Inflation anxiety across the globe is translating directly into changed shopping habits, making it difficult for retailers to respond accurately and efficiently. Here, Trevor Jordaan, senior industry strategies director at Blue Yonder, explains the dynamics in different markets and how retailers need to adapt.

Inflation is no longer a passing phase – it’s reshaping grocery behaviour on a global scale. A survey of more than 6,000 consumers across the US, the UK, France, Germany, Australia, New Zealand, and the Middle East found that 85% are concerned about the impact of grocery inflation and rising grocery prices [Blue Yonder]. This isn’t just sentiment; it’s translating into decisive shifts in how people shop and where they spend, as households adapt to ongoing financial pressures.

These changes are driven by a potent mix of cost-of-living pressure, continued supply chain disruption, and global tariff uncertainty. Consumers are not only altering their grocery baskets – they’re rebalancing household budgets and making trade-offs across categories. For retailers, the message is clear: staying competitive and maintaining profitability now means understanding and adapting to a new set of consumer priorities.

The consumer lens

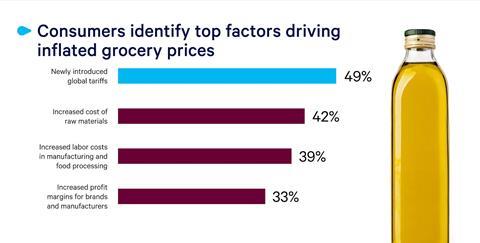

While inflation anxiety spans regions, perceptions of what’s driving it vary considerably, making it harder for retailers to align pricing and messaging with shopper perceptions. Nearly half (49%) of consumers blame newly introduced tariffs as the leading cause, with others pointing to the rising cost of raw materials (42%), higher labour costs in manufacturing and food processing (39%), or higher supplier and brand margins (33%) [Blue Yonder].

Regional differences are stark: tariffs are the dominant explanation in the US, the UK and Middle East, while raw material costs lead in France and Germany, and brand margins top the list in Australia and New Zealand.

And generation adds another layer: Baby Boomers lean toward labour costs, while younger groups are more likely to cite tariffs. These differences matter, as perceptions shape trust, loyalty and, ultimately, purchasing behaviour.

The new shopping playbook

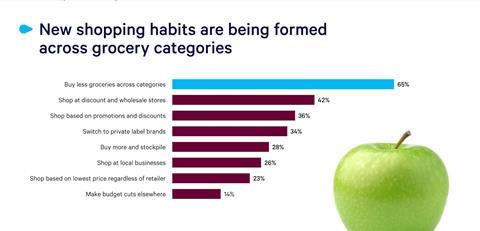

Consumers are acting, and concern about inflation is translating directly into changed shopping habits. Sixty-five per cent are buying fewer grocery items across categories. Others are shifting to discount and wholesale formats (42%), chasing promotions (36%), or opting for own-brand alternatives (34%) [Blue Yonder]. This value focus is prompting many retailers to double down on private-label strategies and, in some cases, tighten supplier partnerships or integrate further into their supply chains to protect affordability.

The squeeze goes beyond groceries. Spending is being cut in clothing and footwear, electronics, streaming subscriptions, personal care and household appliances. Few consumers are unwilling to make these trade-offs to offset grocery inflation.

So where does this leave grocery retailers?

These aren’t temporary behaviours – they’re signs of a long-term redefinition of value. Price, promotion and product availability are being re-evaluated with value-for-money now being the dominant driver of choice. To compete effectively in this environment requires three non-negotiables from retailers:

- Act at market speed on price and promotions – use dynamic, targeted offers and competitive own-brand ranges to keep shoppers engaged without eroding margins;

- Build end-to-end supply chain visibility – transparency from supplier to shelf will help manage costs, anticipate demand shifts, and adjust sourcing quickly before issues hit the shelf;Replace static planning with integrated, agile execution – connected forecasting, inventory management, and store operations are critical and will outpace siloed systems to align supply with shifting demand in real time.

Competing in a cost-conscious era

As this value-driven mindset hardens, trust becomes the ultimate differentiator. Retailers who align pricing, availability and communication with consumer expectations – and do so consistently – will strengthen loyalty. The ability to analyse demand patterns, flex stock levels, and tailor promotions locally will be critical.

To stay ahead, retailers must adopt scenario planning, powered by AI and machine learning, and invest in visibility tools across the supply chain to improve resilience and flexibility.

One leading UK grocery retailer has done exactly this. Working with Blue Yonder, it has optimised demand planning, store order planning, replenishment and space planning across fresh, frozen and ambient categories. The results speak for themselves: transformed forecasting, improved stock management, record product availability during peak seasons, and measurable growth in both sales and market share.

How the world runs on Blue Yonder

Blue Yonder solutions deliver the power of digitalisation in a connected, value-added manner that creates benefits across the supply chain ecosystem, including:

● Retail planning: Blue Yonder’s AI-driven demand forecasting and inventory optimisation ensure the right products are available at the right time, while reducing waste and protecting margins.

● Blue Yonder Platfom: The Blue Yonder Platform is the industry’s first cloud-native, end-to-end supply chain platform that delivers real-time insights, AI-powered decision-making, and unmatched security for agile, resilient, cost-effective, sustainable growth. At its core, the Blue Yonder Platform unifies planning and execution, connecting merchandising, supply chain and finance so that decisions flow directly into action across stores, warehouses and suppliers.

● Synchronised execution: This isn’t just forecasting in isolation. Blue Yonder supports retailers in curating assortments, planning promotions and managing replenishment, while also synchronising execution across warehouses, transportation and store operations.

● Multi-enterprise network: Through its network, retailers can connect seamlessly with suppliers to improve visibility, anticipate constraints and orchestrate responses before disruption hits.

Future-ready retailers

The challenge is set: grocery inflation is redefining value across every category and channel globally. The leaders who respond with agility, visibility and trust will not just survive inflationary pressure – they’ll emerge as the preferred choice in a fundamentally changed market.

To discover more about Blue Yonder’s services, go to https://now.blueyonder.com/grocery-e2e.html