With production costs rising and disposable income falling, consumer packaged goods brands find themselves in the unenviable position of needing to navigate an increasingly complex commercial environment. Find out how Revenue Growth Planner can help you conquer that challenge.

For consumer packaged goods (CPG) brands, what might once have felt like extraordinary operating circumstances have rapidly become the norm.

In May last year, for example, the Consumer Brands Association issued a warning1 about “out-of-control wholesale costs” and “15 straight months of record-high producer prices”. Numbers from the US Department of Agriculture suggest that food production costs rose by $66.2bn (18%) during 20222, the biggest increase on record.

While these numbers may speak mainly to the situation in North America, the same pressures apply in the UK as well.

Further increases lie ahead here, too. A rise in the National Living Wage in April will increase payroll costs by around 10% for some manufacturers. From raw materials to human resources, the stark reality is that most goods are now fundamentally more expensive to make than they were a year ago.

Understanding shopper intent

However, CPGs aren’t the only ones facing up to a tougher economic reality. Much as it might now be more expensive for brands to manufacture their products, shoppers are facing financial challenges of their own, with discretionary spend coming under increased threat.

In turn, evidence is beginning to mount that brands will face a tough battle to retain the loyalty of their customers over the next 12 months.

For instance, a dunnhumby study of almost 10,000 global grocery shoppers3 found that a third of customers are switching to private label as a “value seeking” strategy.

Elsewhere, two of dunnhumby’s other studies show a dramatic increase in emphasis around private label. In both Spain and Italy, the quality, price, and variety of a retailer’s private label range is now one of the major factors that shoppers use when deciding where to shop4.

UK-based sales of the cheapest own-label products have spiked by 47% over the past year

“Saying” and “doing” are different things, of course, particularly in regard to consumer intent. Nonetheless, the news that UK-based sales of the cheapest own-label products have spiked by 47% over the past year5 indicates something about the scale of the challenge that CPGs now face: national brands may play a significant role in most customers’ lives, but loyalty is hard-won and easily lost.

Mitigating the impact of the current climate

As taxing as the current environment may be, brands do have numerous ways in which to mitigate its impact.

A smarter approach to assortment offers a way to optimise costs by reducing duplication of need, allowing production to be focused around the most popular pack sizes and variants, for instance. Media can be used to proactively communicate key differentiators over competing brands, and promotional analytics employed to minimise investment into ineffective promotions.

Mitigation should not be the only strategy, however. The grocery market can shift incredibly quickly, and those brands with the requisite levels of agility also stand to capitalise on those changes. Keeping a finger on the pulse, anticipating future trends, and adjusting go-to-market strategies at speed will all be vital capabilities over the coming year.

Perhaps the greatest opportunity at play here is the chance to learn more about how customers are reacting to this evolving market, and build a brand strategy that truly anticipates those behaviours. By predicting, understanding, and reacting to those shifting needs, brands have the ability not just to insulate themselves against the challenges outlined above, but explore opportunities to grow their revenues as well.

Doing that effectively, of course, requires both a long- and short-term view of the market; one in which immediate trends can be detected and responded to, and future opportunities foreseen far in advance – particularly as the current economic pressures begin to subside.

Providing CPGs with market-level insight

Developed in response to this need, Revenue Growth Planner is a new, self-service product that offers CPGs a forecast, built on market representative elasticities, of volume demand for the coming 12 months based on different pricing and promotional scenarios. The product employs dunnhumby’s world-leading demand modelling capabilities, refined over 30+ years and already used by major retailers around the world.

With the help of Revenue Growth Planner, brands can gain a better understanding of how their products resonate with customers, particularly how shoppers might respond to any changes in their price and promotional strategic architectures. Some of the key features offered by the tool include:

- “What if…” forecasting, giving users the ability to simulate the likely impact of changes to key product dimensions such as base pricing and promotional mechanics to their retail volumes, sales and margin, as well as those of their competitors

- Trend monitoring, enabling brands to identify and respond to emerging opportunities as customers move between different price ladder rungs or size variants.

- Comprehensive insight into their brand’s optimal pricing and promotional mix, allowing users to confidently rebalance their brand playbooks

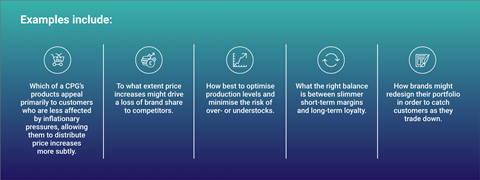

The addition of Revenue Growth Planner to the dunnhumby portfolio of products and services also allows many other critical planning questions to be answered more easily.

And it’s just as relevant for demand planners and category managers as it is for revenue growth management teams.

Providing CPGs with market-level insight into both their own and competing products, it provides a clear view of the potential for cannibalisation, weekly updates, and an accurate reflection of a fast-moving landscape.

Offering a credible, point in time view of the future and the ability to understand the impact of underlying changes in your go-to-market strategy, Revenue Growth Planner gives you the confidence to act decisively – even in these uncertain times.

Revenue Growth Planner is a new tool developed by dunnhumby and is currently exclusive to UK-based brands.

To find out how your brand can utilise Revenue Growth Planner, contact us to start the conversation.

Sources

[1] Steep Wholesale Prices Show Sustained Cost Pressures for CPG – Consumer Brands Association, 14th June 2022

[2] Cost of Growing Food in US Is Set to Rise by Most Ever in 2022 – Bloomberg, 1st September 2022

[3] dunnhumby Consumer Pulse – October 2022

[4] dunnhumby Retailer Preference Index for Spain and Italy - 2022

[5] Shoppers turn to own-label lines to save money – BBC News, 31st January 2023