The price of agricultural inputs has started to ease – but many food producers still face crippling costs that far outpace food price inflation, data from farm supplies co-op AF shows.

AF’s twice-yearly Aginflation Index, published this week, revealed a fall of 2.6% in the average cost of farming inputs for the six months to the end of March. This compared to an average RPI food inflation rate of 14.3% for the period.

It marks the first average cost of production drop in more than three years, AF said. Its previous Aginflation Index, last October, showed a 34.2% jump in the cost of inputs in the 12 months between September 2021 and September 2022. This represented a big annual increase compared with the average cost hike of 22% for the year to September 2021.

The index is a weighted average of over 130 items using data from the AF procurement teams, which spend more than £350m a year to procure farm inputs on behalf of AF’s 3,000 farming members.

The index revealed two of the business’s nine key farming input categories were subject to double-digit deflation: fertiliser and fuel. These reduced in price by 30% and 23% respectively.

Three other categories – machinery, contract hire, and animal feed and medicine – showed a slight fall in costs by 2.3%, 1.9% and 1.7% respectively.

But three key inputs continued to be plagued by inflation. The cost of chemicals is up 13%, while rent and other business operating expenses are up by 7% and labour is up 6.6%.

AF’s Aginflation Index score of 288 points – which combines all its key prices into one metric – was also 62.7% higher than its RPI index score of 177, and reflected the continuing gap between farm input costs and food price inflation, it pointed out.

Despite the fall in many input costs, some farmers were continuing to see price pressures rise, said AF CEO David Horton-Fawkes.

Inflation is particularly apparent in crop protection products and feeds containing soya – with AF noting the price of compound blended feeds used across the livestock sector had not fallen as far as what markets had suggested, despite the fall in cereal commodity prices.

Why costs are down but retail prices keep going up

“The dip in aginflation is very good news but it’s too variable across different types of farm business to give much cause for relief,” Horton Fawkes argued.

“The gap between the cost of production and the value of sales is still too wide and too variable to be sustainable. The significant drop in fertiliser prices is, of course, welcome but many farmers bought their fertiliser when prices were still sky high and now output values are falling, so this could be a very difficult harvest for farmers,” he warned.

“It’s alarming that crop protection prices are continuing to rise, and we are encouraging our members to look beyond brand names and focus on active ingredients. We’ve been tracking Aginflation for 16 years and we’ve seen this lag before. If previous patterns continue, we should see these prices begin to ease next year as the reduced cost of production begins to impact,” Horton-Fawkes said.

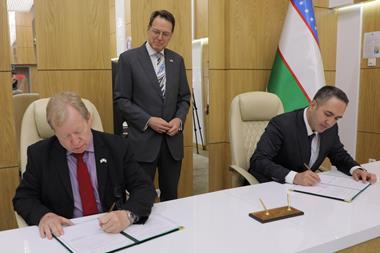

It comes as AF – which is the UK’s largest farm input buying group – this week announced the creation of a buying alliance with the next two largest operators in the sector: Fram Farmers and Woldmarsh Producers.

The tie up, called the Agri Procurement Alliance, will represent the buying interests of 6,000 UK farmers, offering them greater buying power on key inputs, with an initial focus on fertiliser sourcing.

Horton-Fawkes told The Grocer the partnership could also help reduce the cost of production for farmers and give them a greater influcence on supply chains.

“A small difference in input prices can have a big influence on outputs,” he said.

No comments yet