-commerce buyers in Western Europe, according to the research, when it comes to groceries 68% of drivers would prefer to drive to the shops, while just 17% prefer to buy groceries online for home delivery

This could be due to a number of reasons. With the rush to go online, many consumers were left disappointed at not being able to book delivery slots or being unable to register for an account with the major supermarkets. In addition, the personal experience – particularly in fresh produce – of being able to touch and see the goods is often a stronger motivator for purchase than relying on the retailer to fulfil that mission.

The strength of the relationship between grocery shoppers and their cars can also be seen in internal Waze UK data, with 10 million grocery navigations by Waze users in 2021. But the real significance is in how that figure has been accelerating. Between 2019 and 2021, Waze navigations to grocery retailers surged by almost half (47%) compared to a 16% increase across all navigations.

Time slots

But it’s not just a numbers game. Waze’s research revealed that there is a lot to be learned by studying when and why people get behind the wheel and where they go when they do so. For instance, it’s clear that drivers like to stock up on groceries for the weekend with Waze UK data showing that Friday and Saturday are the most popular days for food shopping. Enthusiasm drops a gear on Sunday, which is the least popular day.

When drivers prefer to buy groceries can also be observed. For example, on a Saturday, the post-lunch 12-4pm slot is most popular. In the week, it’s the key after-school and commuting period of 4-6pm.

Motivating factors

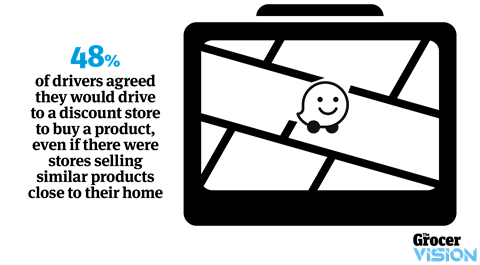

Shoppers are frequently motivated by the opportunity to snap up a good deal and, during a cost of living crisis, deal hunters are more likely to go that extra bit further if they know they can get a bargain. Waze UK data reveals that the discount sector has experienced a significant growth in navigations – up 57% between 2019-2021. Waze’s research also discovered that 48% of drivers agreed they would drive to a discount store to buy a product, even if there were stores selling similar products close to their home.

Yet, when it comes to the supermarket that Waze users will travel furthest for, there is one grocery retailer that comes out on top, with drivers prepared to go an average of 9.1km to visit this particular outlet, compared to 4.5km for other supermarkets.

Meanwhile, while 84% of grocery shoppers set out with a specific plan to do so, some drivers will make purchases on the spur of the moment, buying fast food spontaneously, for example. Those with longer car journeys, such as sightseers or staycationers, also make spontaneous purchases when driving to their destinations.

Influencing decisions – Waze knows

Whatever their destination or motivation, however, reaching and being able to influence these potential customers on their journey – whether short or long – is a clear sweet spot for marketers and advertisers.

Understanding times and motivations for travel is key to unlocking how receptive drivers are to advertising while in the car. Almost a quarter of those who have travelled by car and bought something say they would change their choice of retailer while driving if they saw or heard an advert for another one that interested them, according to Waze’s research. And around one in seven drivers (14%) have actually stopped and bought something because of an advert they saw or heard while driving.

This knowledge and the ability to influence drivers’ decisions puts Waze in pole position to help retailers gain a deeper level of understanding about how drivers are shopping, their purchase intentions when in the car and how they are making decisions on-the-move.

Importantly for grocery retailers, it can also unlock opportunities to understand driving consumers’ mindsets, reach people on-the-go to attract new and additional business, drive footfall into stores and serve their existing customers with relevant, real-time contextual information at the time they need it most.

To read the full Waze study and discover how the driving app specialist can help you further unlock the appeal of your grocery business to drivers, click here.

Source

1 Ipsos research commissioned by Waze