UK consumers are reaching their spending limits after years of cuts. Recent research from AlixPartners reveals that, while fewer plan to reduce spending in 2026, this reflects exhaustion rather than recovery. Only groceries show positive spending intent, as households maintain already-reduced levels.

For years, UK consumers have weathered economic storms. From the lingering effects of the pandemic to the political turbulence of the 2023 “mini-budget”, households have been tightening their belts and adapting to ongoing financial pressures.

Our recent research, however, reveals that many consumers are reaching their limits. AlixPartners’ 2026 Global Consumer Outlook indicates the proportion of UK consumers planning to spend less this year has dropped from nearly four in ten in 2025 to nearly three in ten in 2026. But this isn’t the recovery signal it appears to be.

Rather, it shows many households have already cut spending as deeply as they can. They now face a cliff edge: unable to spend more even as prices continue to rise. For consumer products businesses, this demands both resilience and adaptation.

55% of UK consumers intend to maintain their spending levels in 2026, up from 46% the previous year, while the share planning to spend more has fallen. This must be viewed in the context of years of spending cuts, as it reflects consumers maintaining spending at already-reduced levels.

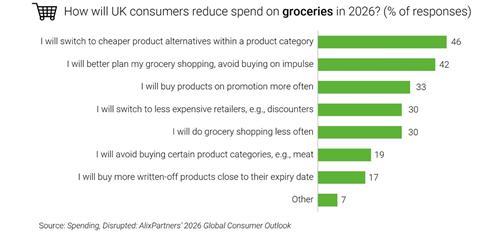

Consumers are more discerning than ever, with 46% of those planning to spend less on groceries saying they are actively switching products to find better value as their primary strategy, while 42% cite better planning. This isn’t just a trend among lower-income households; it’s a universal behaviour.

For those still actively reducing grocery spending, the approach has become highly strategic. 46% are switching products to find better value, while 42% mention improved planning and budgeting. This value-seeking behaviour isn’t confined to lower-income households, it’s universal across all income brackets.

The great divide: Essentials versus discretionary

In this constrained environment, a clear hierarchy of needs has emerged. Our analysis, which measures the net intent* to spend more, shows a dramatic split between what consumers consider essential and what they deem discretionary.

Groceries stand alone as the only category with a positive net spending intent, though it has plummeted from +35ppt last year to just +8ppt for 2026. Every other category faces a steep decline in net spending intent. Consumers are decisively pulling back from areas like sporting goods (-35ppt), consumer electronics (-32ppt), and beauty and cosmetics (-29ppt). Even categories like clothing and homewares are seeing a combined sharp negative net spend intent of -19ppt relative to the previous year.

How to defend your margin and brand

For branded players, own-label producers, and their suppliers, the path forward looks very different. Success depends on understanding your role in this new consumer mindset and executing with precision.

The temptation to chase short-term volume growth through aggressive promotions is strong. But it can be a dangerous game.

Price and promotion are the most accessible levers available. However, overuse trains consumers to expect discounts, permanently eroding margins and brand value. Once value has been given away, it’s extremely difficult to recapture.

Instead consider:

- Focusing on the long game. First, protect your margin percentage. Think five years ahead, not just this quarter.

- Double down on what makes your brand distinctive. Maintain product quality. Resist the urge to shrinkflate or dilute your offer. Reinforce the specific benefits that keep you relevant to your core consumers.

- Protect your brand investment funding. When consumer spending capacity eventually returns, you need to be the brand they remember, desire and return to.

This strategy must also include a proactive approach to SKU rationalisation. Retailers are likely to streamline their ranges and manufacturers should get ahead of this trend. Prioritise protecting high-margin products and ensure that reduced complexity benefits your operations, rather than simply serving retailers with smaller SKU ranges.

A relentless drive for operational efficiency will be critical to funding these investments. Your commercial and operational KPIs should reflect this new market context, setting reasonable expectations for your teams

Why this is own label’s moment to shine

Focus on your premium ‘Best’ tier to drive trial and retention, demonstrating that own-label means quality, not just lower price. Continue to serve households under pressure with your ‘Good’ and ‘Better’ tiers. Continued investment in targeted innovation is crucial to stay ahead of the competition and become an indispensable partner in your retail customers’ category strategies. And, like everyone else, a continued push for operational efficiency is non-negotiable.

How to reinforce quality and partnership

Continue to innovate to support your customers’ evolving needs, whether it’s helping a branded player maintain quality or enabling an own-label producer to enhance their premium offering. Your own operational efficiency is key to remaining cost-competitive and proving your value as a strategic partner.

The UK consumer is at a turning point. The strategies that worked yesterday will not suffice for the challenges of tomorrow. The businesses that will thrive are those that recognise this new reality, choose their strategy wisely and execute it flawlessly.

This article was written by Andy Searle, EMEA leader of consumer products, partner and managing director, AlixPartners and Tony Reynolds, director, AlixPartners.

*Our net intent score, expressed as a percentage point value (ppt) on pages 3-7 of our full report, indicates the overall balance between those consumers who say they plan to spend more in 2026 and those who say they plan to spend less, relative to 2025. A positive score means more people expect to increase spending; a negative score means more expect to cut back. The score only reflects intent and is not tied to actual spending amounts or percentage changes in expenditure. It therefore should not be interpreted as a direct measure of monetary growth or decline in any given industry category, region, or demographic group.