As the cost of living crisis hits Brits in the pocket, have they maintained their sustainable shopping habits or is price their priority? Where are they cutting back or making swaps? And do they find it easy being green on a budget – or should grocery businesses be doing more to help?

This research was commissioned by The Grocer and carried out by Lumina Intelligence independently from Japan Tobacco International (JTI) UK.

Free download: 10 charts explaining UK attitudes to the cost of living crisis

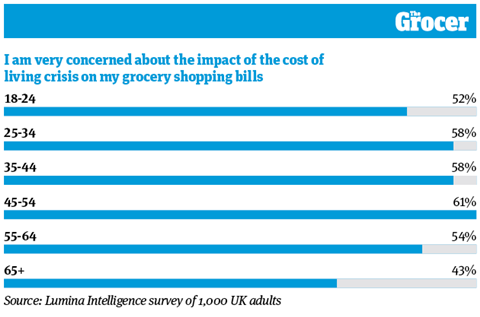

1. Over-65s are least concerned by the cost of living crisis

Britain is experiencing one of the worst cost of living crises in its history. As rates of food & drink inflation rise higher than headline figures and prices continue to climb, it’s no surprise shoppers are worried about the cost of their groceries.

According to our Lumina Intelligence survey of 1,000 UK adults, more than half of Brits are very concerned about the impact on their grocery bills (53%). While the 45 to 54 age group is the most concerned, over-65s are least worried. In fact, 11% of this age group say they are not very concerned – on a par with 18 to 24-year-olds. More women (59%) than men (47%) say they are very concerned. The region that is most concerned is the south east (61%), while the east Midlands is the least (38%).

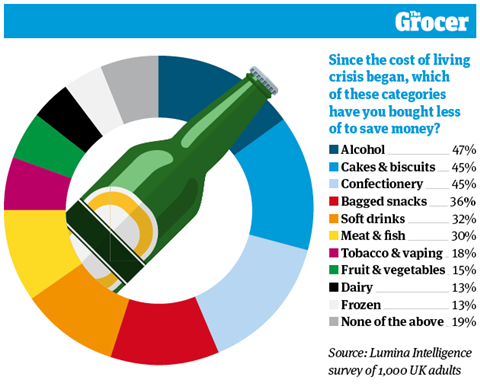

2. Alcohol is the most common category for Brits to cut back on

Frozen food, dairy products and fruit & veg appear to be the highest priorities for shoppers during the cost of living crisis. When asked which categories they have cut back on to help save money, these three were chosen least. At the other end of the scale, alcohol was the category Brits were most likely to cut back on amid cost pressures (47%).

This was followed by treat items like cakes & biscuits and confectionery, chosen by 45% of respondents, and bagged snacks (36%). The 18 to 24 age group was least likely to cut back on alcohol (35%), instead choosing to buy fewer soft drinks (38%). The region most likely to buy less booze was Scotland (61%), while people in the north east were least likely (33%).

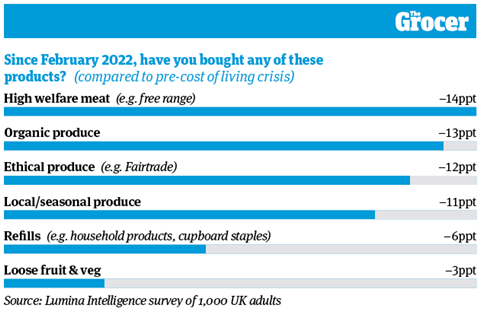

3. Uptake of high welfare meat has fallen most starkly

Many respondents have bought fewer sustainable products since costs started rising. Pre-February 2022, 35% of respondents said they were buying high-welfare meat. Today, that figure has fallen 16 percentage points to 19%. That’s the most dramatic decline recorded across all products listed, including organic (–13ppts) and ethical produce such as Fairtrade (–12ppts).

That said, the 18 to 24 age group was most likely to continue buying high welfare meat, such as free-range, during the crisis (26%). The most popular product before (63%) and during the crisis (60%) was loose fruit & veg, down only three percentage points. There were also minimal declines in refills (–6ppts) and local, seasonal produce (–3ppts).

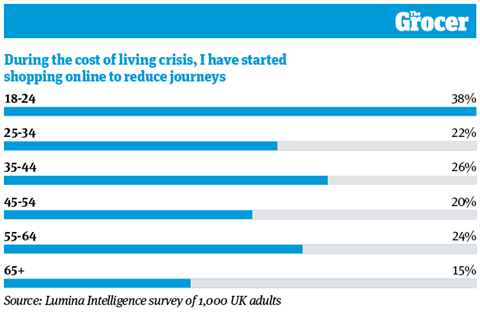

4. 18 to 24-year-olds have made the biggest switch to online shopping

The rising price of fuel has been one of the biggest impacts of the cost of living crisis for UK drivers. So has a desire to save on petrol or diesel affected where, how and how frequently they shop? According to our research, 31% of Brits haven’t changed their shopping habits for this reason, though 32% said they had started doing bigger shops to reduce journeys.

Some 22% have started walking to the shops rather than driving, while 23% have switched to online. The region that made the most dramatic switch to online was the north east (40%), while the age group most likely to do so was 18 to 24-yearolds. This demographic also saw the most respondents (13%) starting to take public transport to the shops, rather than the car.

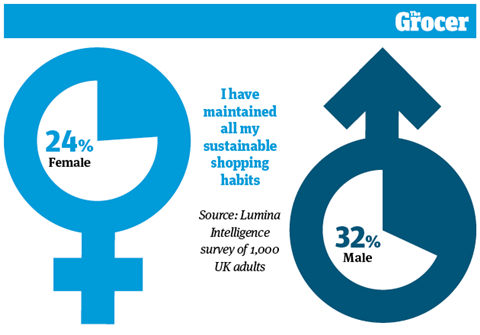

5. More men than women have kept to their sustainable shopping habits during the crisis

It appears men remain more green than women, as a lower proportion have sacrificed their ecoconscious customs to save money. At a total level, 46% of Brits have sacrificed some of their sustainable shopping habits, while 16% have ditched them altogether. Ruth Forbes, sustainability director at JTI, says this is “not surprising”. She calls on the industry to make changes. “If we want people to not only return to sustainable shopping habits but adopt new ones, it is up to manufacturers and retailers to make sustainable products more affordable and accessible to all.”

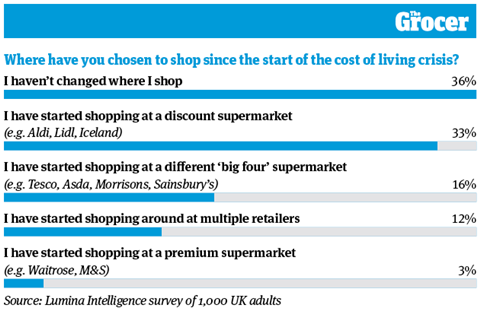

6. One in three Brits have switched to shopping at a discounter

As JTI’s Forbes puts it, “shoppers are really feeling the strain at the moment”. So it is unsurprising many are switching to the cheaper discount retailers. As our survey shows, 33% of Brits have started shopping at the likes of Aldi, Lidl and Iceland in recent months, with women (37%) more likely to make the swap than men (29%). In terms of age groups, 25 to 34-year-olds were mostly likely to switch to a discounter (42%), while the over-65s were most likely to stay put (56%).

Not all switching is towards the discounters, though – 16% of respondents moved to a different big four supermarket. Shopping around was preferable for 12% of shoppers, who have started visiting multiple retailers for the best deal.

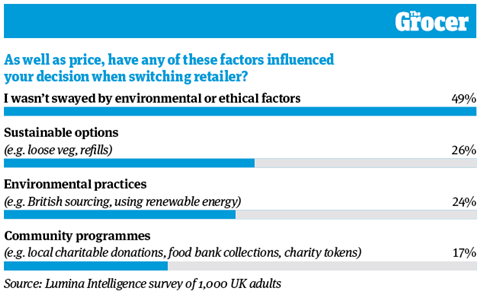

7. Half didn’t consider environment or ethics when switching retailer

As chart six shows, the majority of Brits have changed where they shop during the cost of living crisis. But were they motivated by price alone? For many, that was the case – nearly half of shoppers (49%) were not swayed by environmental or ethical factors when switching retailers.

However, environmental concerns are still front and centre for some shoppers, as 26% chose retailers with sustainable options such as loose veg. The age group most likely to be influenced by retailers’ environmental practices, such as British sourcing or using renewable energy, was 18 to 24-year-olds (35%). JTI’s Forbes believes that while sustainability may “take a back seat for some” during the crisis, “we expect this to be temporary”.

8. Over half of Brits want more promos on sustainable products

Some Brits may be considering the environment less during the crisis, but for those that are still mindful of the planet as well as their purse strings, there are some things retailers could be doing to help. For example, a third of shoppers want more advice from retailers on how to be sustainable on a budget, while the same number (33%) want to know how to make the most of their food or waste less.

Top of the list was their wish for retailers to run more promotions on sustainable products. This answer was chosen by more than half of respondents (56% and overindexed with women (61%), 35 to 44-yearolds (62%) and the south east region (61%).

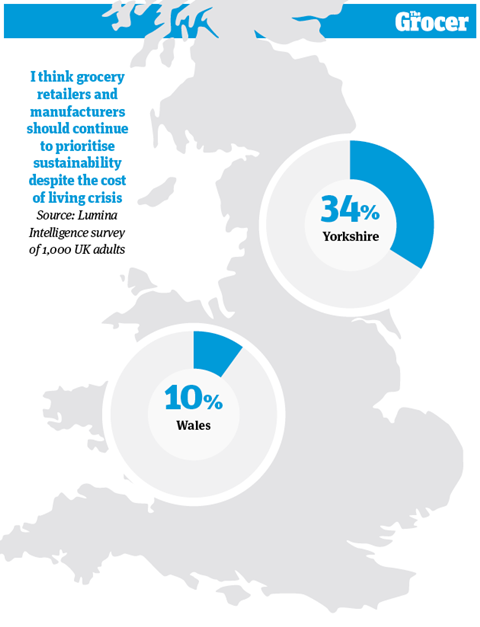

9. People in Yorkshire are most keen for retailers to prioritise sustainability

Many consumers have been sacrificing sustainability in a bid to keep costs down. But would they accept retailers and manufacturers making the same sacrifices? Twenty-nine per cent thought some rowbacks on sustainability were acceptable. And 23% thought businesses should put price above sustainability.

However, 24% thought businesses should continue to prioritise sustainability. The region that agreed with this statement the most was Yorkshire (34%). Forbes believes ecoconscious shoppers will expect businesses to “commit to ambitious sustainability targets” and stick to them, “in good times and in bad.”

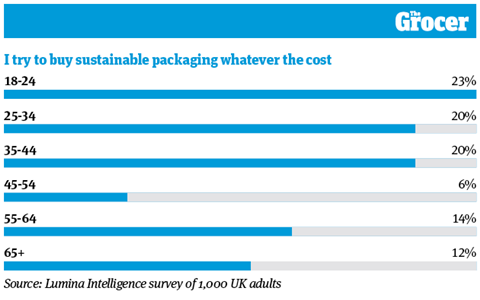

10. Eco-friendly packs are most crucial to younger shoppers

When asked to what extent sustainable packaging informed their choices during the cost of living crisis, 56% of respondents said a little: they buy it if the price is right. Twenty-nine per cent said price was always considered over packaging. The smallest percentage of respondents (15%) said they tried to buy sustainable packaging whatever the cost, with 18 to 24-year-olds most likely to take that view.

Forbes believes “buying products in sustainable packaging is a quick, easy and tangible way” for consumers to reduce their environmental footprint. So for manufacturers, she says, “offering more environmentally friendly packaging is crucial for meeting consumers’ expectations”.

Downloads

10 Charts Cost of Living Crisis

PDF, Size 0.26 mb